MYX Finance Gains 19% After KuCoin Alpha Listing, Outpaces Broader Market

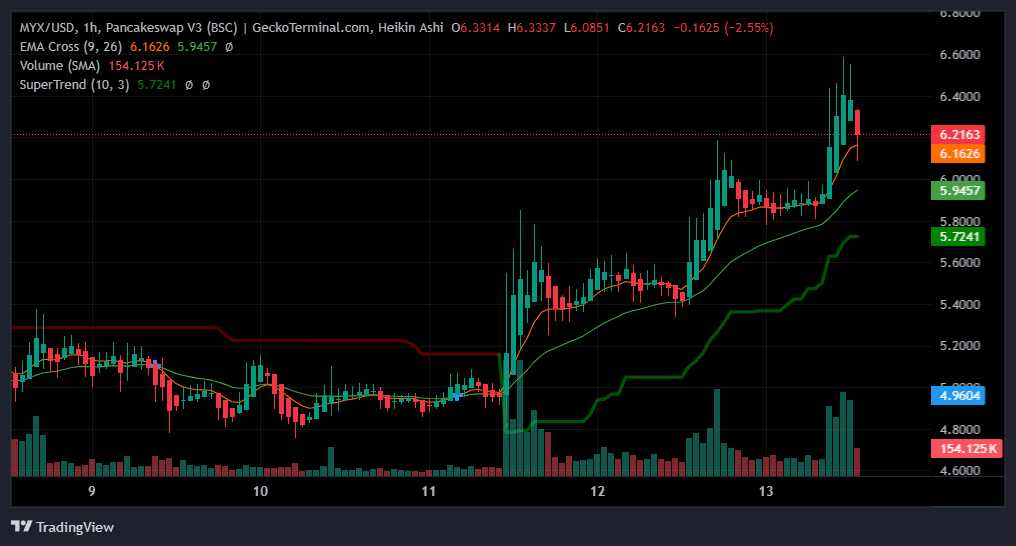

MYX Finance climbed 19% to hit $6.43 before pulling back to $6.15, where it traded at press time. The rally followed the token’s listing on KuCoin Alpha on Jan. 12.

Daily trading volume climbed to $32.2 million, up 27% from the previous day, according to CoinGecko data.

MYX traded between $4.63 and $6.43 over the past seven days, with the current price near the top of that range. The token remains 68% below its all-time high of $19.03 set in September 2025.

Price chart of MYX.

KuCoin Alpha Listing Expands Exchange Access

Major exchange KuCoin listed MYX through its Alpha platform on Jan. 12, according to the exchange’s official announcement.

KuCoin Alpha serves as the exchange’s launchpad for early-stage tokens, providing projects with access to its global user base before potential graduation to the main trading platform.

The listing expanded MYX’s availability beyond existing venues, including Bitget and Gate. MYX Finance operates a trading platform on BNB Chain BNB $911.1 24h volatility: 1.4% Market cap: $125.51 B Vol. 24h: $2.02 B where users can bet on token price movements without going through a traditional broker.

The platform holds approximately $23 million in user deposits.

BNB Chain Sector Performance

MYX ranks 48th among BNB Chain ecosystem projects by market capitalization at $1.17 billion.

The token’s 23% weekly gain placed it among the top performers in the sector, where most major tokens posted single-digit moves over seven days.

BNB, the ecosystem’s native token, added just 0.68% over the same period. PancakeSwap, another prominent BNB Chain project, gained 5.42%.

The broader crypto market declined 2% over seven days amid cautious sentiment, with the Fear & Greed Index at 26. By comparison, MYX significantly outperformed both its sector and the wider market.

The token has faced scrutiny in the past. In September 2025, analytics platform Bubblemaps flagged suspicious wallet activity during the original token distribution. MYX Finance denied the allegations at the time.

nextThe post MYX Finance Gains 19% After KuCoin Alpha Listing, Outpaces Broader Market appeared first on Coinspeaker.

You May Also Like

MoneyGram launches stablecoin-powered app in Colombia

Solana Treasury Firm Holdings Could Double as Forward Industries Unveils $4 Billion Raise