Behind the war of words between Base: Net capital inflow in the past three months exceeded US$2.5 billion, and TVL exceeded US$14.2 billion, surpassing Solana

Author: Frank, PANews

Many public chains have always liked to label their competitors as Solana, but it seems that no one can really threaten Solana. However, recently Solana's co-founder Toly seems willing to debate with Base's co-founder. At the same time, in recent times, Base's ecological data in various aspects has experienced explosive growth. Not only are many indicators in the leading position in the L2 ranks, but TVL, capital inflow and other data have even surpassed Solana.

It seems that Base is the biggest potential rival in Solana’s mind? PANews reviewed Base’s recent data and compared it with Solana to see if Base’s rise is an enemy at the gate or another “crying wolf”?

The two co-founders are engaged in a heated argument

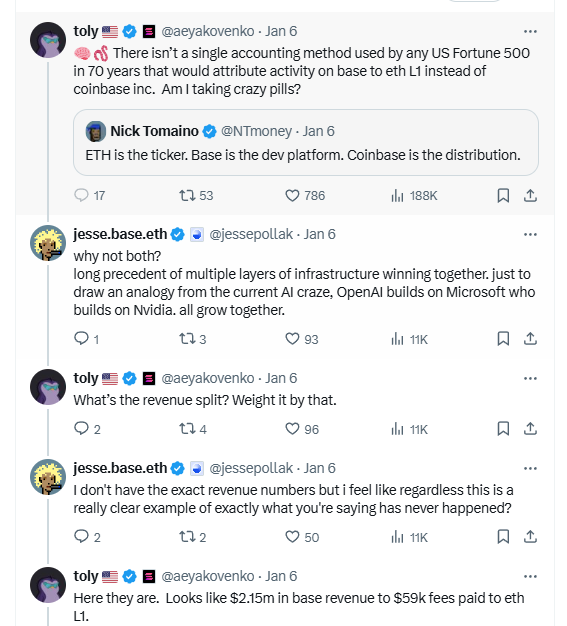

On January 6, Solana co-founder Toly commented on social media that the development of Base did not bring real growth to the Ethereum ecosystem, but Coinbase was absorbing the Ethereum ecosystem through Base. In response to this statement, Base founder Jesse responded on social media, saying that Base and Ethereum are not in a zero-sum competition. Base, like other L2s, is developing within the overall route of Ethereum. With the development of Base, Ethereum is also growing stronger.

Toly then used an analogy, just like the competition between Google and Microsoft, both have contributed to Linux, but in terms of value capture, this is separate. Therefore, no Fortune 500 company in the United States uses a single accounting method to attribute Base's activities to Ethereum, but all are accounted for in Coinbase. And the $2.15 million in revenue generated by Base only paid $59,000 to the Ethereum mainnet.

It seems that Toly is speaking up for ETH for not capturing value from Base. In fact, the debate may not be about the competition between Base and Ethereum, but about the competition between Solana and Base. Although there are many competitors of Solana in the market, such as Sui, Aptos or Hyperliquid, they all position themselves as competitors of Solana. But judging from the statement of the Solana team, the biggest competitor in their eyes may be Base.

As early as December, Pudgy Penguins announced the issuance of tokens on Solana, and after going online, the Solana network created a record high of 66.9 million transactions per day. During this process, Jesse also publicly said: "I and the Base community will welcome Pudgy Penguin and its token PENGU with open arms." This move was also considered by the community to be an open attempt to steal business from Solana.

In addition, the two have also exchanged views in many discussions. For example, Yuga Labs co-founder Garga.eth complained about the Ethereum ecosystem, which was met with dissatisfaction from Jesse, and Toly added fuel to the fire in the following comment: "Bridge ETH to Solana, I absolutely have no objection to ETH becoming the best currency on Solana." Previously, Jesse has also made many comments comparing Base and Solana.

BaseTVL and capital inflow surpass Solana

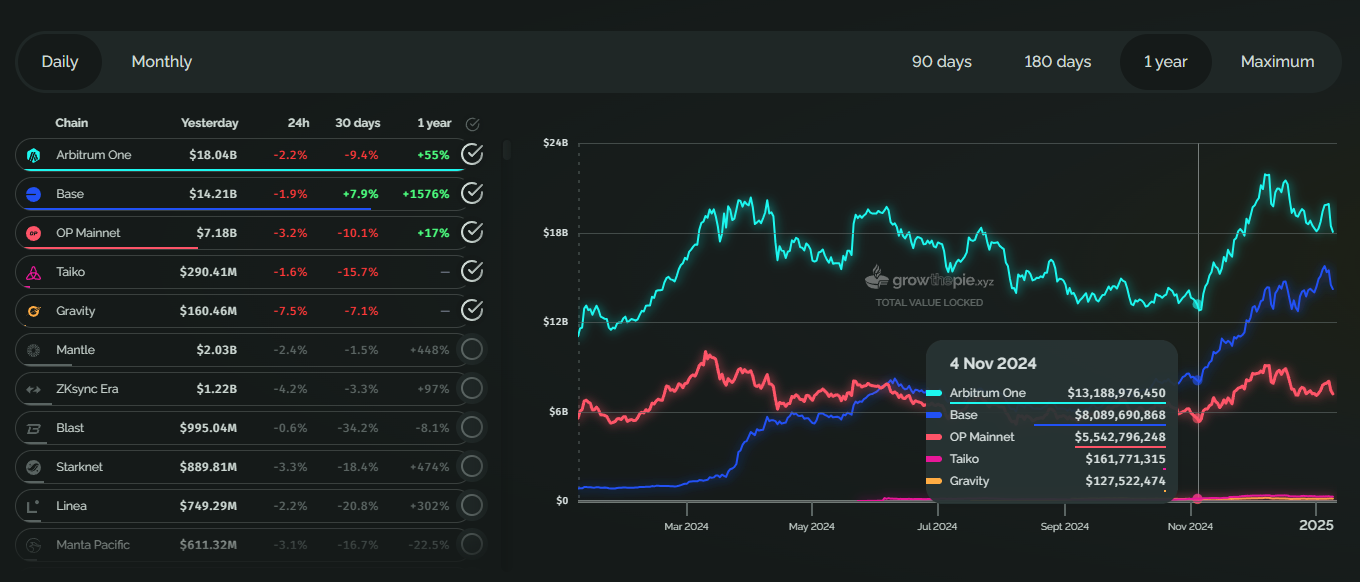

Behind the verbal battle between the two, there is an undercurrent of data between Base and Solana. PANews compared several data indicators of Base and Solana in the past year. It can be seen that Base's current overall data is still not as good as Solana, but Base's growth rate is leading Solana in all aspects. If it continues to develop at this rate, Base will likely surpass Solana in terms of data within 1 to 2 years.

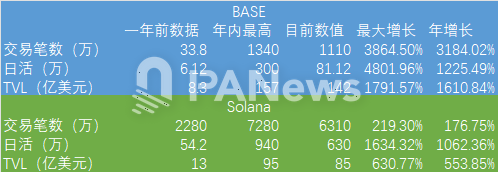

PANews selected several commonly used indicators for public chain comparison, such as the number of daily active addresses, number of transactions, TVL, etc. The data selected is the data changes from one year ago to January 10, 2025.

First, let’s look at the changes in Base. One year ago, Base had about 338,000 daily transactions, 61,200 daily active addresses, and a TVL of about $830 million. These figures were equivalent to 1.48%, 11.29%, and 63.85% of Solana at the time.

As of January 10, 2025, Base's data changes are about 11.1 million transactions per day, about 811,200 daily active addresses, and about $14.2 billion in TVL. The current ratios of these three data to Solana are: 17.59%, 12.88%, and 167.06%.

The annual growth rates of these three indicators of Base were 3184.02%, 1225.49%, and 1610.84%, respectively. During the same period, the growth rates of these three indicators of Solana were 176.75%, 1062.36%, and 553.85%, respectively.

It can be seen that after a year of development, Base's transaction volume and daily activity data are still far behind Solana. In terms of TVL, Base has surpassed Solana. Interestingly, Jesse and other key team members shaved their heads on a live broadcast on January 9 to celebrate this data.

In terms of the growth rate of other data, Base's growth momentum is also more aggressive than Solana. If both parties maintain their current growth efficiency, Base may surpass Solana in terms of the number of transactions in a year.

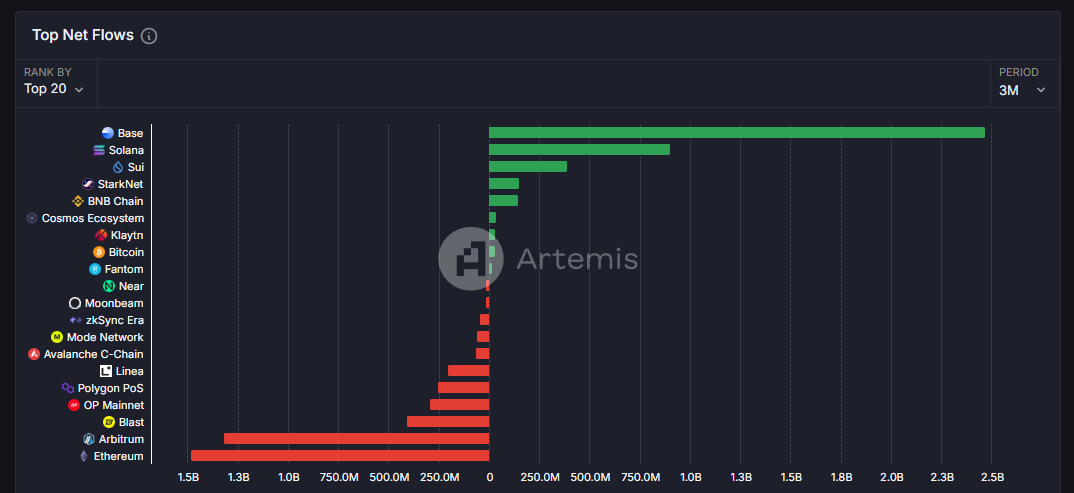

In addition to these data, a more important indicator is also quietly changing. For most of the past year, Solana has been the network with the most inflow of funds among public chains. Data from the last three months shows that Base has become the public chain with the highest net inflow of $2.5 billion, while Solana ranks second with a net inflow of $900 million.

The main changes in this data may have occurred in the near future. The total net inflow in the past year was about US$3.8 billion, which means that the net inflow in the past three months (2.5 billion) accounted for 65% of the whole year.

From the election to Virtuals, Base is getting closer with AI

Judging from the changes in details, this is indeed the case. Base's TVL seems to have seen a significant increase since November 3. However, this is not an isolated case for Base, as Arbitrum also experienced a wave of rapid development during the same period.

The reason behind this wave of growth may mainly come from the overall market growth brought about by Trump’s election after the US election. In the past month, the main reason why Base has attracted attention is that in the MEME track that has long competed with Solana, a product that can compete with it, Virtuals Protocol, has finally appeared.

After various networks launched Pump.fun imitations, they basically disappeared quietly. However, Virtuals Protocol finally caught the trend of AI Agent and became the most popular AI Agent one-click publishing platform. It gave birth to several AI Agent tokens with market value exceeding 100 million, such as aixbt and GAME.

According to the data from Dexscreener, on January 11, the DEX transaction volume on Solana was $6.88 billion, with 5,324 new trading pools created in 24 hours, while the transaction volume on Base was $2.12 billion, with 2,673 new trading pairs launched in 24 hours. The gap between the two in the MEME field is narrowing step by step, and Base seems to be the only public chain network that can approach Solana's popularity in MEME.

However, Sui had a short-lived boom before, but after the popularity declined, it inevitably fell into silence again. The relative advantage of Base is that its fund sedimentation effect is much stronger than Sui, so as long as the TVL volume does not drop drastically, perhaps this popularity can still be maintained.

By comparing the data, we can find that Base is becoming Solana's strongest competitor, but the problem is that Base has always lacked its own governance token, which makes it difficult to be priced by the market. The lack of public chain tokens also allows Virtuals protocol to obtain more capital spillover effects on the Base public chain. Perhaps in order to solve this problem, on January 4, Base developer Jesse Pollak tweeted that Coinbase is considering providing tokenized COIN stocks to US users of its Base network.

If this goal can be achieved, perhaps the biggest significance is not that there is another important asset in the field of RWA, but that the value brought by the development of Base can finally be more directly reflected in the stock price of Coinbase, and for investors who can only participate in cryptocurrency transactions, it can also be regarded as a disguised way to participate in the governance of Base and enjoy dividends. Judging from the current data performance of Base, the market value converted into tokens should be above 10 billion US dollars. On January 11, the market value of Coinbase was about 64.7 billion US dollars. This market value is placed after BNB and SOL in the cryptocurrency. I wonder if Coinbase's market value can surpass BNB and SOL once the on-chain funds of Base are added.

You May Also Like

Botanix launches stBTC to deliver Bitcoin-native yield

Unprecedented Surge: Gold Price Hits Astounding New Record High