PayPal Survey: 4 In 10 US Merchants Now Accept Crypto

A rising share of shops in the US are now taking crypto at checkout. That shift is small in some places and big in others, but it is real. Reports say that roughly four in 10 US merchants accept cryptocurrency today, and customer interest is a clear reason why.

Merchant Demand Is Rising

According to a new survey from PayPal and the National Cryptocurrency Association, about 39% of merchants have added crypto as a payment option.

Many of those firms say they hear from buyers about crypto use on a regular basis. Reports note that 88% of merchants have gotten questions about paying with crypto, and 69% say they see demand at least once a month.

Also, 84% of respondents think crypto payments will be common within five years, which shows a lot of business leaders expect wider use soon.

Who’s Accepting Crypto

Adoption is uneven. Big companies with annual revenue above $500 million lead the pack, with roughly 50% accepting crypto.

Smaller shops lag at about 34%, while midsize firms sit near 32%. Travel and hospitality, gaming and digital goods, and higher-end retail are among the sectors pushing crypto forward. These markets often sell online or to tech-savvy buyers, so it makes sense they’d move faster.

Crypto’s Role In Sales

Crypto’s Role In Sales

For merchants that already accept digital assets, crypto is not just an occasional trickle. Reports say digital assets account for over a quarter of sales for some of those sellers.

Around 72% of current crypto-accepting merchants said their crypto sales grew over the past year. That kind of growth helps explain why firms want to keep the option available.

A common complaint is that setup is still too hard. Surveys found about 90% of merchants would accept crypto if it were as easy as taking a credit card.

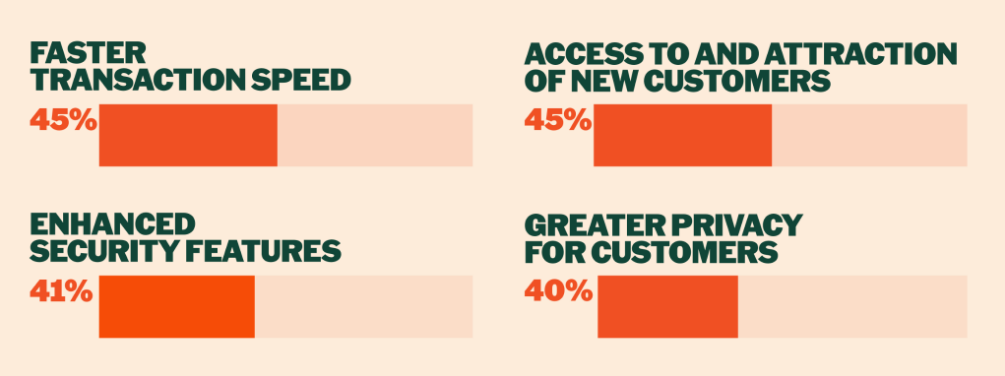

Payment tools and integration are top concerns. Merchants list faster payments, the chance to reach new customers, and better buyer privacy as reasons to accept crypto.

Younger generations are pushing the trend too — Millennials and Gen Z buyers are often the ones asking to use crypto at checkout.

What Merchants Want NextThe survey was run in October 2025 and polled about 619 payment strategy decision-makers across retail, travel, and digital goods.

PayPal and the NCA put the findings in a public release at the end of January 2026. Many executives say the next step is simpler tools and clearer rules. If merchants get easier on-ramps and reliable rails for settlements, acceptance could spread faster.

Featured image from PayPal Newsroom, chart from TradingView

You May Also Like

Pi Network Tech Upgrade Unlocks Mainnet Migration for 2.5 Million Users and Introduces Palm Print Security

PayPal P2P, Google AI Payments, Miner Pivot — Crypto Biz