Solana Meme Coin Activity Surges as Network Sustains 3,000+ TPS

This article was first published on The Bit Journal.

Solana meme coin activity has surged sharply in recent months as speculative trading returned to the network. The spike appears speculative at first glance.

However, the underlying data shows the trend is serving as a live stress test for Solana’s scalability, throughput, and fee efficiency under sustained demand.

Solana Maintains Stable Throughput Amid Meme Coin Surge

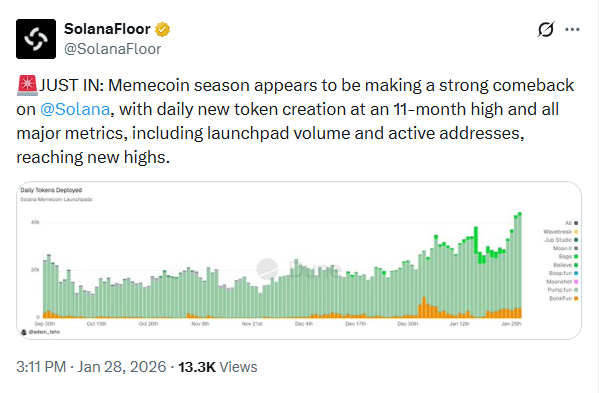

Solana meme coin action has been at its hottest in close to a year in recent weeks. Daily token deployments exceeded 40,000.

Despite the increase, the network was able to handle stable transaction throughput and prevented congestion from lasting long periods of time, which only goes on to show off its production level quality.

Since 2023, Solana meme coin activity has been associated with consistently high transaction activity. The network has been handling high volumes without sustained performance degradation. This trend is unlike competition blockchains that typically enter slow periods during speculative cycles.

Also Read: Solana vs Ethereum: Perps Volume Flip Signals Faster Risk

Transaction Throughput Holds Firm

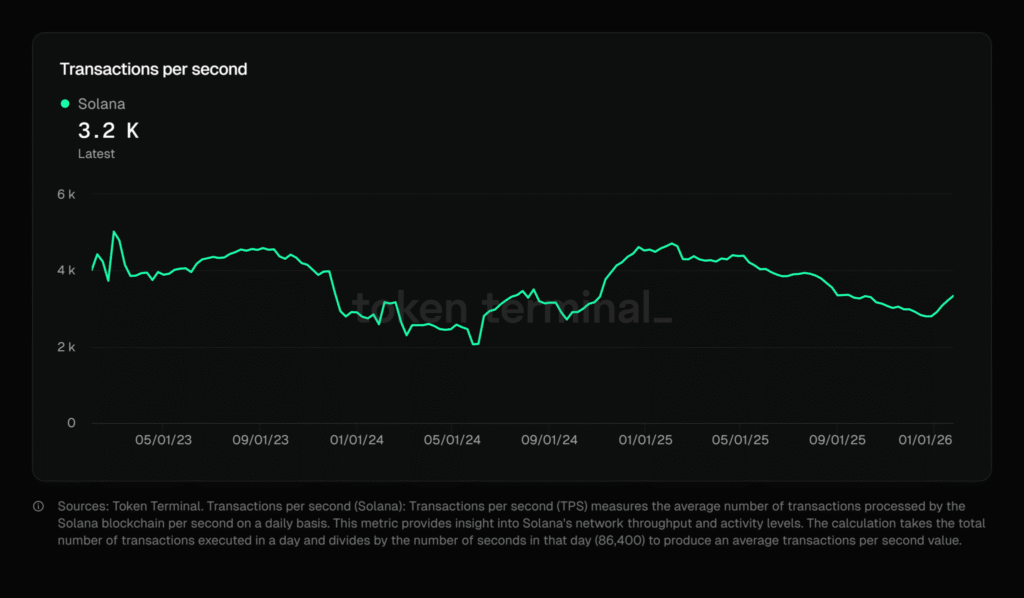

Solana meme coin activity unfolded alongside steady throughput between 2,000 and 5,000 transactions per second. Recent readings hovered near 3,200 TPS.

Source: Token Terminal

Source: Token Terminal

These levels persisted even during peak launch periods. Short-term spikes did not result in lasting slowdowns. Throughput normalized quickly after demand surges.

Recovery Signals Ecosystem Expansion

In mid-2024, Solana’s TPS briefly fell toward 2,000 as market activity cooled. That decline proved temporary.

As Solana meme coin activity returned into 2025, throughput scaled higher again. The rebound points to organic ecosystem growth rather than isolated stress events.

Solana Commands L1 Throughput Share

Weekly data shows Solana capturing roughly 40% of total Layer-1 transaction throughput. Only Internet Computers process more, averaging near 4,100 TPS.

By comparison, Ethereum, BNB Chain, and TRON typically operate below 150 TPS. This gap explains why Solana meme coin activity concentrates on the network.

Architecture Absorbs High Demand

Solana’s design allows activity to scale without destabilizing performance. Parallelized execution processes transactions simultaneously. Low fees reduce friction. Optimized networking limits bottlenecks.

As Solana meme coin activity increases, demand becomes additive. Low degradation under stress confirms real-world readiness rather than laboratory benchmarks.

Token Deployments Hit 11-Month High

Daily token deployments recently surpassed 40,000. This marked the strongest Solana meme coin activity since early 2024.

Importantly, throughput remained stable near 3,000 to 5,000 TPS. High-volume token creation did not impair execution or settlement.

Source: X

Source: X

Launchpad Participation Broadens

Solana meme coin activity is spreading across multiple launchpads. Activity is not concentrated in a single venue.

This diversification signals broad participation. High throughput lowers entry barriers. Developers and traders can launch, trade, and iterate without congestion risk.

Speculation Converts Into Revenue

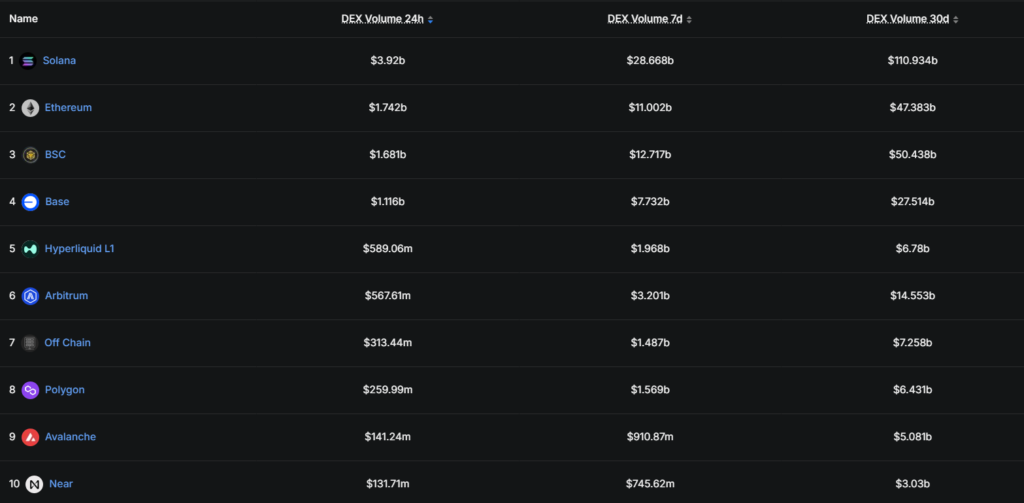

Solana meme coin activity has generated measurable economic value. Over the past 30 days, decentralized exchange volume exceeded $110 billion.

Ethereum recorded roughly $47 billion over the same period. The gap highlights sustained trading intensity on Solana.

Source: DeFiLlama

Source: DeFiLlama

Application Revenue Confirms Monetization

Higher usage translated into rising application revenue. Solana generated about $145 million in app revenue during the same 30-day window.

This revenue emerged during a meme coin-driven cycle. It did not rely on low-activity periods. Base and Hyperliquid trailed despite strong niches.

Fees and MEV Reinforce Sustainability

As activity scales, base fees and priority fees compound. MEV extraction further supports monetization. Solana meme coin activity therefore produces paid usage. Throughput is not hollow. Demand converts into durable revenue streams.

Conclusion

Solana meme coin activity is acting as a real-time stress test for the network. Data shows sustained throughput, minimal degradation, and rising economic output. The results suggest Solana’s scalability advantage translates into long-term value rather than temporary volume.

Also Read: Solana Price Forecast: $SOL Eyes Breakout After Channel Break

Appendix: Glossary of Key Terms

TPS: Short for transactions per second, the number of transactions a blockchain can process in one second.

Layer-1 Blockchain: A root blockchain that accepts transactions without any other chains.

Throughput: The amount of traffic a network can process over time.

Parallelizability: A design that is able to execute multiple transactions in parallel.

Decentralised Exchange (DEX): A blockchain-native digital trading venue where users can directly trade with other users without the use of an intermediary.

App Revenue: Earnings from the use of users in applications based on blockchain.

Maximal Extractable Value (MEV): Additional value captured by validators when ordering transactions.

Frequently Asked Questions About Solana Meme Coin Activity

1- What is driving the Solana meme coin activity?

Low fees, fast execution, and high throughput attract speculative trading and rapid token launches.

2- Has network performance degraded during surges?

No. Solana has maintained stable TPS and quick recovery after demand spikes.

3- How does Solana compare to Ethereum?

Solana processes far more transactions per second and currently supports higher DEX volume.

4- Does meme coin trading create real value?

Yes. Rising DEX volume and app revenue confirm sustainable economic activity.

References

AMB Crypto

Token Terminal

Read More: Solana Meme Coin Activity Surges as Network Sustains 3,000+ TPS">Solana Meme Coin Activity Surges as Network Sustains 3,000+ TPS

You May Also Like

SBI VC Trade Adds Litecoin to Japanese Lending Program

Work Dogs TGE Is Running — Is WD About to Drop in Q2 After March 30?