Solana (SOL) Price: Traders Bet on Recovery as Long Positions Jump

TLDR

- Solana traders are increasing long positions in derivatives markets, suggesting expectations of price gains

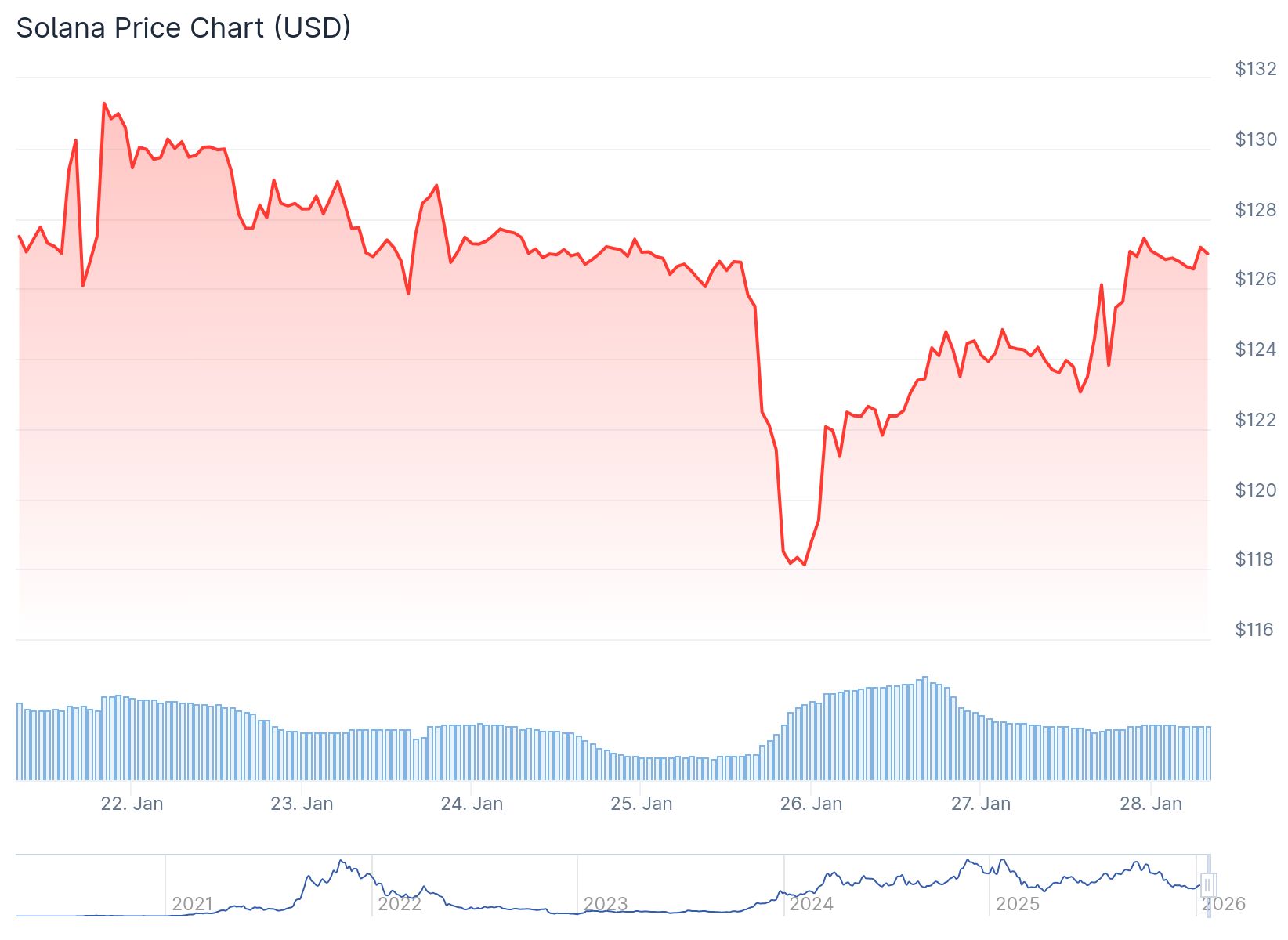

- SOL is trading near $127.35 with a market cap of $72.08 billion after weeks of pressure

- The shift comes after a recent slump tied to market worries and legal concerns

- Solana’s fast transaction speeds and low costs continue attracting new projects and traders

- Long-heavy positioning can reverse quickly through liquidations if prices drop

Solana traders are placing more long bets in derivatives markets after weeks of hesitation. Data shows more traders are opening positions that profit from price increases rather than declines.

Solana (SOL) Price

Solana (SOL) Price

SOL is currently trading near $127.35 with a market cap of $72.08 billion. The token has been holding near recent resistance levels as buying interest slowly returns.

Going long means betting that prices will rise. Traders use derivatives contracts linked to SOL’s price instead of buying the actual token.

Right now, long positions outnumber short positions. Short positions make money when prices fall, so this imbalance shows traders expect higher prices ahead.

The increase in bullish positioning follows a difficult period for SOL. The token spent weeks under pressure from broader market concerns and legal issues.

During that time, many traders stepped back. Trading activity slowed and confidence weakened across the market.

Return of Confidence

The return of long bets suggests some traders believe the worst news is already priced in. That belief alone can bring buyers back into the market.

Staking activity on Solana has remained steady during the downturn. When people lock up tokens to earn rewards, it often shows long-term trust in the network.

Solana stays popular with traders because of its speed and low costs. Transactions settle in seconds and cost very little compared to other networks.

The network continues attracting new projects ranging from finance apps to tokenized assets. More activity on Solana usually means more demand for SOL to pay transaction fees.

Network History Remains a Factor

Past network outages and recent security concerns have not been forgotten. These issues make some traders quick to exit when markets turn unstable.

Rallies driven by derivatives positioning can reverse quickly. When too many traders hold long positions, even small price drops can trigger forced selling.

These liquidations can wipe out gains in minutes. Beginners often feel the impact most because they tend to enter positions late.

Trader positioning often changes before prices move. When confidence appears early, price movements sometimes follow later.

Solana has been hovering near resistance levels while the wider crypto market searches for the next altcoin to gain attention. Bitcoin has cooled off recently, shifting focus to alternative tokens.

Solana’s market cap of $72.08 billion reflects a 2.08% gain in the last 24 hours. The increase in long positions comes as buying pressure gradually returns to the market.

The post Solana (SOL) Price: Traders Bet on Recovery as Long Positions Jump appeared first on CoinCentral.

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?

XRPL Validator Reveals Why He Just Vetoed New Amendment