Bitcoin Crashes to $64,000 as $1.4 Billion in Leveraged Positions Liquidated

Bitcoin plunged nearly $10,000 in 24 hours, briefly touching $60,000 on Friday morning in Asia before recovering to trade around $64,000, down 10% from the previous day, as a market-wide selloff triggered $1.39 billion in leveraged position liquidations.

The decline extended Bitcoin's losses to approximately 40% from its October 2025 peak above $125,000, erasing all gains made following the U.S. presidential election. The total cryptocurrency market capitalization fell to $2.2 trillion, down 9.22% over 24 hours.

Since Thursday, Ethereum dropped 10.29% to $1,889, marking a 30% decline over the past week, while Solana fell 15.94% to $76.06, trading below $70 for the first time since 2023 during the selloff.

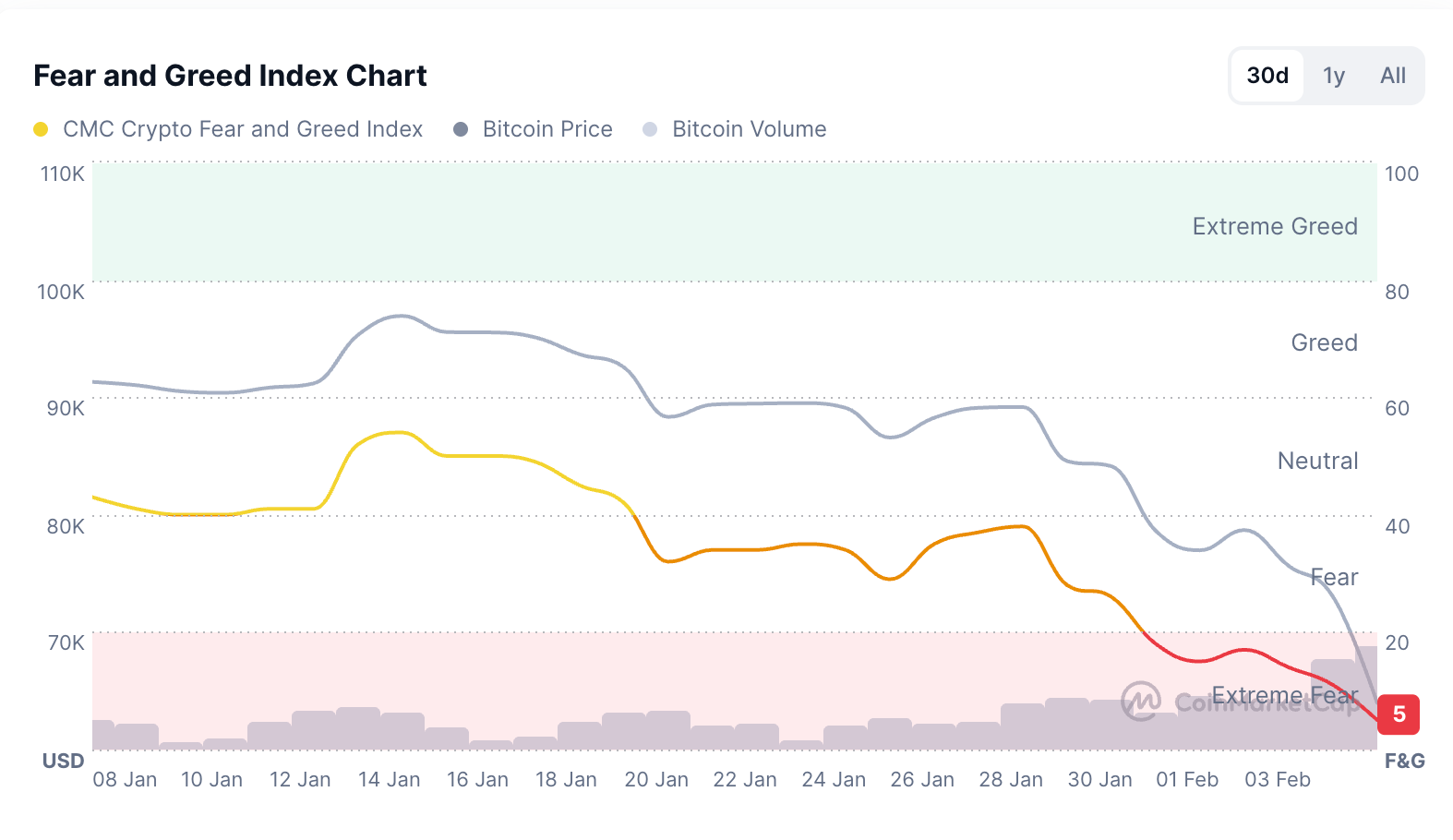

CoinMarketCap's crypto fear and greed index hit an all-time low of 5, down from 52 on Jan. 14 when Bitcoin was trading at $95,000. The metric measures market sentiment on a scale from 0 (extreme fear) to 100 (extreme greed).

The crash intensified pressure on Strategy, which reported a $12.4 billion net loss for the fourth quarter on Thursday driven by the mark-to-market decline in its Bitcoin holdings. The company's stash of over 713,000 Bitcoin, valued at approximately $46 billion, now trades below its cumulative cost basis of $76,052 per token for the first time since 2023.

Strategy, led by Bitcoin advocate Michael Saylor, has pursued an aggressive strategy of issuing debt and equity to acquire Bitcoin since 2020. The model relied on the company's shares trading at a premium to the value of its holdings, allowing it to sell stock, purchase more Bitcoin, and repeat the cycle.

That premium has evaporated as Bitcoin prices fell, effectively stalling the acquisition machine. Strategy did not announce any new equity raises or debt issuances in its earnings report, marking a departure from previous quarters when market selloffs typically prompted fresh capital-raising announcements.

Saylor said the company faces no margin calls and has $2.25 billion in cash, sufficient to cover interest payments and distributions for more than two years. Strategy reiterated Thursday that it does not expect to generate earnings or profits in the current year or the foreseeable future.

The company added $75.3 million worth of Bitcoin in late January, signaling its accumulation strategy remains formally intact despite the challenging market conditions.

Strategy shares have fallen 72.1% over the past six months to $106.99, underperforming even Bitcoin's 44% decline during the same period. The divergence reflects investor concerns about the sustainability of the company's debt-funded acquisition model.

Eleven U.S. state pension schemes that purchased Strategy shares collectively face approximately $337 million in paper losses as the stock continues to decline, DL News reported. Ten of the 11 funds are down roughly 60% on their investments.

The broader crypto market selloff comes as risk appetite weakens across financial markets. U.S. spot Bitcoin exchange-traded funds recorded $544.9 million in net outflows on Wednesday, led by BlackRock's IBIT with $373.4 million in withdrawals.

Other Bitcoin treasury companies have faced similar pressure. Tom Lee's BitMine, which holds 4.29 million Ethereum tokens, is facing more than $7 billion in unrealized losses as Ethereum's price declined.

The sustained downturn marks a significant shift from the optimism that characterized crypto markets following the November 2024 election, when expectations of crypto-friendly policies under the incoming administration drove prices higher.

Analysts have attributed the selloff to a combination of factors including weakening risk appetite, profit-taking after the November rally, and broader macroeconomic concerns. The crypto market has shown high correlation with technology stocks, which have also faced selling pressure in recent weeks.

The extreme fear reading suggests capitulation among retail investors, though historically such readings have sometimes preceded market bottoms. However, with leveraged positions continuing to unwind and corporate holders facing mounting pressure, the path to stabilization remains uncertain.

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

XRP Ledger Unlocks Permissioned Domains With 91% Validator Backing