MAP Protocol, Useless Coin, LUNC lead the charge as Bitcoin hits $105k

MAP Protocol (MAPO) was the best-performing cryptocurrency on Saturday as it jumped by 100%. It rose to a high of $0.010, its highest point since Feb. 2, and 153% above its lowest point this year.

This increase has pushed its market cap to over $53 million.

MAP Protocol price led the charge

MAP Protocol is a layer-2 network for Bitcoin, allowing peer-to-peer cross-chain transactions. Its token surged as the total value locked in the network jumped.

Its TVL jumped to $23.3 million on Saturday, the highest point since February. All dApps in the ecosystem, like HiveSwap, StaQ, and Butter Network, have all added substantial assets in their ecosystems.

The biggest risk for MAPS Protocol price is that it has become highly overbought, with the Relative Strength Index jumping to 93. This means that the token may have a big dive as investors book profits.

Useless Coin price hits all-time high

The Useless Coin price surged to a record high of $0.078 on Friday, even as the crypto market crashed. The Solana meme coin has jumped by over 1,245% from its lowest point this year, giving it a market cap of over $70 million.

Useless Coin, unlike MAPS Protocol, has no utility, and its price is soaring mainly because of hype and FOMO among crypto investors.

Technicals suggest that the USELESS token has more gains ahead. It formed a cup-and-handle pattern whose upper side was at $0.047 and the lower side was at $0.0051 or a 90% dip. Measuring the same distance from the cup’s upper side gives it a target of $0.090, a few points above the current level.

LUNC price rises as burn rate jumps

Terra Luna Classic (LUNC) token rose by over 10% on Saturday. This jump happened after the LUNC token burn rose by over 234 million in the last seven days, bringing the cumulative burn to 410 billion.

Technicals suggest that the LUNC price has more gains in the coming weeks. It has remained in a tight range and formed a double-bottom pattern with a neckline at $0.00007253.

LUNC has also moved in the accumulation phase of the Wyckoff Theory, pointing to an eventual comeback. A move above the neckline at $0.00007253 will point to more gains to the 50% retracement level at $0.0001135.

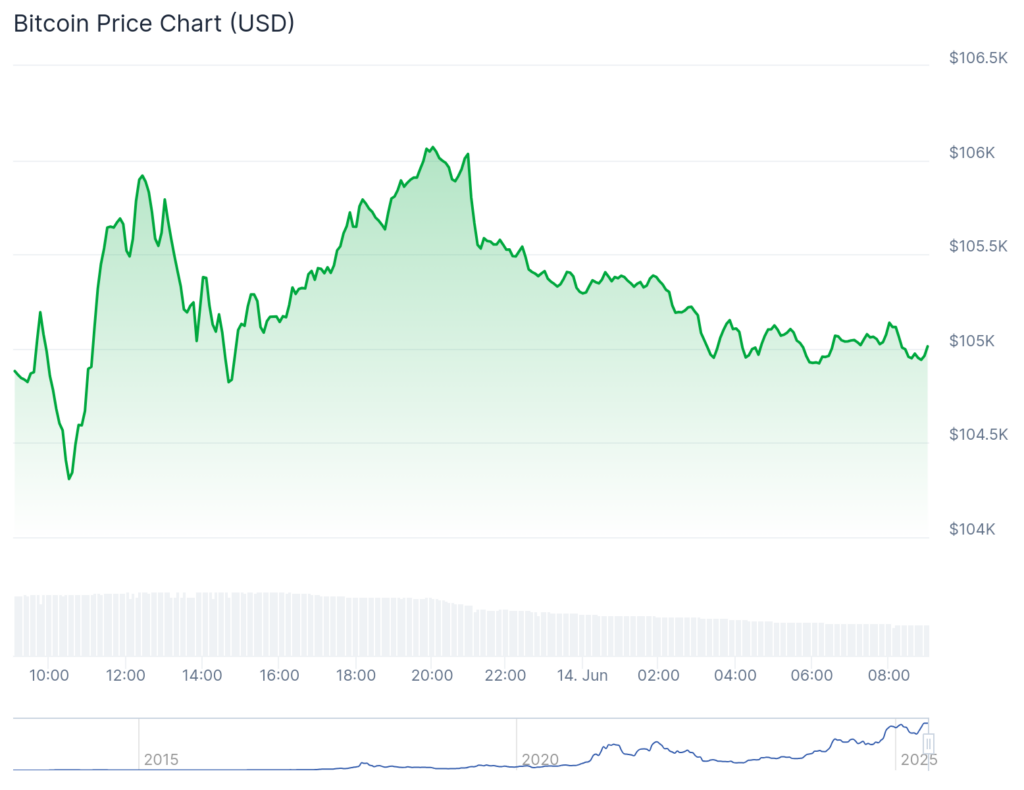

Meanwhile, Bitcoin rallied past $105,000 at last check on Saturday. See below.

You May Also Like

Where Next for Bitcoin? The Bull and Bear Case

The million-dollar winner of the X Creators Contest has been exposed for involvement in a Memecoin scam.