Hyperliquid Price Analysis: Why a $648K Whale Move Failed to Lift HYPE Price

This article was first published on The Bit Journal.

HYPE price analysis begins by explaining why a large whale withdrawal did not manage to change Hyperliquid’s overall market direction. Recent on-chain activity and derivatives data show that selling pressure remains strong, even after a major institutional move.

Dragonfly Capital transferred a sizeable amount of HYPE off an exchange, a step that often signals confidence or long-term positioning. However, price movement, exchange flows, and trader behavior indicate that this confidence was limited and not reflected across the broader market.

What does this HYPE price analysis say about the current market tone?

It shows that bearish control remains intact and has not eased in any meaningful way. Even after a large withdrawal from an exchange, the price failed to stabilize and continued to trend lower.

Hyperliquid Price Analysis: Why a $648K Whale Move Failed to Lift HYPE Price 4

Hyperliquid Price Analysis: Why a $648K Whale Move Failed to Lift HYPE Price 4

This behavior indicates that sellers are still firmly active and willing to push the market down. At the same time, buying interest has not appeared at levels strong enough to shift short-term momentum or challenge the prevailing trend.

What the recent HYPE withdrawal reveals about market behavior?

Hyperliquid has remained in focus as HYPE price analysis tracks growing interest from both institutions and traders across its ecosystem. Recently, Dragonfly Capital moved 25,989.71 $HYPE from Bybit, a transfer valued at approximately $648.6K.

Such withdrawals are commonly linked to self-custody decisions rather than immediate selling intent. However, since other large holders did not mirror this behavior, the move reflected individual conviction rather than a broader accumulation phase across the market.

Why the Whale Withdrawal Failed to Boost HYPE Price Analysis?

The withdrawal did not align with other key demand indicators in the market. Following the transfer, the price of HYPE failed to stabilize or show any meaningful rebound, indicating that the market did not interpret the move as a bullish catalyst. Traders have observed that large, isolated withdrawals often lose their impact when broader metrics, such as overall exchange flows and trader positioning, do not confirm follow-through.

In this case, the lack of additional accumulation and supporting activity meant that market sentiment remained largely unchanged, reinforcing the current HYPE price analysis that sellers continue to dominate short-term trends.

How are spot flows impacting the market?

Spot flows initially showed signs of easing pressure. During one session, $1.62M in net outflows were recorded, pointing to a temporary reduction in exchange supply and a short pause in selling activity. However, this trend reversed quickly.

The data revealed a +$538.75K net inflow, indicating that tokens were moving back onto exchanges. These inflows are generally linked to potential selling, reinforcing the view in HYPE price analysis that distribution pressure has resumed and short-term weakness may continue.

| Metric | Value |

|---|---|

| Dragonfly Withdrawal | 25,989.71 HYPE ($648.6K) from Bybit |

| Spot Flows | +$538.75K net inflow |

| DMI Indicators | -DI: 24 (+DI: 17) |

| ADX | 22 |

| Open Interest | -7.91% to $1.31B |

| Long Liquidations | $1.94M vs $1.58K shorts |

What does the $28 rejection mean for the market?

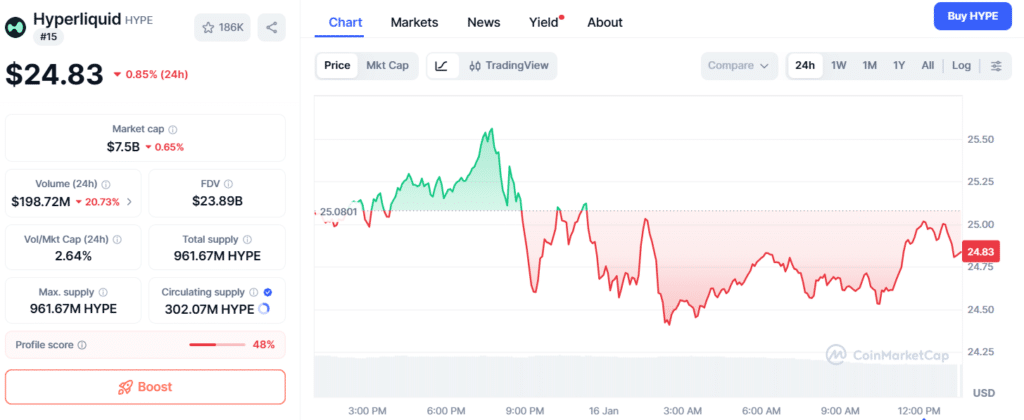

The $28 resistance held firmly as sellers pushed the price down, breaching the $25 support level and bringing $HYPE to $24.83, showing growing weakness. If selling pressure continues, $22 becomes the next potential downside target, while extended weakness could eventually expose $15.

Trend indicators show the negative DMI at 24 above the positive DMI at 17 and the ADX reading at 22, signaling that bearish momentum is gaining strength. This setup suggests that short-term pressure is likely to persist, supporting the present HYPE price analysis.

| Metric | Value |

|---|---|

| Current Price | $24.995 |

| Key Resistance | $28 |

| Next Support | $22 |

| Major Support | $15 |

What do derivatives and liquidations indicate for HYPE?

Derivatives data points to a reduced risk appetite among traders. Open Interest fell 7.91% to $1.31 billion, reflecting that traders are closing positions instead of adding new exposure. Liquidation activity also remained low. Long liquidations totaled about $1.94M, compared with only $1.58K on shorts.

On Binance, short liquidations were limited to $1.48K versus $142.6K in longs, while Hyperliquid recorded $1.69M in long liquidations with almost no shorts affected. This clear imbalance signals continued downside pressure rather than any potential rebound driven by short squeezes, reinforcing the current HYPE price analysis.

Conclusion

HYPE price analysis now shows that sellers remain in control of the short-term market direction. Recent exchange inflows, weak technical structure, declining leverage, and muted liquidations all indicate that downside risk is likely to continue.

Traders and analysts note that only a clear shift back to sustained outflows and renewed buying activity could help stabilize the price. Until such conditions emerge, HYPE remains vulnerable, and any meaningful recovery may be delayed.

Glossary

Dragonfly Capital: Major investor moving HYPE off exchanges.

Self-Custody: Holding crypto in your own wallet.

Open Interest (OI): Active derivative contracts showing market activity.

Distribution Pressure: Selling that can push prices down.

Net Outflow: More tokens leaving an exchange than entering.

Frequently Asked Questions About HYPE Price Analysis

Why did Dragonfly Capital withdraw $648K worth of HYPE?

Dragonfly Capital withdrew HYPE mainly for self-custody, not for immediate selling.

How much HYPE did Dragonfly Capital move?

Dragonfly Capital moved 25,989.71 HYPE, worth about $648,600.

What do spot flows tell us about HYPE?

Spot flows show that tokens moved back onto exchanges, indicating potential selling pressure.

What does the $28 price rejection mean?

The $28 price rejection means sellers are strong, and HYPE could drop toward $25 or $22.

What do open interest and liquidations indicate?

Open interest fell 7.91% and liquidations are low, which shows continued selling pressure and weak bounce potential.

Sources

AMBCrypto

CoinMarketCap

Read More: Hyperliquid Price Analysis: Why a $648K Whale Move Failed to Lift HYPE Price">Hyperliquid Price Analysis: Why a $648K Whale Move Failed to Lift HYPE Price

You May Also Like

Holywater Raises Additional $22 Million To Expand AI Vertical Video Platform

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement