XRP Ledger Activity Crashes 99% in 48 Hours as Weekend Liquidity Vanishes

- XRP Ledger activity plunge reflects timing effects, not lasting network disruption

- Weekend liquidity gaps triggered sharp metric drops without damaging XRP Ledger fundamentals

- Institutional flow pauses exaggerated activity data while XRP price structure stayed stable

At first glance, it seems disastrous to report that XRP Ledger activity fell by 99% in just 48 hours, yet the timing of the drop offers important clarification. According to market analysts monitoring on-chain data, the decline coincided with a typical weekend liquidity slowdown as institutional and enterprise participants paused operations.

XRP Ledger payment volumes rely heavily on concentrated flows rather than continuous retail usage, with market making, cross-border settlement testing, and institutional transfers driving activity. These flows do not occur evenly across the trading week, so when major participants step back over the weekend, reported activity can fall sharply without signaling distress.

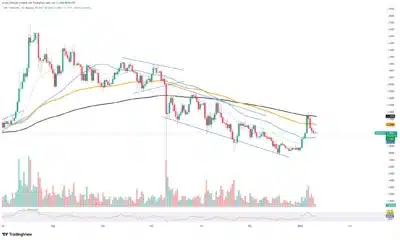

The calculation window influenced the severity of the reported decline because activity levels before the drop were elevated and exaggerated the percentage change. Price behavior reflected restraint instead of panic, with XRP holding above short-term support while facing resistance near longer-term exponential moving averages.

Volume trends reinforced that interpretation as trading volumes remained thin and irregular during low-liquidity weekend sessions.

Also Read: XRPL Sets 11.5M XRP Liquidity Target as DeFi Push Nears Critical Phase

Weekend liquidity gaps distort XRP Ledger activity data

According to analysts, shallow liquidity environments magnify on-chain metric changes, where modest participation shifts trigger large percentage swings. Such conditions often produce unreliable short-term signals, with false breakouts and sudden reversals emerging from thin order books. Historical patterns support this view, as XRP Ledger activity repeatedly rebounds once weekday trading and institutional flows resume.

Source:

Payments volume usually recovers before price action stabilizes, offering an early signal of renewed network participation. Market observers noted that sustained weakness into midweek sessions would raise concern, yet no continued inactivity has appeared so far.

The immediate risk centers on volatility rather than structural damage, since low liquidity exaggerates price movement in both directions. Despite dramatic headlines, underlying network operations remain unchanged, while participants monitor activity as normal trading conditions return.

The 99% decline in XRP Ledger activity reflects a temporary liquidity absence, with regular participation offering clearer insight into network strength.

Also Read: Crypto Questions Flood Russia’s Pension Hotline as Public Curiosity Outpaces Policy

The post XRP Ledger Activity Crashes 99% in 48 Hours as Weekend Liquidity Vanishes appeared first on 36Crypto.

You May Also Like

SUI Surges From Consolidation, Buyers Regain Control Above $1.78

Microsoft Corp. $MSFT blue box area offers a buying opportunity