Bitcoin Enters Consolidation Phase Before Key Options Expiry

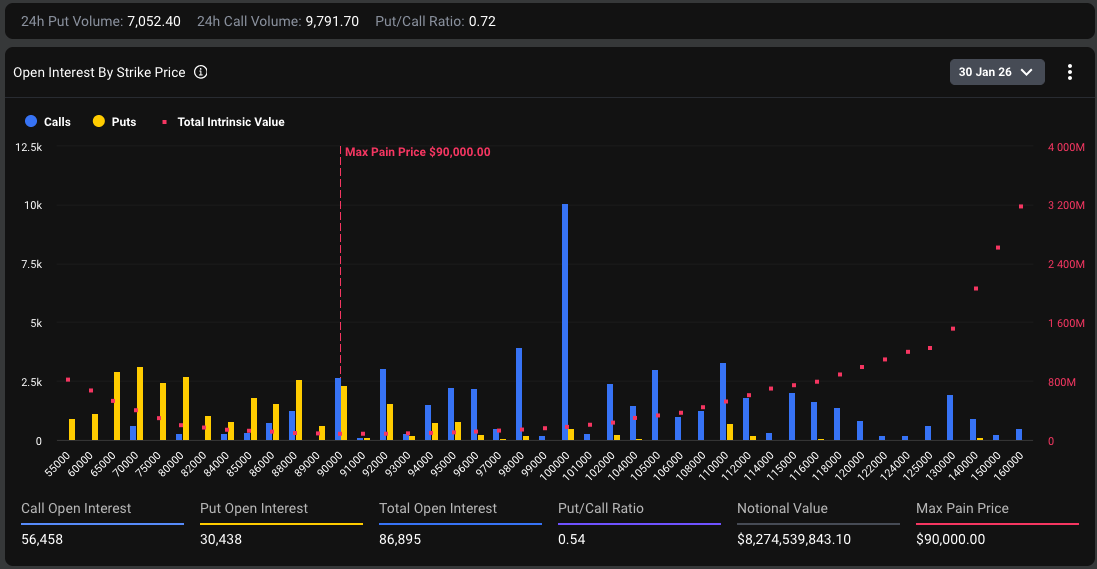

Contracts representing roughly $8.27 billion in notional value are set to expire, a scale that could amplify short-term volatility and influence price behavior around key psychological levels.

Key takeaways:

- Around $8.27 billion in Bitcoin options are set to expire on January 30.

- This is the largest options expiry Bitcoin has seen so far in 2026.

- The estimated “max pain” level sits near $90,000.

The concentration of open interest makes this expiry especially important for traders, as positioning across calls and puts reveals where market participants expect pressure or support to emerge.

Source: Coin Bureau

Source: Coin Bureau

Data from derivatives markets shows a clear clustering of call options around the $100,000 strike, signaling optimism that Bitcoin could challenge six-figure territory. On the downside, put options are spread primarily between $65,000 and $80,000, suggesting traders are hedging against deeper pullbacks rather than immediate collapse.

Bitcoin price consolidates near $95,500

Bitcoin is trading in a tight range around $95,500 after failing to sustain momentum above the $97,000–$98,000 zone earlier in the week.

Price action over the past two sessions suggests short-term equilibrium, with buyers defending dips while sellers cap upside moves. This consolidation phase comes as traders position ahead of the January 30 options expiry, reducing directional conviction and keeping volatility relatively contained in the near term.

Technical indicators signal neutral-to-slightly bullish bias

Momentum indicators reflect a market that is stabilizing rather than trending aggressively. The Relative Strength Index is hovering in the mid-50s, indicating neutral conditions with mild bullish pressure but no signs of overheating.

Meanwhile, the Moving Average Convergence Divergence is flattening near the zero line, suggesting that bearish momentum has faded and that a potential shift toward upside continuation remains possible if volume returns. Overall, technical signals point to consolidation with a slight bullish tilt, leaving Bitcoin vulnerable to sharp moves once a catalyst emerges.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Bitcoin Enters Consolidation Phase Before Key Options Expiry appeared first on Coindoo.

You May Also Like

Once Upon a Farm Announces Pricing of Initial Public Offering

Forward Industries Bets Big on Solana With $4B Capital Plan