Crypto Exchanges’ Stock Plunges 60% as Trading Volumes Vanish – Is the Crash Over or Just Beginning?

Over the last three months, crypto exchange stocks have dropped massively due to the collapse in trading activity on centralized platforms, leaving questions about whether the industry is almost at the bottom of another decline or is just entering the most challenging phase yet.

Stocks of large exchange operators are low by 40-60% since October, as the market traces a dramatic drop in spot trading volumes that has wiped out much of the historic gains made earlier last year.

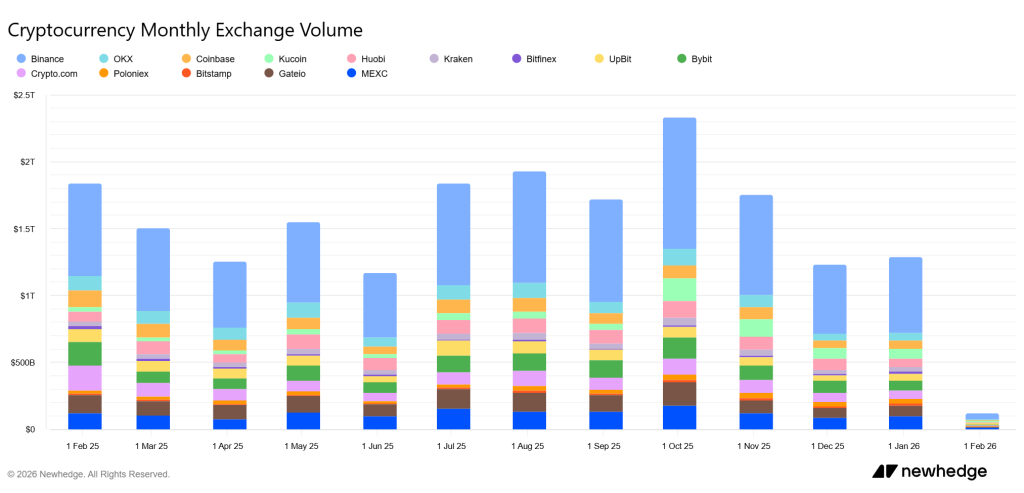

Source: Newhedge

Source: Newhedge

Newhedge data indicate that centralized exchange spot trade volumes were the highest in January 2025 and then in October, when the overall monthly activity rose to approximately $2.3 trillion.

Crypto Spot Volume Falls Nearly 90% From October Peak

Binance transacted nearly $1 trillion in October, over 40% of all volume, before total spot trading across exchanges plunged to about $1.7 trillion in November.

Trading continued to decline, reaching $1.2 trillion in December and plummeting to $120-150 billion in January 2026, nearly 90% less than in October.

Binance was the biggest exchange, with only $70 billion to $80 billion in trades, with the vast majority of other exchanges only registering in single- to low-two-digit billions.

CoinGecko data reveals that Binance held the same position in December with a 38.3% market share, but with spot trading volume decreasing by over 40% month-on-month to $361.8 billion.

Other large platforms, such as Bybit, MEXC, and others, also posted double-digit drops.

Although the total spot trading volume across the top 10 exchanges had increased marginally on a full-year basis in 2025, the second half of 2025 was characterized by an evident slowdown, with a number of key platforms recording annual decreases.

The slowdown in trading activity has translated directly into pressure on exchange stocks.

Shares of Coinbase, Gemini, and Bullish have all underperformed broader equity markets since October, falling far more sharply than Bitcoin itself, which is down about 35% from its peak.

Coinbase shares fell 40.4% over the past six months to $189.62, sharply following the shrinking exchange volume. Bullish also posted a steep decline, dropping 56.7% over the same period to $29.43.

Robinhood Markets proved more resilient, with its shares down 16.0% over six months to $89.37, significantly outperforming crypto-native peers during the period.

After $19B Liquidation, Traders Step Back and Volumes Slide

Market observers say the dynamic is typical of crypto downturns.

When prices rise, trading volumes expand as investors chase momentum, and when sentiment turns, participation drops quickly, amplifying revenue declines for exchanges.

The latest slump follows a record liquidation event on October 10, when roughly $19 billion in positions were wiped out, dampening risk appetite across both retail and institutional traders.

Meanwhile, this cycle has varied from the previous crashes in some significant aspects.

There has been no failure of exchange and a wave of regulatory crackdown like during previous fall seasons.

Rather, the pullback is seen as fueled by exhaustion following a sharp rally, a restrictive financial situation, and wider risk-off action in world markets.

In January, Bitcoin dropped by almost 11%, the most in months since 2018, and investors diverted to perceived safer assets or exited completely.

Historically, such contractions of volumes have followed crypto winters after notable booms, such as the downfall of Mt. Gox in 2014, the bursting of the ICO bubble in 2018, and the liquidity crisis of 2022.

Recoveries have typically taken years and were driven by new structural catalysts rather than a quick return of speculative enthusiasm.

You May Also Like

Victra Named 2025 Recipient of Verizon’s Best Build Compliance Award

Stablecoins could face yield compression after Fed’s rate cut