SharpLink Secures 438K ETH, Spending $290M in Weeklong Buying Spree

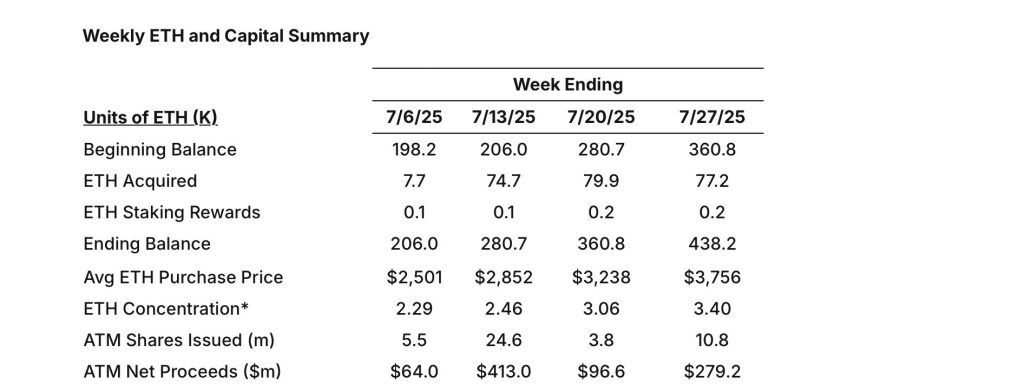

SharpLink Gaming, Inc. (Nasdaq: SBET), known for its bold Ethereum accumulation strategy, has confirmed it now holds approximately 438,190 ETH as of July 27, 2025.

The company acquired 77,209.58 ETH during the week of July 21–27, spending a total of around $290 million at an average purchase price of $3,756.

This marks a 21% increase from the previous week’s ending balance of 360,807 ETH. According to SharpLink’s latest capital summary, this acquisition continues the company’s aggressive treasury strategy launched in early June, which has rapidly expanded its digital asset position.

Staking Rewards and Strategic Intent

Alongside its purchases, SharpLink continues to receive staking rewards, adding 0.2K ETH in the week ending July 27. This brings its cumulative staking rewards to 722 ETH since launching the strategy on June 2, 2025.

The company’s ETH concentration—measuring ETH relative to its overall capital structure—rose to 3.40, up from 3.06 the prior week and a 70% increase since the program began.

Capital Raised Through ATM Facility

To fuel its purchases, SharpLink raised $279.2 million in net proceeds through its at-the-market (ATM) share issuance facility during the week of July 21–25.

A total of 10.8 million shares were issued during that week alone. This follows a previous issuance of 3.8 million shares the week prior, reflecting growing investor interest and confidence in the company’s strategy.

Since July began, SharpLink has raised over $850 million through ATM issuance, allowing continued purchases without heavy reliance on external financing or leverage.

Leadership and Vision Going Forward

Adding momentum to the company’s evolving direction, Joseph Chalom—former digital asset strategist at BlackRock—officially assumed his role as Co-CEO on July 24. Commenting on his decision to join SharpLink, Chalom said.

“I see a powerful opportunity to help shape the future of financial infrastructure and decentralized finance. SharpLink’s commitment to aligning its strategic direction with the Ethereum ecosystem resonates with my passion for digital assets and scaling innovation in global finance. I’m thrilled to be leading SharpLink into its next phase.”

SharpLink Becomes Largest Public Holder of Ethereum

SharpLink Gaming is officially the leading public company holding Ethereum, now controlling 360,807 ETH—valued at approximately $1.33 billion—according to fresh data from analytics platform CoinGecko.

What sets SharpLink apart is not just the size of its ETH treasury, but how it’s used. The company reports that over 95% of its Ethereum is either staked or deployed through liquid staking platforms.

$SBET Price Action

SharpLink Gaming, stock trading under “SBET,” has seen a huge surge over the past month, with its stock price rising by 110.73% to $20.92.

The rapid increase from around $10 at the beginning of July to a peak above $35 mid-month suggests heightened investor interest, possibly fueled by speculative momentum or expectations of a strategic development. While the price has since cooled off from that high, the stock remains elevated compared to its early-July levels.

You May Also Like

XERO Price Crash: Shares Sink 16% to Three-Year Low

YwinCap View On Whether The Gold Market Is In A Bubble