Silver Price Prediction: This Trader Just Mapped Silver’s Next Big Move

Silver has turned into one of the most interesting charts in the macro space right now. After a violent run-up earlier this year and a sharp pullback, price is no longer collapsing; it’s stabilizing. That change alone is what has traders paying attention again, because silver doesn’t usually move slowly for long once momentum returns.

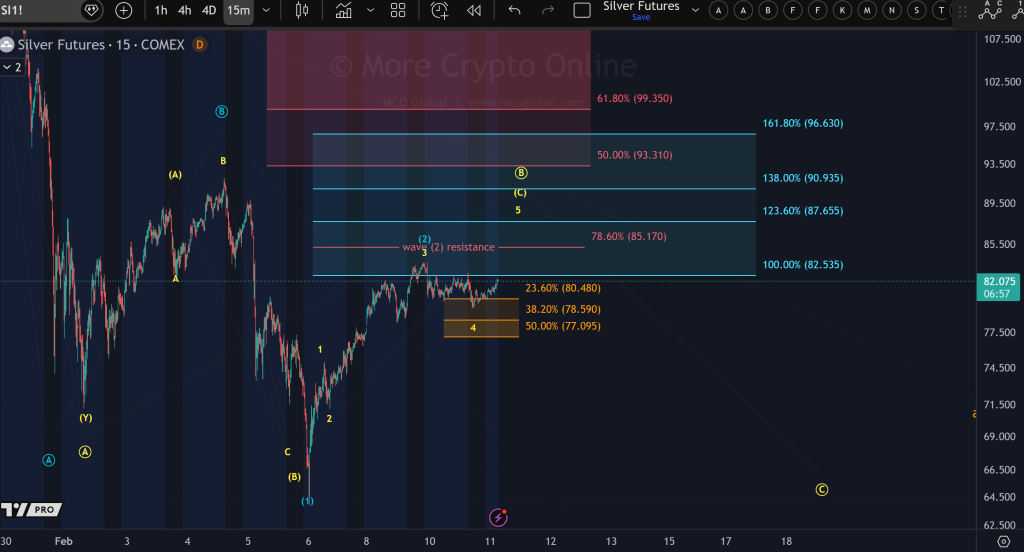

One of the analysts highlighting this setup is More Crypto Online, a respected technical trader known for clean Elliott Wave structure work and level-based charting. In his latest update, he argues that silver’s pullback remains shallow, the structure has not broken down, and the market may still be setting up for one more upside continuation move.

The key point is simple: silver is pausing, and pauses often come before the next leg.

Silver Price Stabilizes Above Support – Why Wave 5 Is Still Alive

In the chart shared by More Crypto Online, the silver price is holding above what he labels as micro support after the recent advance. That matters because the pullback has not turned into a full breakdown. Instead, price is consolidating in a tight range, which keeps the bullish continuation scenario on the table.

From a wave perspective, the idea is that silver may still be working through a broader impulsive structure, with the possibility of a wave 5 push higher still open. In Elliott Wave terms, wave 5 is often the final leg of an upside move – the part where price stretches into one more high before a larger correction begins.

What stands out in this setup is how controlled the retracement has been. The chart shows several key Fibonacci zones around the current range, with support holding roughly in the upper $70s to low $80s area. As long as the silver price stays above that base, the market is essentially building energy rather than bleeding out.

Source: X/@Morecryptoonl

Source: X/@Morecryptoonl

However, the analyst is also clear about the condition that must be met: a breakout is still required. Silver can consolidate forever, but without reclaiming resistance, the move remains only a possibility, not a confirmed continuation.

The upside levels marked on the chart point toward the $85–$90 zone first, and then potentially higher into the low-to-mid $90s if wave 5 truly extends. That’s where the next major test sits.

It’s a classic “structure intact, but trigger not hit yet” situation.

What’s Silver Price Next Move?

Silver is one of those assets that tends to frustrate traders right before it moves. The market has already proven it can rally aggressively, and the recent pullback flushed out weak positioning quickly. Now price is sitting in a stabilization phase, which is usually where the next directional move gets decided.

More Crypto Online’s take makes sense from a technical standpoint: the pullback has remained shallow, support has not collapsed, and the broader structure still allows for another leg higher. That said, silver is also famous for false starts, so treating this as a “wait for breakout confirmation” setup is the more realistic approach.

Right now, the most important level is the $80–$82 zone, which is acting as the short-term base. As long as silver holds above that band, the upside structure stays intact.

If buyers step in and silver breaks cleanly above the next resistance around $85 (currently the silver price is at these levels), the path opens toward the first major target near $90–$93, which is where heavy selling pressure has shown up before.

From there, a full wave 5 continuation would likely aim for the psychological $100 level, and if momentum accelerates the way silver often does, the next extension zone sits around $110–$120, matching the prior peak region.

On the downside, the setup weakens if silver loses $77–$78 support, because that would suggest the consolidation is breaking down instead of building energy. In that case, the market could revisit the deeper demand zone closer to $72–$74 before any sustainable rebound.

For now, silver looks less like a crash chart and more like a coiled spring. Traders are watching closely to see if this consolidation is the calm before the next surge.

If the breakout comes, wave 5 could be the move that puts silver back into focus, with $90 next, and $100+ back on the table quickly.

Read also: Silver Price Is Too Cheap to Ignore: The Paper vs Physical Disconnect Is Reaching Extremes

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post Silver Price Prediction: This Trader Just Mapped Silver’s Next Big Move appeared first on CaptainAltcoin.

You May Also Like

West Monroe Earns Multiple Recognitions in Vault’s 2026 Consulting Rankings

Why Task-Specific Robots Are Winning in Modern Manufacturing