Bitcoin Flirts With $90K Amid 2026 Supercycle Forecast From Binance’s CZ

Bitcoin remained on the back foot on Friday, under the $90,000 level, capping off a week of weakness as cooling tensions over the US and Greenland, and a major buy by Strategy, did little to shore up appetite for cryptocurrencies.

Risk sentiment during the Asian session was also constrained by the Bank of Japan meeting and the US President’s warning of potential military action in Iran.

BTC is down 6% over the last week, despite edging up a fraction of a percentage in the last 24 hours to trade at $89,501 as of 02:59 a.m. EST, with trading volume dropping over 1% to $39.2 billion, an indication of fading trading activity, according to Coingecko data.

The stall below the $90,000 area comes as Binance co-founder Changpeng Zhao (CZ) says BTC will break the four-year cycle this year.

CZ Predicts Bitcoin ‘Super-Cycle’ in 2026

CZ, speaking on CNBC’s Squawk Box on January 23, said that he expects BTC to enter a “super-cycle” in 2026, potentially breaking the cryptocurrency’s historic four-year pattern of price peaks and crashes.

Zhao attributed the bullish sentiment to what he described as increasingly pro-crypto policies in the United States and other countries, which he said are improving the global environment for digital assets.

Bitcoin has, in the past, followed four-year cycles tied to halving events that reduce mining rewards and new supply. These cycles typically produce an all-time high followed by significant price corrections.

“I think this year, given the US being so pro-crypto and every other country is kind of following, I do think we will see this. We will probably break the four-year cycle,” Zhao said.

Zhao also pointed to what he sees as a broader political shift around digital assets, saying that the increasingly pro-crypto stance worldwide is “good for the crypto industry and good for America as well.”

His comments come as BTC holds fort above $89,000, pulling back from its $97,00-$98,000 peak earlier this month.

Bitcoin Price Risks A Sustained Drop

While BTC saw some gains after Trump softened his rhetoric on Greenland earlier this week, the world’s largest crypto largely reversed course, returning to one-month lows.

Retail appetite for BTC remains largely weak after dropping below the ascending triangle pattern.

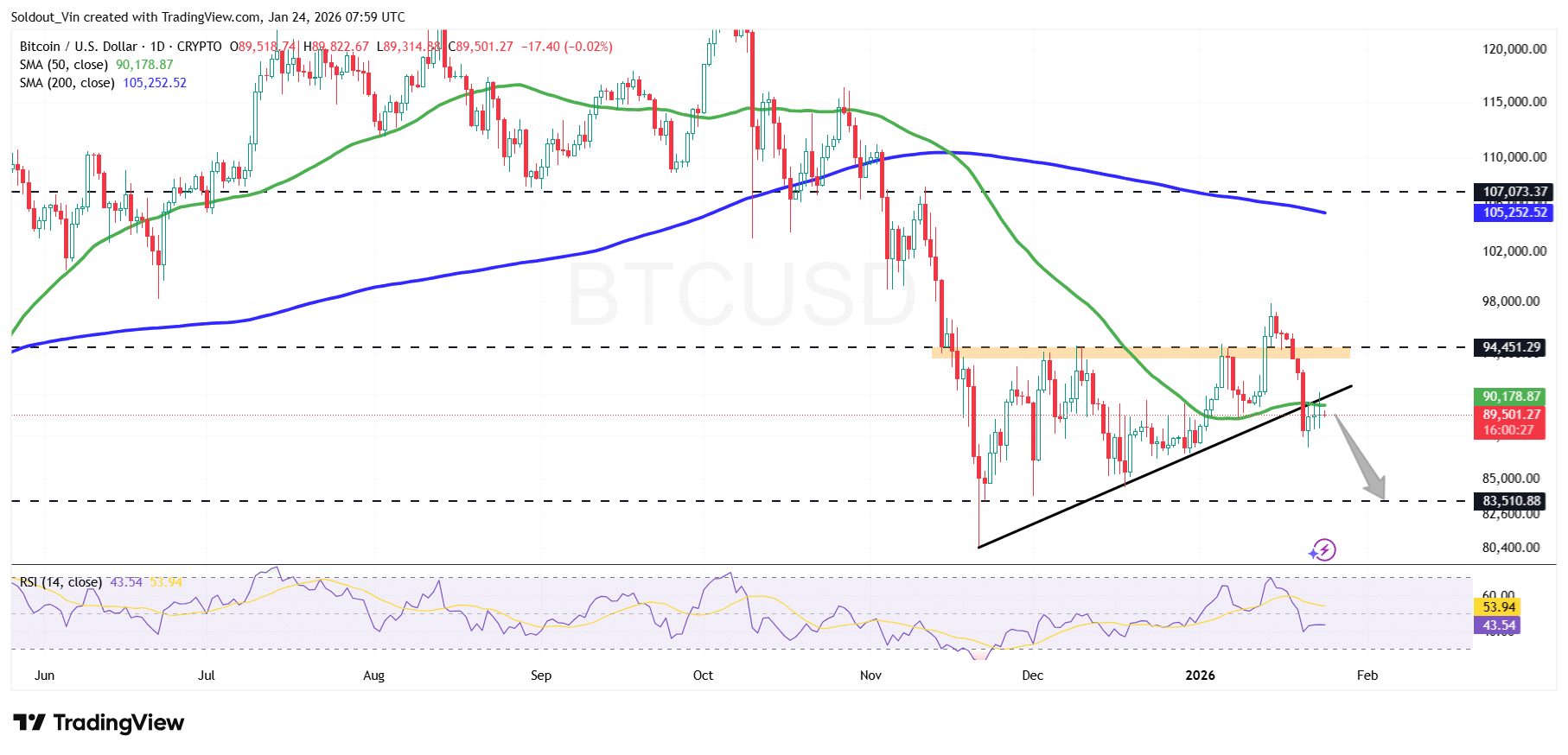

Bitcoin’s price has also fallen below the 50-day Simple Moving Average (SMA) at $90,178, confirming the overall bearish structure. The 200-day SMA at $105,252 serves as the long-term resistance area, just within the $107,000-$106,000 previous supply zone.

The price also shows indecision, remaining within the sideways pattern of between $83,510 and $94,451 from late November, as every move has been capped between a rising support level and the same-level resistance zone.

Meanwhile, the Relative Strength Index (RSI) shows that buyers are currently holding the price above support, with the RSI currently moving in a near-straight line around 43.

BTC/USD Chart Analysis Source: TradingView

BTC/USD Chart Analysis Source: TradingView

BTC Price Prediction: $83,000 Level In Sight

With BTC dropping below the key $90,000 level and the lower boundary of the ascending triangle, it risks a sustained decline.

If the price of Bitcoin drops below the previous demand zone around $85,000, the next key support area, which is now acting as a cushion against downward pressure, will be at $83,510.

Polymarket shows the likelihood of BTC hitting $85,000 has risen to around 34%, as quoted by prominent analyst Michaël van de Poppe on X.

This bearish sentiment is also supported by US spot BTC exchange-traded funds (ETFs), which have recorded net outflows for five consecutive days and $103.5 million in the last 24 hours, according to Coinglass data.

Meanwhile, any attempt to push BTC above $91,000 and keep it above the 50-day SMA could signal a bullish move. In this case, Bitcoin could climb back to its target prices above $94,500, with a long-term target of the $107,000 zone.

Related News:

You May Also Like

BlockDAG Presale Growth vs BlockchainFX and Pepenode

Why This New Trending Meme Coin Is Being Dubbed The New PEPE After Record Presale