$32B and Climbing — AI Crypto Market Blazes With Multi-Day Gains

Over the past week, the crypto economy has been on the rise, with the artificial intelligence (AI) sector of crypto assets climbing 6% and crossing into the $32 billion range.

AI Crypto Market Powers Through Hot Streak

AI-linked digital tokens, which marry blockchain with AI technology, also posted a 4.94% daily lift. These coins often power AI-driven platforms, covering everything from paying for AI services to rewarding participants, running decentralized AI marketplaces, and, in some cases, being launched by AI itself.

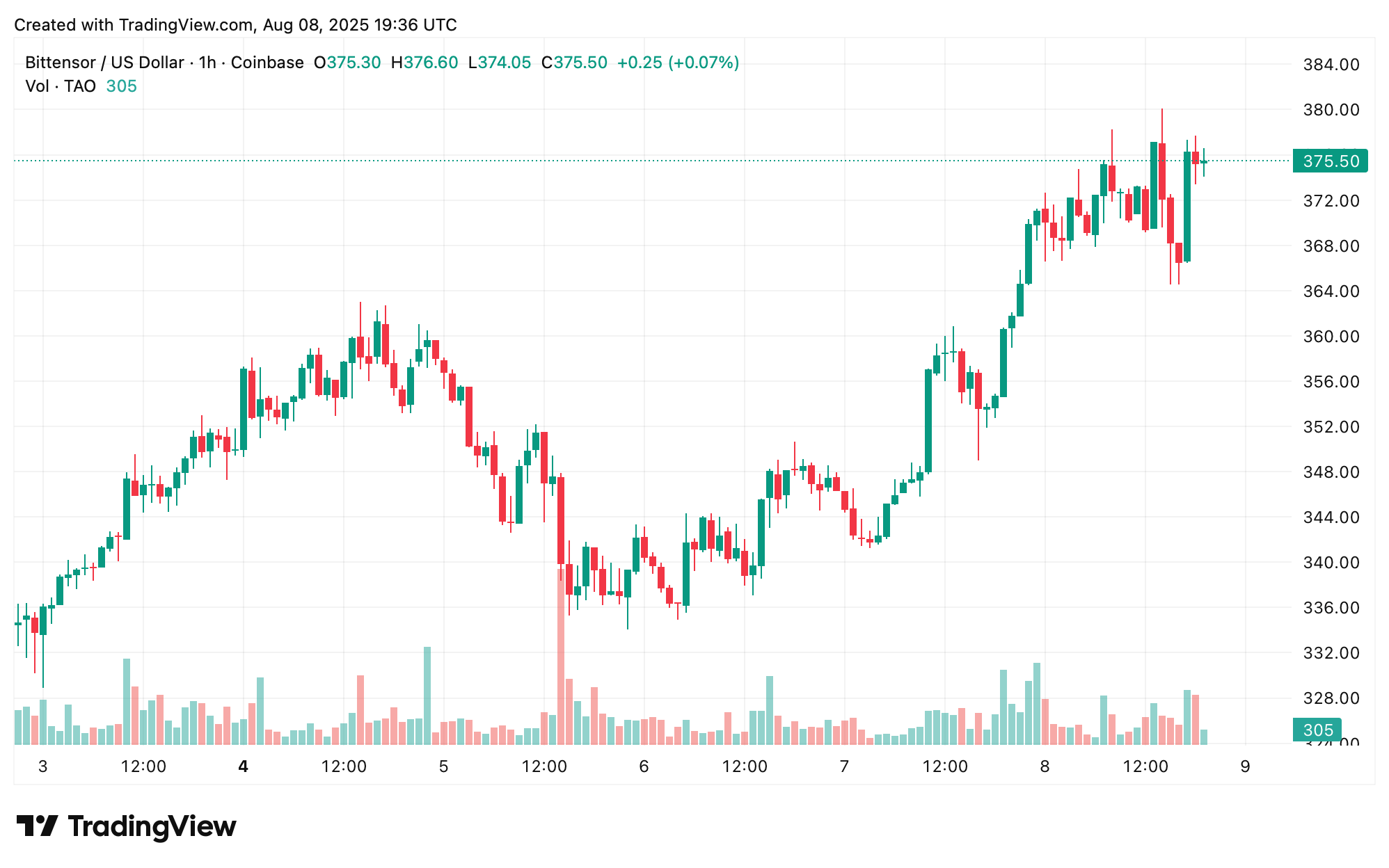

Bittensor (TAO) on Aug. 8, 2025.

Bittensor (TAO) on Aug. 8, 2025.

This week, all ten of the top AI coins gained ground, with every one of them also notching daily increases. Bittensor (TAO) claimed the top spot in terms of market cap at $371.49 per coin, adding 5.47% in 24 hours and locking in over $3.56 billion in market value. NEAR trailed with a 4.88% bump to $2.68, while internet computer (ICP) rose 2.98% to $5.37.

Render (RNDR) picked up 5.4%, while story (IP) stole the spotlight with a 13.87% daily boost, stacking an eye-catching 113.02% gain over the past month. Artificial superintelligence alliance (FET) rose 4.6%, injective (INJ) tacked on 6.02% to stretch its 27.49% monthly climb, fartcoin bounced 8.29% despite a month-long slide, and the graph (GRT) inched up 0.18%.

Virtuals protocol (VIRTUAL) advanced 6.66% on the day, though it remains down 16.82% this month. The recent lift in AI crypto assets points to growing investor curiosity about blending AI with blockchain and digital assets. This mix of innovation and market interest could pave the way for AI’s deeper role in decentralized ecosystems, influencing how these tokens are valued and used. Or, just as easily, they could be the hype that fades into a digital footnote.

You May Also Like

SHIB Price Prediction: Mixed Signals Point to $0.0000085 Target by February End

Fed rate decision September 2025