On-chain detective ZachXBT and $3.9 million worth of Meme coins: The dragon slayer becomes the dragon?

Written by Damilare Damidez , Crypto Analyst

Compiled by: Felix, PANews

Recently, there have been some inconsistent opinions in the crypto community about the reputation of the on-chain detective ZachXBT. Some people still regard ZachXBT as a righteous man, but some people think that the "dragon slayer" ZachXBT has finally become a "dragon". In response, crypto analyst Damilare Damidez published an article to support ZachXBT and revealed the truth behind the controversy.

background

A few days ago, US President Trump launched his meme coin $TRUMP, and his wife soon launched a token. These events caused a lot of excitement in the market. In this meme craze, cryptocurrency trader Micki tweeted: "The busiest person in the crypto field in the next four years will be ZachXBT."

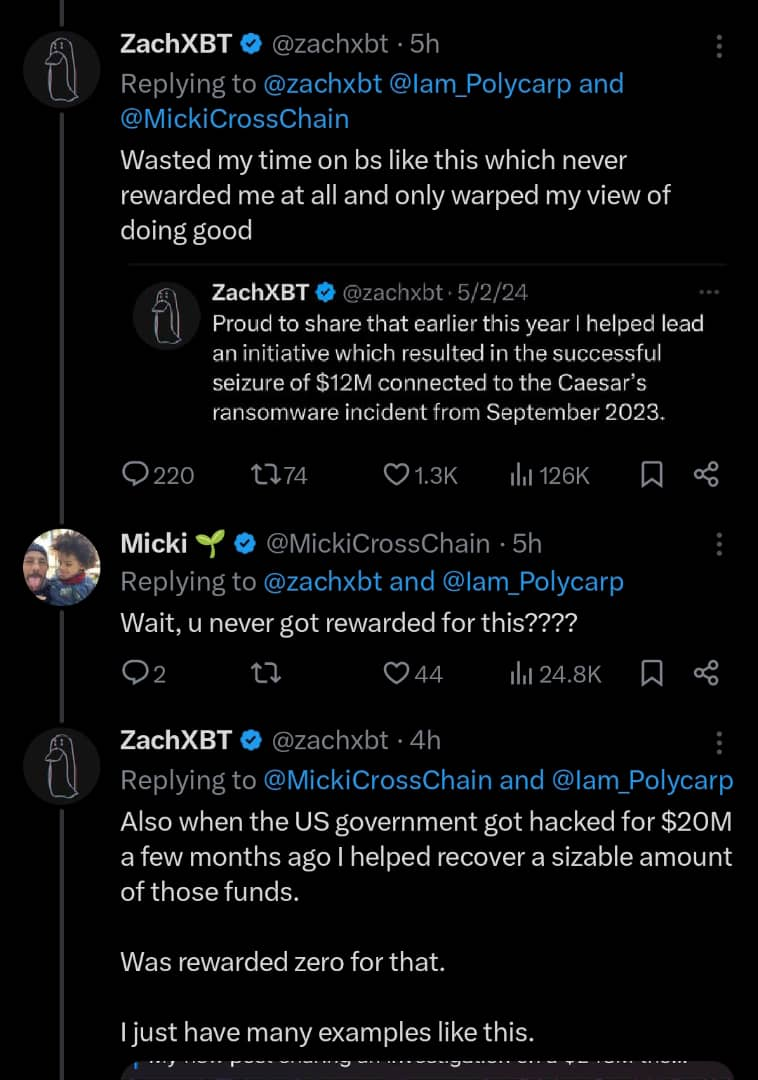

ZachXBT is a well-known blockchain investigator known for working with institutions to track fraud on the blockchain. ZachXBT made a comment about Micki’s remarks and said he did not receive any reward from them.

"One of my biggest regrets is not making money a priority," ZachXBT said. "I wasted my time on things like this (helping recover funds) that didn't bring me any rewards at all and only distorted my perspective on doing good things."

"In addition, a few months ago, the US government suffered a hacker attack and lost 20 million US dollars. I personally helped recover a considerable portion of the funds. But in the end, I personally did not receive any reward."

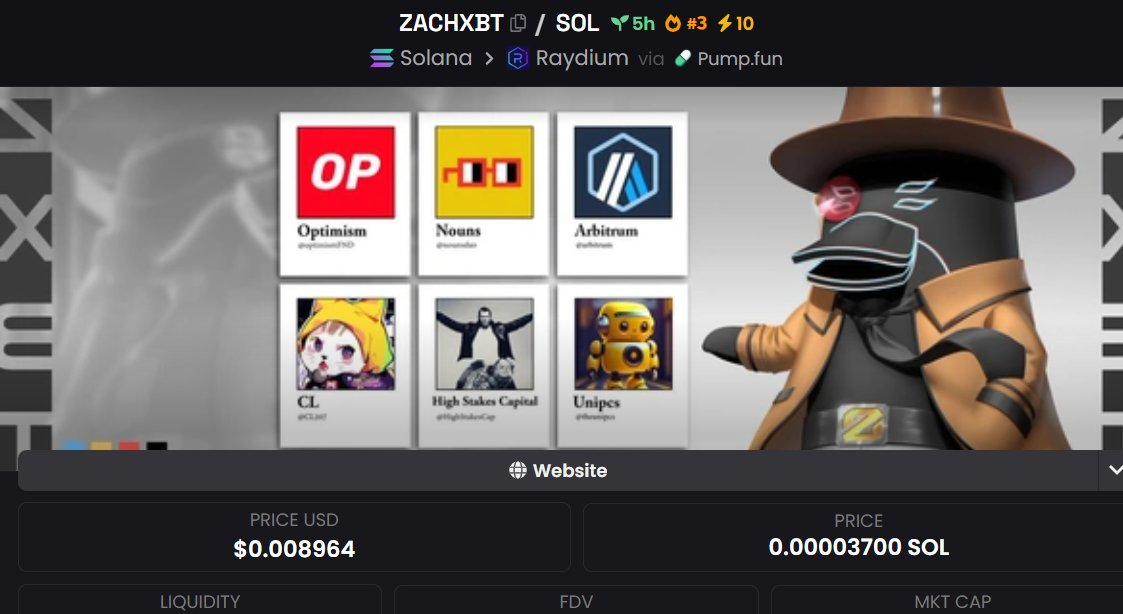

The comments sparked the launch of a token called “Justice for ZachXBT”, called ZACHXBT, created by degen traders. ZachXBT was airdropped 50% of its token supply (500,000 ZACHXBT).

Here’s how ZachXBT handles this:

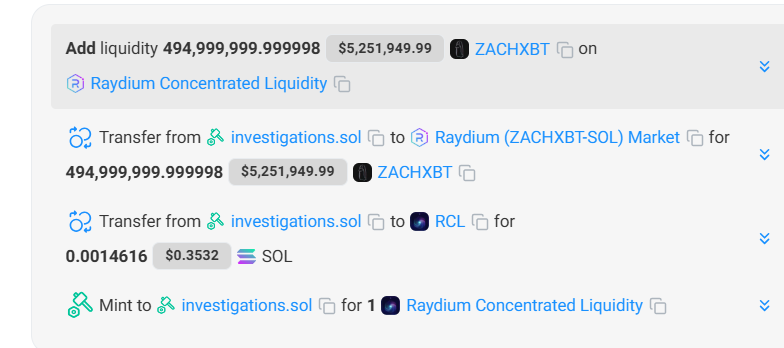

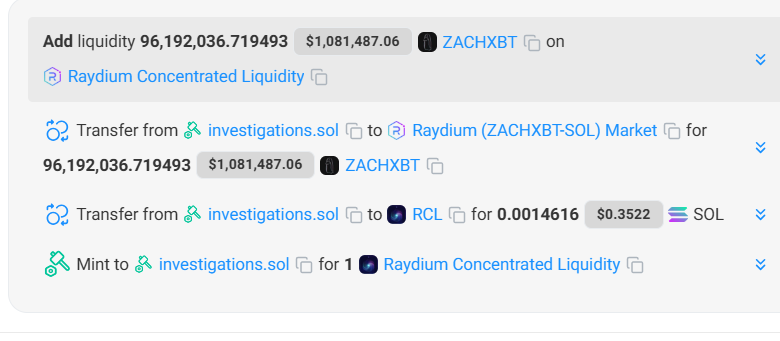

Increased liquidity by 50% :

ZachXBT added his airdropped token to a one-sided liquidity pool on Raydium. The token’s market cap surged from $5 million to $80 million in two hours.

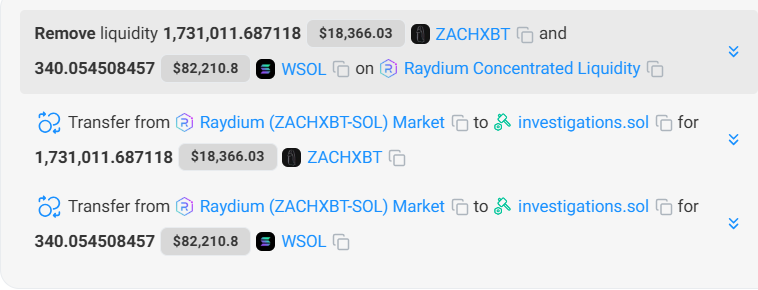

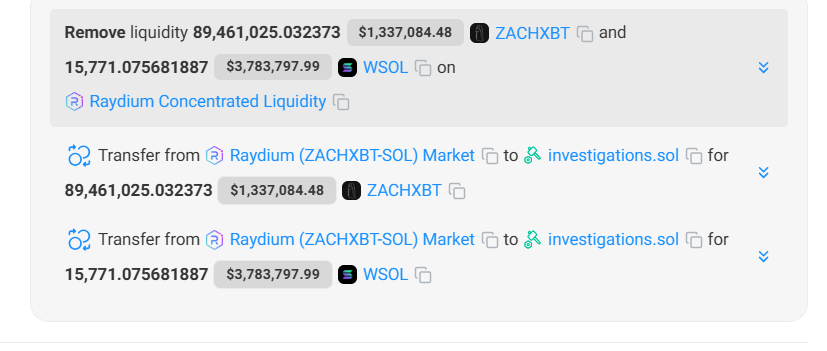

One hour later, ZachXBT extracted liquidity:

- Initial withdrawal: 1.7 million ZACHXBT and 340 SOL

- Later, 89 million ZACHXBT and 15,771 SOL

- Total withdrawals: 91 million ZACHXBT and 16,111 SOL

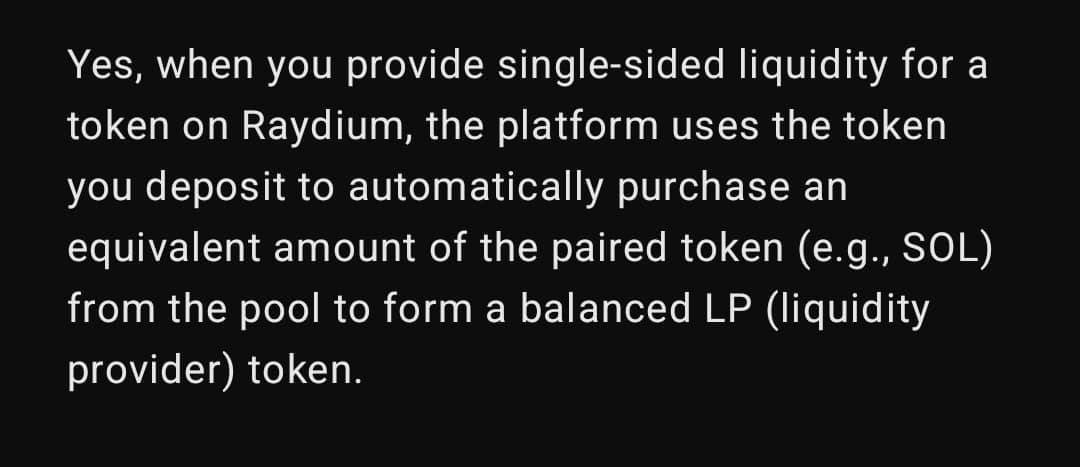

The following diagram shows how unilateral pools and liquidity extraction work:

When you provide unilateral liquidity for a token on Raydium, the platform will automatically purchase an equal amount of paired tokens, such as SOL, from the pool using the tokens you deposited to form a balanced LP token.

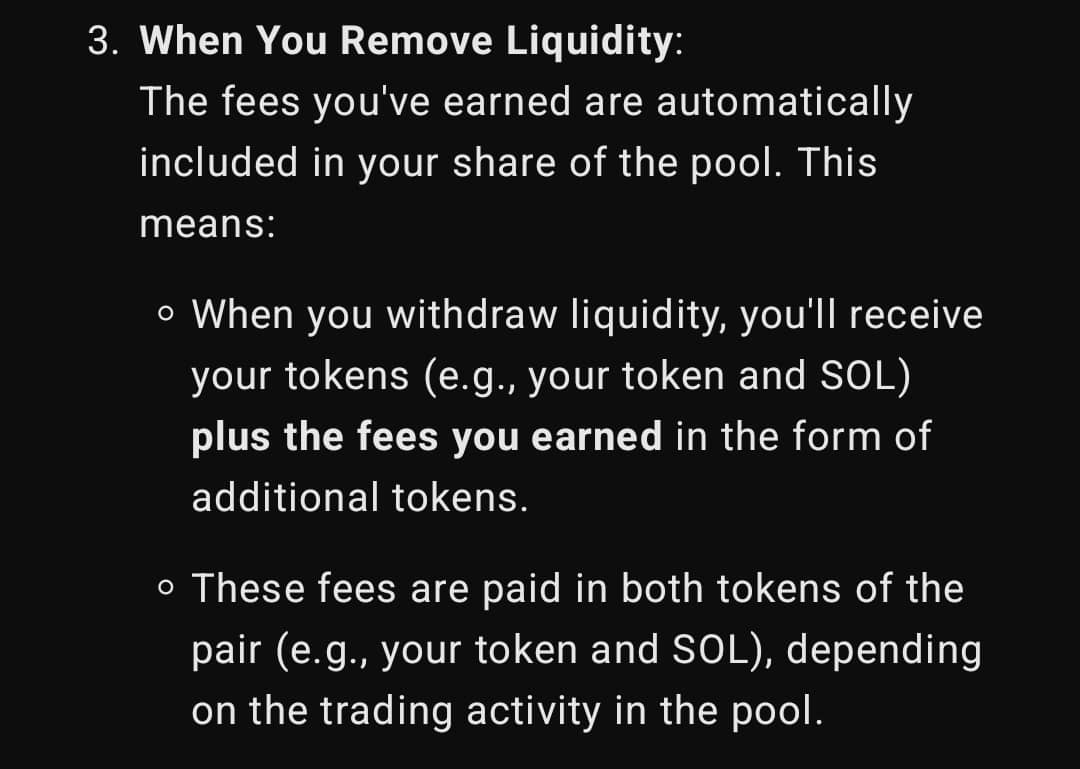

When liquidity is removed, the fees you earn are automatically credited to your share of the pool. This means:

- When you withdraw liquidity, you will receive your tokens (e.g., your tokens and SOL) plus the fees you earned in the form of additional tokens

- These fees are paid in both tokens of the trading pair (such as your token and SOL) depending on the trading activity in the pool.

Including donations, the total is 16,348 SOL (worth $3.87 million).

ZachXBT transferred the 16,348 SOL worth $3.8 million earned to another wallet.

FjQBfqpcgsrH4tG2Gpa6pDNoGT6fCwEvinMvVcK7ZxSG

ZachXBT then sends it to Wintermute.

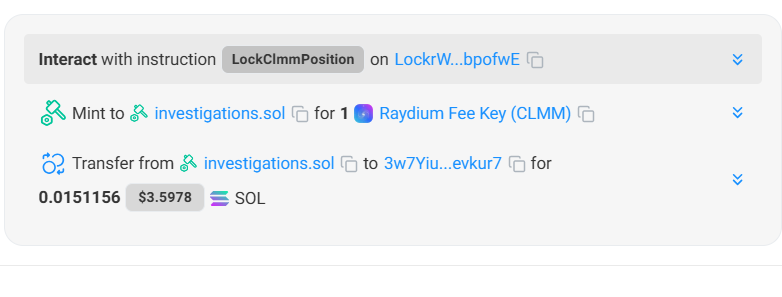

Locking the fund pool:

ZachXBT then locked the liquidity pool and added 96 million ZACHXBT to it.

Additional Token Sale: ZachXBT also received 50% of the supply of another token, CRIME, which it sold for $57,000 (still in wallet).

Why are tokens being sold?

The token’s collapse was not due to ZachXBT’s actions, but rather to FUD and a lack of on-chain knowledge among traders. As soon as word spreads that liquidity is being withdrawn, many people will panic and sell their holdings.

analyze

ZachXBT's actions demonstrate responsibility:

- Instead of blocking the project, he added liquidity, allowing others to trade

- The 10% withdrawal helped him gain financially, but many people felt that he deserved it

- Re-increasing liquidity without showing any sign of struggle

The dispute stems primarily from misunderstanding rather than malice.

in conclusion

ZachXBT’s treatment of the $ZACHXBT token represents a fair approach. The purpose of the token is to recognize his contribution and he earned profits without using his influence.

ZachXBT is still a hero, not a villain. The market just needs more education about on-chain mechanics and liquidity dynamics.

Related reading: From victim to whistleblower: The story of ZachXBT, the most powerful detective in the cryptocurrency world

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

While Shiba Inu and Turbo Chase Price, 63% APY Staking Puts APEMARS at the Forefront of the Best Meme Coin Presale 2026 – Stage 6 Ends in 3 Days!