Daily Market Update: Markets in Freefall as Bitcoin Tests $74K and Gold Drops 10%

TLDR

- Bitcoin touched $74,000 before rebounding above $76,000 as weekend liquidity dried up and forced selling accelerated

- Leveraged crypto traders lost $510 million in 12 hours with long positions taking $391.6 million in liquidations

- Stock futures tumbled Monday with Nasdaq 100 down 1% and S&P 500 off 0.8% following precious metals collapse

- Gold fell 10% and silver dropped 15% after Friday’s historic 30% crash in silver prices

- January jobs report and earnings from Amazon, Alphabet, Disney, Palantir, and AMD expected this week

Bitcoin experienced sharp volatility early Monday, briefly dropping to $74,000 before climbing back above $76,000. The V-shaped price movement highlighted how shallow order books can create extreme swings during low-volume periods.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

Cryptocurrency markets endured heavy liquidations over the past 12 hours. Data shows $510 million in leveraged positions were wiped out during the selling wave.

Long positions bore the brunt of losses at $391.6 million. Shorts accounted for $118.6 million in forced closures.

The selloff extended beyond Bitcoin to major altcoins. Ethereum fell more than 8% over 24 hours as traders pulled back from risk assets.

BNB, XRP, and Solana each dropped between 4% and 6%. Dogecoin and TRON also posted declines as market sentiment weakened.

Weekend trading conditions worsened the price action. With institutional desks inactive and traditional markets closed, order books thinned considerably.

This reduced liquidity allowed smaller sell orders to push prices through support levels. The same shallow depth enabled quick recoveries when buyers stepped in.

US Stock Futures Drop on Metals Crash

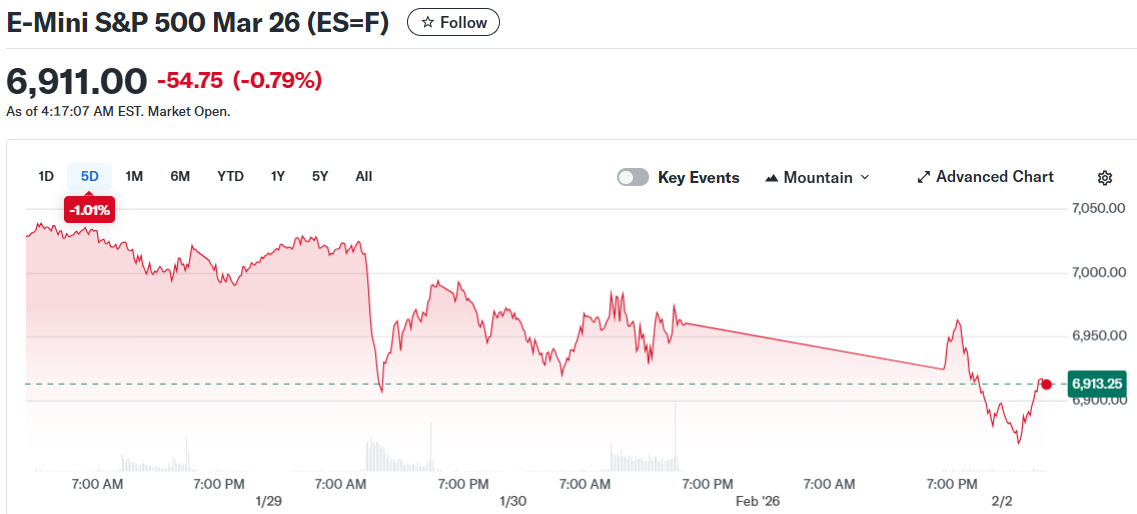

American stock futures opened sharply lower Monday morning. Nasdaq 100 futures fell 1% while S&P 500 futures declined 0.8%.

E-Mini S&P 500 Mar 26 (ES=F)

E-Mini S&P 500 Mar 26 (ES=F)

Dow Jones futures dropped 0.6% as investors processed Friday’s market action. The losses came after precious metals suffered a dramatic collapse.

Gold plunged as much as 10% during Monday trading. Silver crashed over 15% following Friday’s historic 30% single-day drop.

Both metals pared some losses later in the session. The crash erased much of the gains precious metals posted in early 2026.

Bitcoin fell below $80,000 over the weekend for the first time since April. The cryptocurrency was trading around $77,000 Monday morning.

Market participants are digesting President Trump’s nomination of Kevin Warsh to lead the Federal Reserve. The announcement has sparked questions about future monetary policy direction.

Most traders still anticipate two interest rate cuts before year-end. Uncertainty around artificial intelligence investments is also weighing on tech stocks.

Major Earnings and Economic Data This Week

Over 100 S&P 500 companies will release quarterly results this week. Amazon, Alphabet, Disney, Palantir, and Advanced Micro Devices headline the earnings calendar.

Friday brings the January jobs report at 8:30 AM Eastern. Economists forecast 65,000 new jobs added last month with unemployment steady at 4.4%.

China released January manufacturing data showing mixed signals. A private survey indicated slight factory expansion while the official measure showed contraction.

The Chinese data provided context but had limited direct impact on cryptocurrency prices. Beijing’s yuan management restricts capital flow influence on Bitcoin markets.

Thin liquidity continues to drive short-term price action in crypto markets. Both downside drops and upside rallies can extend further than fundamentals suggest until order book depth improves.

The post Daily Market Update: Markets in Freefall as Bitcoin Tests $74K and Gold Drops 10% appeared first on Blockonomi.

You May Also Like

“Token Hóa” Đang Tăng Tốc: CEO Bitget Gracy Chen Và Tầm Nhìn Về Một Kỷ Nguyên Tài Chính Không Biên Giới Tại “The Rollup”

What You Need to Know About Ethereum’s Hegota Upgrade