Here’s Why XRP Is Crashing Rapidly Today

- XRP plunged as heavy long liquidations triggered aggressive, cascading sell pressure.

- Technical breakdown below key support levels accelerated XRP’s rapid decline.

- Weak momentum and leveraged positions continue weighing heavily on XRP price.

XRP faced sharp downside pressure today as a surge in liquidations accelerated selling across major trading platforms, with the decline following an extended buildup of leveraged long positions that unraveled quickly once price levels weakened.

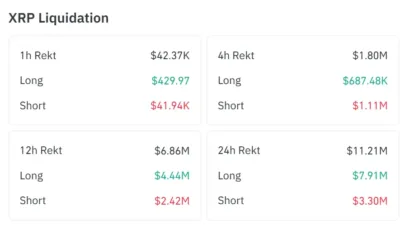

As forced selling increased, XRP losses expanded at a rapid pace across the session. According to Coinglass, liquidation data highlights the source of the rapid selling pressure, with total XRP liquidations exceeding $11 million over the past 24 hours, largely driven by long position losses. Consequently, traders positioned for upside were forced to exit as prices moved lower, adding further sell orders into the market.

This liquidation process created a compounding effect, since additional long positions failed to meet margin requirements as XRP dropped. Hence, exchanges automatically closed those positions, pushing prices even lower and turning a gradual decline into a sharp sell-off.

Short-term liquidation metrics showed brief short liquidations earlier in the session, which triggered minor rebounds but lacked momentum. As a result, sellers quickly regained control and continued driving XRP lower.

Long liquidations also dominated the 12-hour trading window, highlighting how bullish positioning remained elevated before adequate support developed. When key levels failed to hold, liquidation cascades intensified the downward move.

Source: Coinglass

Also Read: XRP Goes Parabolic Every Time This Happens

Technical Analysis Confirms Continued Weakness

Technical indicators reinforced the bearish outlook as XRP broke below its 20-day moving average and stayed under the Bollinger Band midline. This breakdown weakened the overall market structure and clearly signaled the loss of short-term trend support.

Price action tracked near the lower Bollinger Band, reflecting sustained downside pressure despite conditions that often suggest oversold levels. Persistent selling pressure continued to prevent any meaningful recovery attempts from gaining traction.

Source: Tradingview

The relative strength index dropped below 30 on the daily chart, placing XRP in oversold territory as liquidation-driven selling dominated market activity. This pressure prevented oversold signals from slowing the decline despite weakening momentum across shorter timeframes.

Support between $1.55 and $1.58 became the immediate focus as XRP tested the zone amid sustained selling pressure. At the time of writing, XRP trades near $1.59, which is a drop of 3.16% within 24 hours.

Resistance remains firm near $1.80, where previous recovery attempts stalled and reinforced bearish sentiment across the market. Low buying volume during minor rebounds also reflected limited confidence among market participants.

In conclusion, XRP is crashing rapidly today due to heavy long liquidations combined with a clear technical breakdown. Forced selling amplified losses while weak chart structure restricted recovery as XRP trades near key support levels.

Also Read: Vitalik Buterin Unveils Bold Creator Token Plan to Fight AI Content Flood

The post Here’s Why XRP Is Crashing Rapidly Today appeared first on 36Crypto.

You May Also Like

“Vibes Should Match Substance”: Vitalik on Fake Ethereum Connections

Why Bitcoin Crashed Below $69,000 — Causes & Outlook