Binance to Move $1 Billion User Protection Fund Into Bitcoin

Bitcoin Magazine

Binance to Move $1 Billion User Protection Fund Into Bitcoin

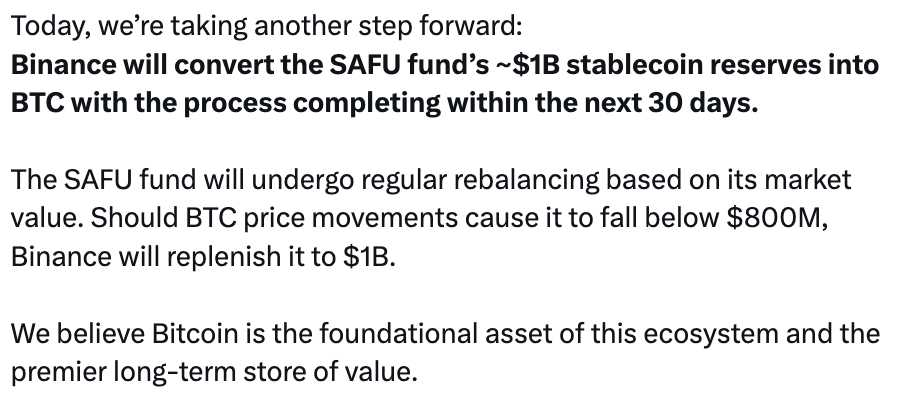

Binance said Friday it will convert the stablecoin holdings in its $1 billion Secure Asset Fund for Users (SAFU) entirely into bitcoin over the next 30 days.

The exchange said the transition will be carried out gradually and accompanied by regular audits.

Binance also pledged to replenish the fund if bitcoin price volatility causes its value to fall below $800 million, using treasury reserves to restore it to $1 billion.

Binance launched its SAFU back in 2018 to protect users against losses from extreme events such as hacks or major system failures. The fund is financed through a portion of Binance’s trading fees and is held separately from user assets in cold wallets.

Binance has repeatedly cited SAFU as a cornerstone of its risk-management and trust framework.

“This initiative is part of Binance’s long-term industry-building efforts,” the exchange said in its translated statement posted to X. “We will continue advancing related work and gradually share progress with the community.”

Binance’s decision comes as bitcoin slumps

The move comes during a period of heightened market stress. Bitcoin has declined significantly from recent highs, while liquidity dislocations during extreme price moves have revived debate over exchange infrastructure and transparency.

Binance framed the decision to re-denominate SAFU in bitcoin as a statement of conviction in the asset’s long-term role within the crypto ecosystem, positioning bitcoin not merely as a trading instrument but as the industry’s foundational reserve asset.

The exchange said future reviews could consider allocations to other “core assets,” including its native BNB token.

SAFU was most visibly deployed in 2019, when Binance covered losses after a security breach resulted in the theft of roughly 7,000 BTC, reimbursing affected users in full without impacting account balances. Since then, the fund has remained largely untouched, serving as an assurance mechanism rather than an actively deployed resource.

At the time of writing, Bitcoin is trading below $83,000. It slid 6% over the past 24 hours, trading as heavy selling pushed daily volume to $94 billion. The asset is now down 6% from its seven-day high of $87,883, though it remains about 2% above its weekly low of $81,315, which hit late Thursday night.

Bitcoin’s circulating supply stands at 19,982,315 BTC out of a capped 21 million, giving it a global market capitalization of roughly $1.65 trillion — also down 6% on the day.

This post Binance to Move $1 Billion User Protection Fund Into Bitcoin first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

Tether’s USDT Hits 12.6M MiniPay Wallets as $153M Flows Power Emerging Markets Push

Whales Dump 200 Million XRP in Just 2 Weeks – Is XRP’s Price on the Verge of Collapse?