How to use Monad 10000 TPS with OnFinality RPC

The launch of Monad sparked attention across the ecosystem for one reason: speed. This new execution-focused L1 is designed to achieve 10,000 TPS while maintaining full EVM compatibility. With the Monad blockchain now supported on OnFinality, developers can build with the same tools they already know but on a significantly faster foundation. In this article, you will learn what Monad is, how it achieves high throughput through parallel execution, what people are building on Monad, and how to access the Monad RPC from OnFinality.

Table of Contents

- What is Monad

- Why Monad Matters

- Key Benefits and Use Cases of Monad

- What People Are Building on Monad

- How Monad Works

- How to Access Monad RPC on OnFinality

- Common Questions about Monad

- Summary

- About OnFinality

What is Monad

Monad is a high-performance L1 blockchain that executes Ethereum transactions at massive scale. It preserves the EVM environment but introduces a redesigned execution engine built for parallelisation. Core characteristics:

- Aims for 10000 transactions per second

- Uses optimistic parallelization to run independent transactions simultaneously

- Ensures deterministic outcomes through conflict detection

- Fully EVM compatible for seamless migration

Why Monad Matters

User activity is growing across DeFi, gaming, consumer apps, and AI-powered agents. These workloads demand higher throughput and faster confirmation. Why Monad stands out:

- Parallel execution L1s are becoming the next major category

- Most L1s operate between 300 to 2000 TPS, while Monad targets 10000+ TPS

- Real-time apps need low-latency execution

- DeFi infrastructure requires predictable performance

Key Benefits and Use Cases of Monad

What Monad enables:

- High-frequency trading systems

- Agent driven automation

- Real time gaming

- High traffic consumer apps

- Payment and settlement rails

Why developers prefer Monad:

- Faster confirmation

- Higher throughput

- EVM compatibility

- No tooling rewrites

What People Are Building on Monad

Monad ecosystem developers are building across multiple categories. DeFi:

- Pancake Swap: performance-focused DEX

- Gearbox Protocol: Permissionless Credit Markets

- LeverUp: LP- Free Perps with 1001x lever

Gaming:

- Lumiterra: AI powered open world game

- Bro Fun: Vegas on Monad

Social:

- Farcaster: Wallet + social media combined

- Fomo: Never miss on next signal

Culture and memecoins:

- Monadverse: NFTs on Monad

- Fluffle: Grow your focus, Evolve dragns

How Monad Works

Monad’s performance comes from four innovations:

- Parallel execution of independent transactions

- Deterministic state updates through conflict detection

- High-performance EVM runtime written in low-level optimised code

- Pipeline architecture overlapping execution, verification, and state writes

How to Access Monad RPC on OnFinality

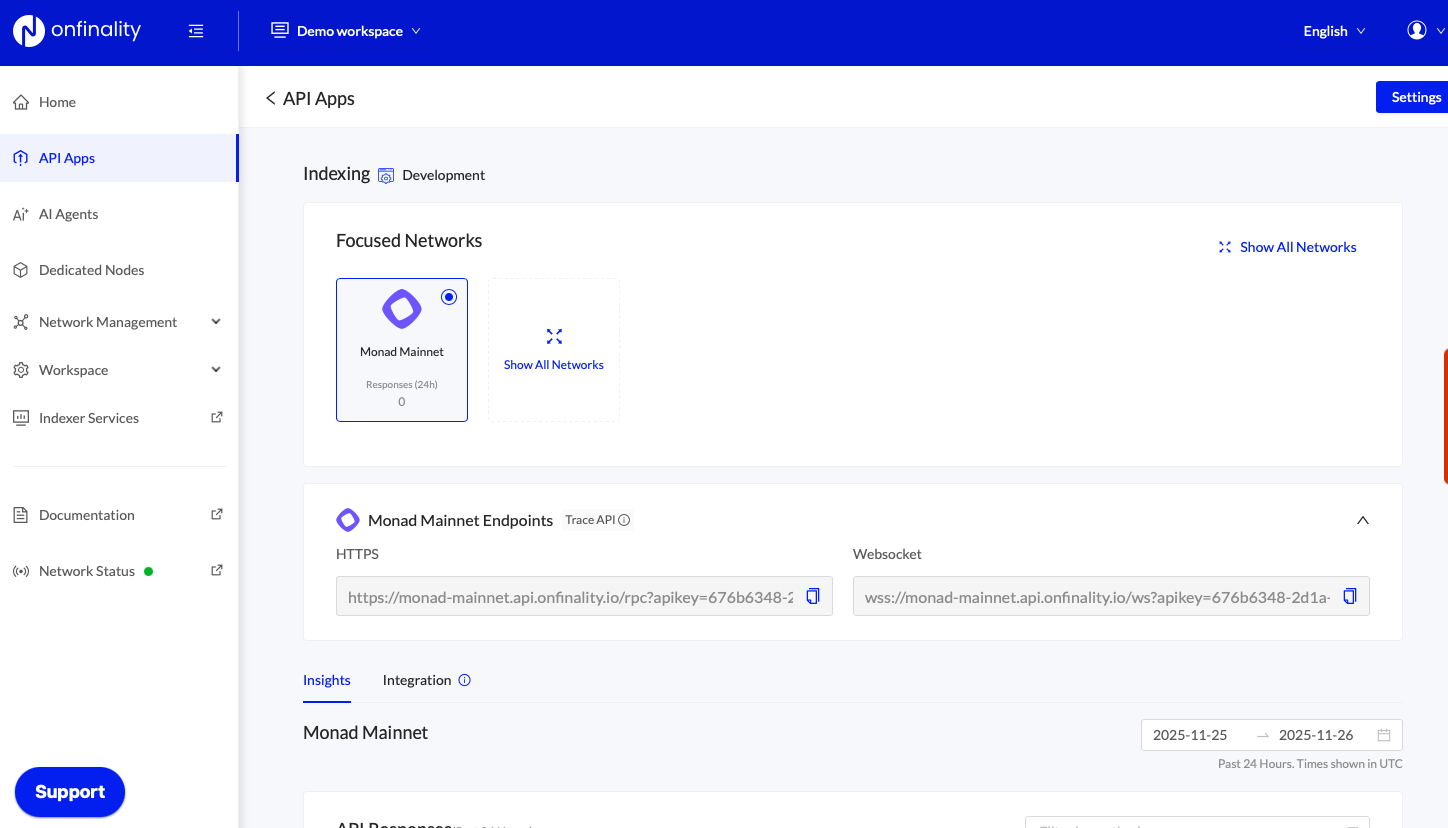

Developers can connect to Monad using OnFinality’s Dashboard and public RPC endpoints:

For high performance Monad endpoints with support SLAs and higher rate limits:

- STEP 1: Login into Onfinality Dashboard

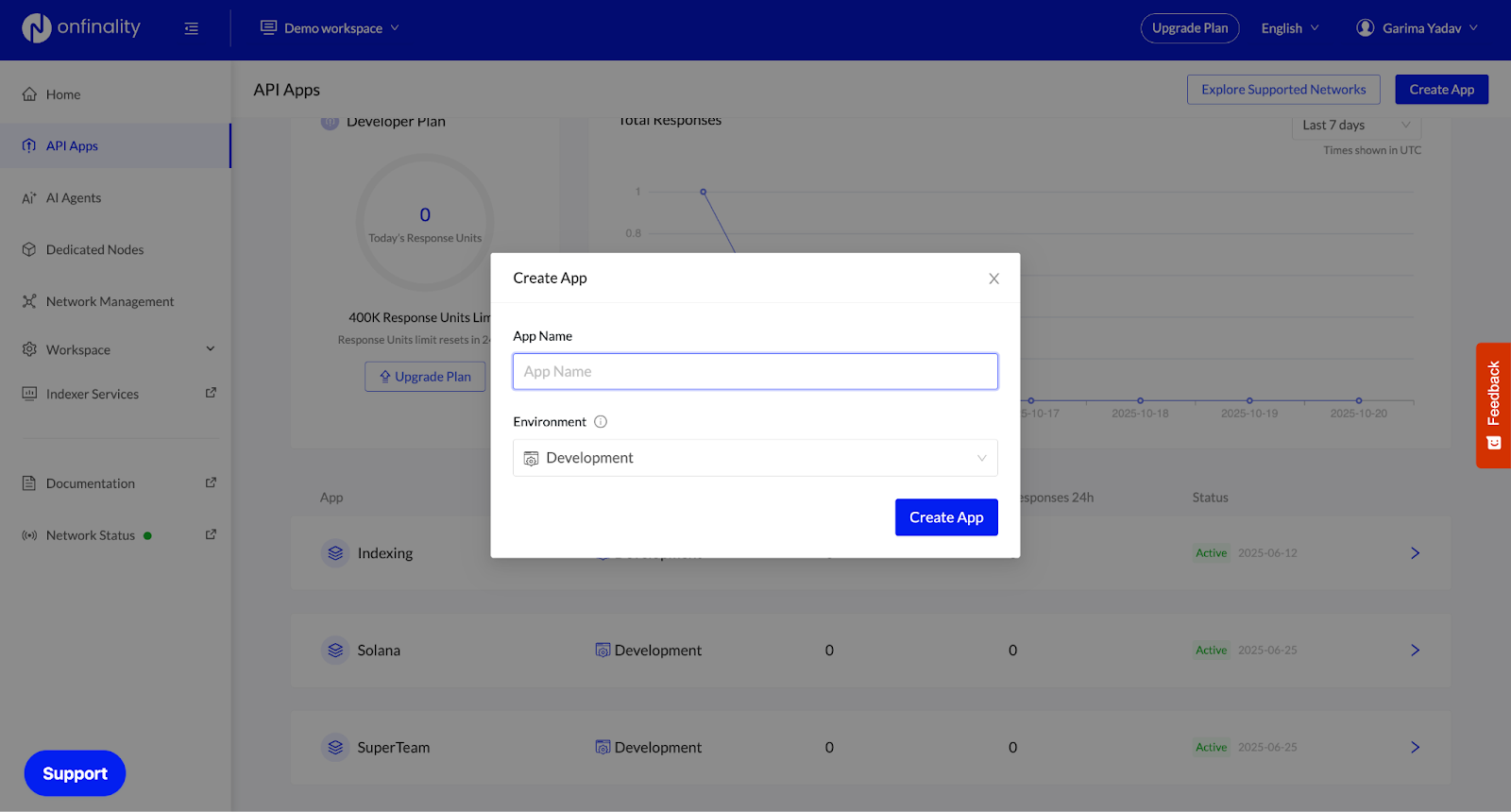

- STEP 2: Create an app on the dashboard

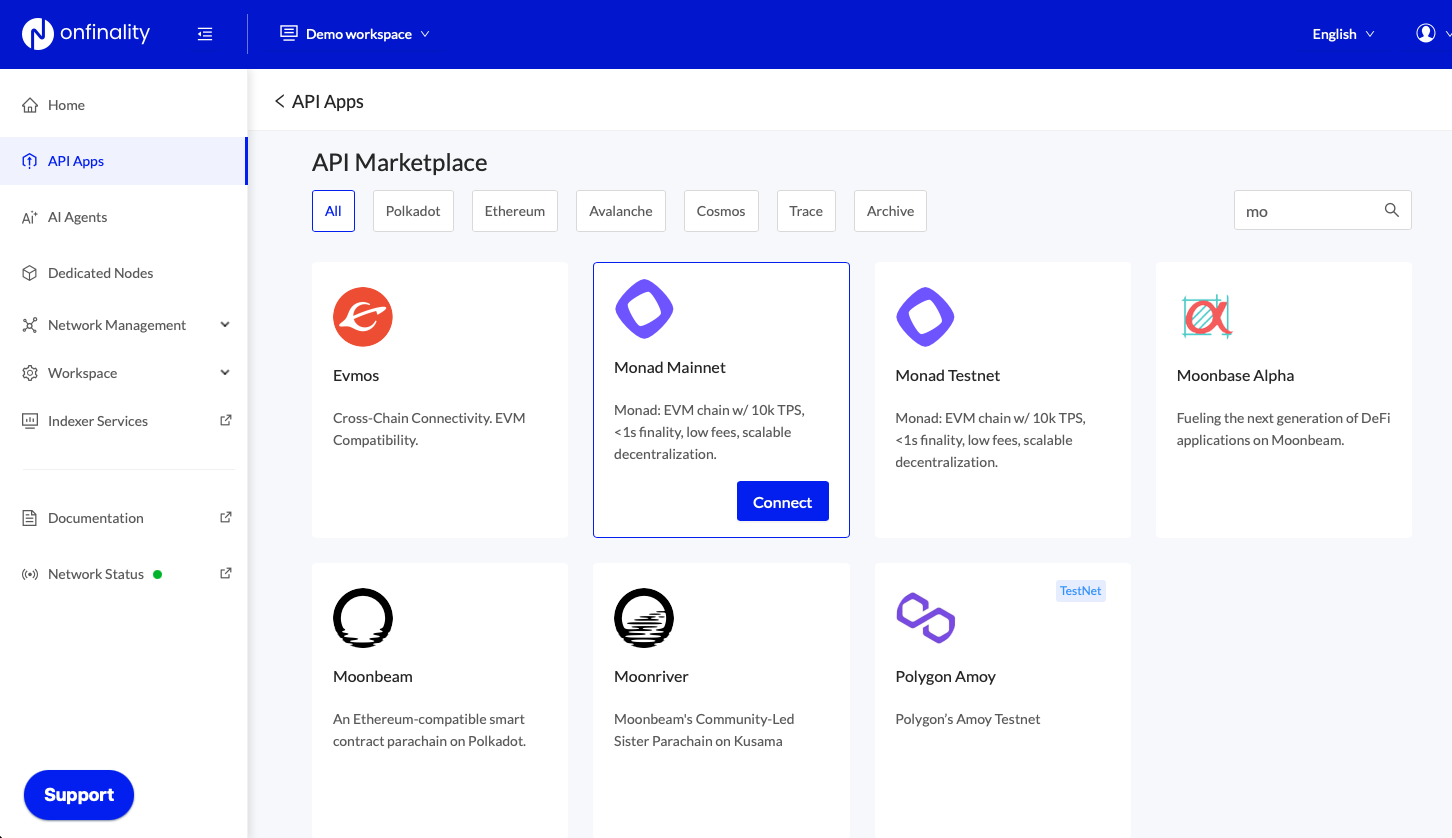

- STEP 3: Select Monad from the network list.

- STEP 4: You can use the Monad RPC and WebSocket link given on the dashboard

- STEP 5: Use it in your webApp or any of your application to communicate with Monad

Example: You can check whether the RPC is active or not by using the following command on your cli:

curl --location 'https://monad-mainnet.api.onfinality.io/public' \ --header 'content-type: application/json' \ --data '{"id": 1, "jsonrpc": "2.0", "method": "eth_blockNumber", "params": []}'

For deeper configuration, explore the Monad RPC Reference.

Monad Public RPC Endpoints

OnFinality also provides free public Monad RPC endpoints for development & testing purposes

Monad Public RPC Endpoint - Https:https://monad-mainnet.api.onfinality.io/public

Monad Public RPC Endpoint - Web Sockets: wss://monad-mainnet.api.onfinality.io/public-ws

Our public endpoints have rate limits applied and are not intended for production use.

Common Questions about Monad

Is Monad EVM compatible?

Yes, Monad is 100% EVM-compatible at the bytecode level, enabling existing Ethereum smart contracts to run without modifications and work seamlessly with Ethereum's tooling ecosystem.

How does Monad reach 10000 TPS?

Through parallel execution, pipelining, and an optimised EVM runtime.

Which apps benefit most?

DeFi, bots, gaming, and high-volume consumer apps.

Summary

Monad combines full EVM compatibility with a redesigned parallel execution engine targeting 10000 TPS. With OnFinality supporting the Monad mainnet, developers gain a fast and scalable RPC infrastructure ready for production workloads. Start building today by exploring the Monad RPC on OnFinality or browsing more networks on the OnFinality blog.

About OnFinality

OnFinality is a blockchain infrastructure platform that serves hundreds of billions of API requests monthly across more than 130 networks, including Avalanche, BNB Chain, Cosmos, Polkadot, Ethereum, and Polygon. It provides scalable APIs, RPC endpoints, node hosting, and indexing tools to help developers launch and grow blockchain networks efficiently. OnFinality’s mission is to make Web3 infrastructure effortless so developers can focus on building the future of decentralised applications.

App | Website | Twitter | Telegram | LinkedIn | YouTube

You May Also Like

Unlocking Massive Value: Curve Finance Revenue Sharing Proposal for CRV Holders

Best Crypto To Buy Now: Pepeto vs BlockDAG, Layer Brett, Remittix, Little Pepe, Compared