The truth about the wealth of TRUMP tokens: Big players compete in the arena, with an average purchase of $590,000 per person, and an address bought $1.09 million in one minute after the token was iss

Author: Frank, PANews

On January 18, before taking office, US President Trump issued his personal MEME token TRUMP (OFFICIAL TRUMP), creating the first personal cryptocurrency issued by a US president in history. After the issuance of the TRUMP token, it not only caused an uproar in public opinion, but also triggered a crazy market for this token in the market. In just two days, the market value of the TRUMP token exceeded US$82 billion (FDV), an increase of about 450 times from the issue price of US$0.1824 to the highest price of US$82. Many quick players made a lot of money, while more people watched and sighed at the high prices.

PANews conducted an analysis of the first purchase time, purchase price, and reduction time of the top 1,000 TRUMP token holders, to interpret the financial game behind this presidential token from a data perspective.

The average purchase amount of large investors was US$590,000

As of the afternoon of January 20, the number of addresses holding TRUMP tokens on the chain has exceeded 853,000. Together with the number of holders on centralized exchanges, the total number of holders should be no less than 1 million. The top 1,000 addresses hold a total of 78.12 million coins, accounting for about 39% of the total circulation (excluding major exchange addresses). The total amount of coins held by these large holders is about US$4.68 billion. In terms of the cost of holding coins, the total amount spent by these large holders for the first time was about US$428 million, and the initial purchase of about 15.91 million tokens was about US$26.9. As of the afternoon of January 20, the average increase achieved by these large holders was about 123%.

On the surface, these investors have achieved great profits, and have once again written a legend of wealth in the MEME track. However, judging from the average initial purchase amount of the address, the addresses currently in the top 1,000 are indeed generous big players, with an average initial purchase amount of about US$591,000. This amount is very different from other MEMEs.

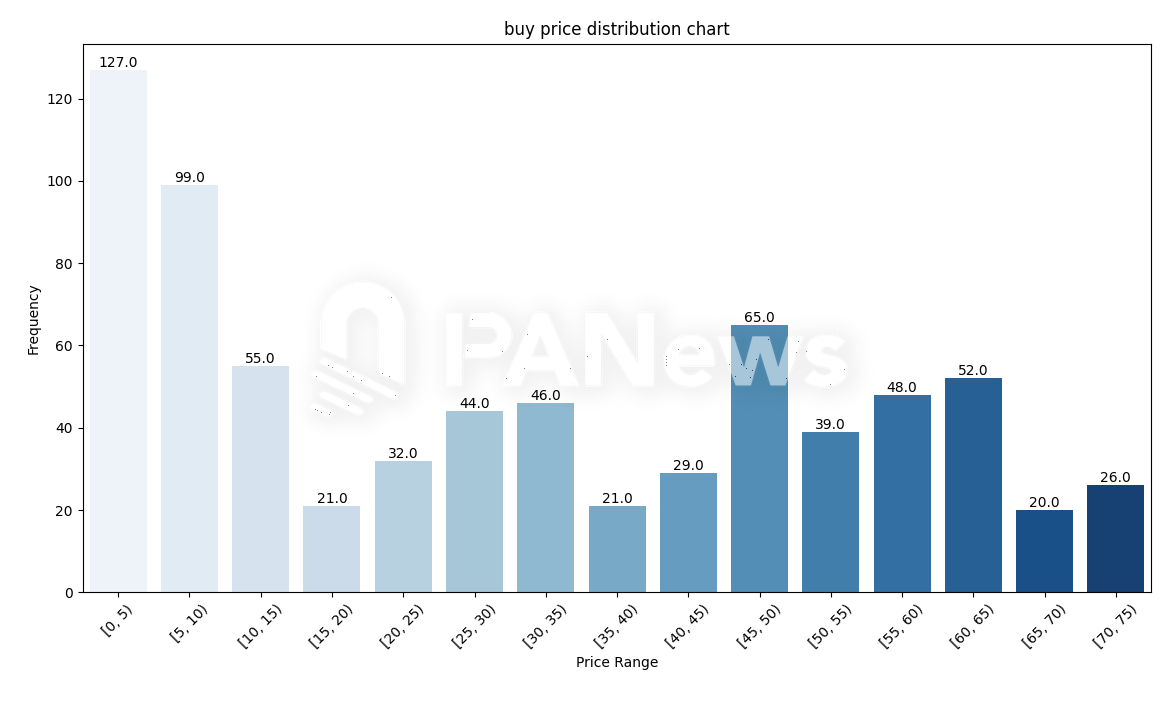

Nearly 40% of large households have a cost price below $15

From the overall purchase cost distribution of large investors, the most common purchase cost is around $3.1, which is within half an hour after the token is issued. The second most common purchase cost is between $5 and $10. The initial purchase cost is less than $15, accounting for about 38.8% of the total analysis samples. In addition, the initial purchase cost between $45 and $65 is the most common, accounting for about 28%.

In general, the number of tokens purchased by these big investors in their first transaction accounted for 44% of their total holdings, and 7.7% of them chose to buy in one transaction.

In addition, nearly 10% of the big investors invested more than $1 million at the first time. This is very different from the traditional MEME coins. However, the initial purchase cost of these super big investors is not low, with an average cost of about $46, and they basically bought on the 19th. These big investors may represent the investment logic of the main players. Even when facing the tokens issued by the US President, they will still set aside one day for decision analysis and enter the market at a price that most people think is not low.

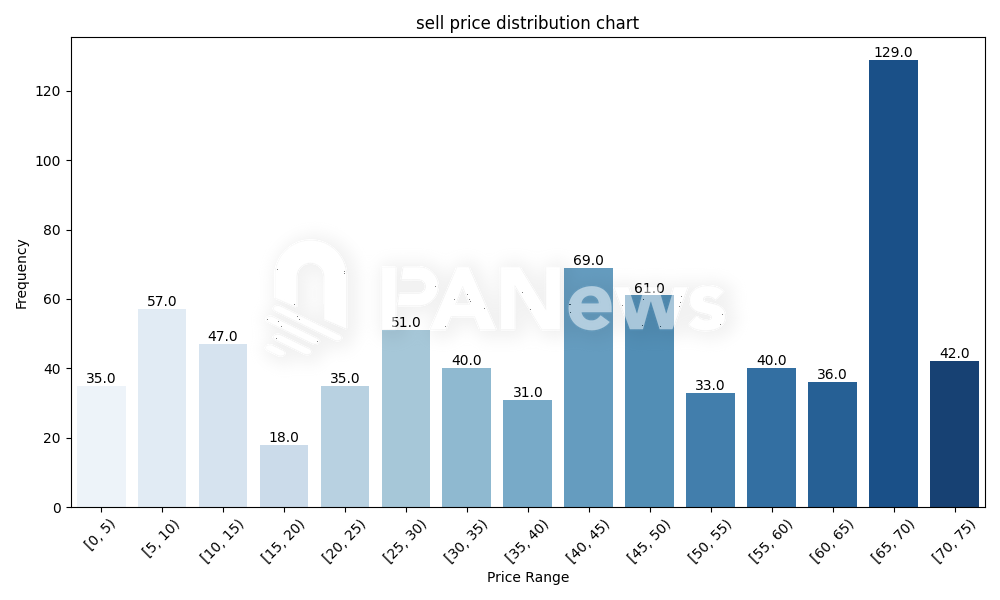

From the perspective of selling prices, the price range for the first sale was between $65 and $70, with 17.8% of addresses selling for the first time in this price range. The second most common price range was between $40 and $50. Overall, the total amount spent by these top addresses on the first purchase was approximately $428 million, and the total amount of the first sale was approximately $1.06 billion, with the overall profit from the first sale being 2.47 times the return.

In addition, about 28% of the addresses did not sell after buying. The average holding cost of these large addresses was US$23.45, and the total initial purchase amount was approximately US$67 million.

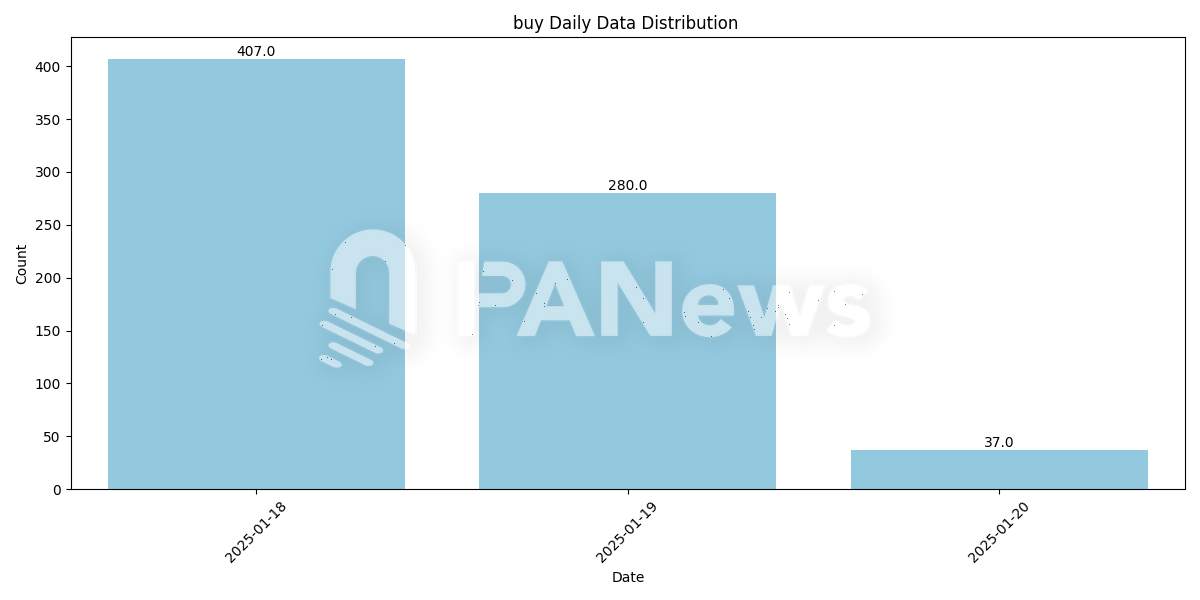

In terms of time, 56% of the addresses bought on the first day, and most of the addresses bought the tokens right after they were issued.

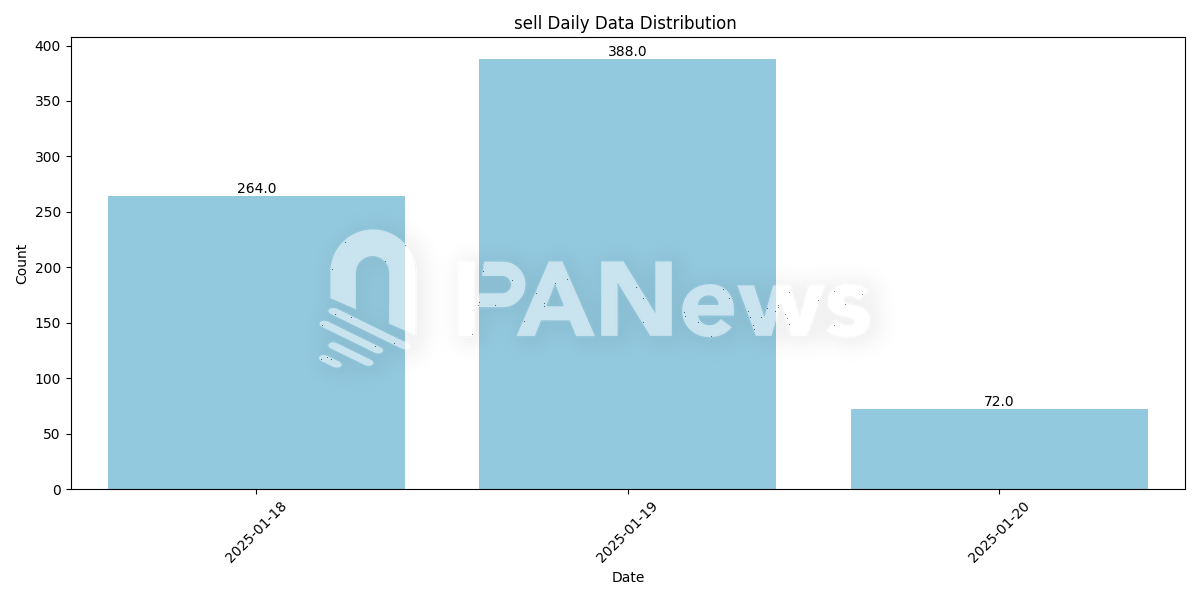

In terms of selling time, most of the big investors sold their first lot on the 19th. From the big data of holding time, the average holding time of these big investors is about 7.5 hours.

The strongest address invested millions 1 minute after issuance

Among them, the strongest main force is the address 6QSc2CxSdkUQSXttkceR9yMuxMf36L75fS8624wJ9tXv. At 10:01 on January 18, the address spent $1.09 million to buy 5.97 million tokens at a price of about 0.1835, which is almost the same as the opening price. The address then dispersed the tokens to multiple addresses for distribution. Calculated at the highest price of $82, the maximum value of the tokens at this address can reach $477 million. According to incomplete statistics, the associated addresses of this address have sold more than $20 million in tokens. According to discussions on social media, this address has previously targeted tokens such as GRIFT, CHILLGUY, and MOODENG, and is considered by many netizens to be the address of Jupiter insiders. Judging from the transaction behavior, even if the user knew that Trump had issued tokens at the first time, he was able to make a decision in 1 minute and bet $1.09 million. This behavior is hard to believe is a coincidence or operational ability.

In addition, the TRUMP token was created at around 10 a.m. on the 17th, and trading began a day later. I wonder if some people who knew about it in advance were prepared to buy in advance?

A game that tests your financial strength and hand speed

Overall, compared with the development history of other MEME coins, the real advantage of TRUMP is not the amazing increase. In the data of large investors, we rarely see cases where small funds are purchased to achieve exaggerated returns. Judging from the investment amounts of KOLs who have gained large profits on social media, their investment funds are not small. It can be said that the TRUMP token seems to be a once-in-a-lifetime opportunity, but in fact, the opportunity of 10U Ares is not big. Compared with the previous tokens that have increased by tens of thousands of times, TRUMP's 450-fold increase is not high.

The reason why TRUMP has triggered the FOMO sentiment among the people is that, on the one hand, the sky-high market value of the token of up to 82 billion US dollars has caused an exaggerated effect on the outside world. On the other hand, some KOLs who bought in early publicly posted their orders, which made the FOMO sentiment even stronger. After all, compared with the previous effect of relying on analysis and various insider information to barely bet on a golden dog, TRUMP can be said to be issued in the open market. At this time, it seems that the competition is more about hand speed and amount of funds.

As many members of the Trump family participated in the issuance of MEME coins and the early profit-taking, the TRUMP token fell to $30 on January 20, with a correction of more than 60%. This drastic fluctuation proves that even the MEME coins issued by the president cannot avoid the high volatility. From the perspective of chips, TRUMP coins have become a market for big players to compete, rather than the next gold mine to change their destiny.

You May Also Like

Bitcoin ETFs Outpace Ethereum With $2.9B Weekly Surge

CME Group to launch options on XRP and SOL futures