Ripple Says No IPO Despite $40B Valuation and Wall Street Interest

Ripple has no plans to pursue an initial public offering despite closing a $500 million fundraising in November at a $40 billion valuation that attracted major Wall Street players.

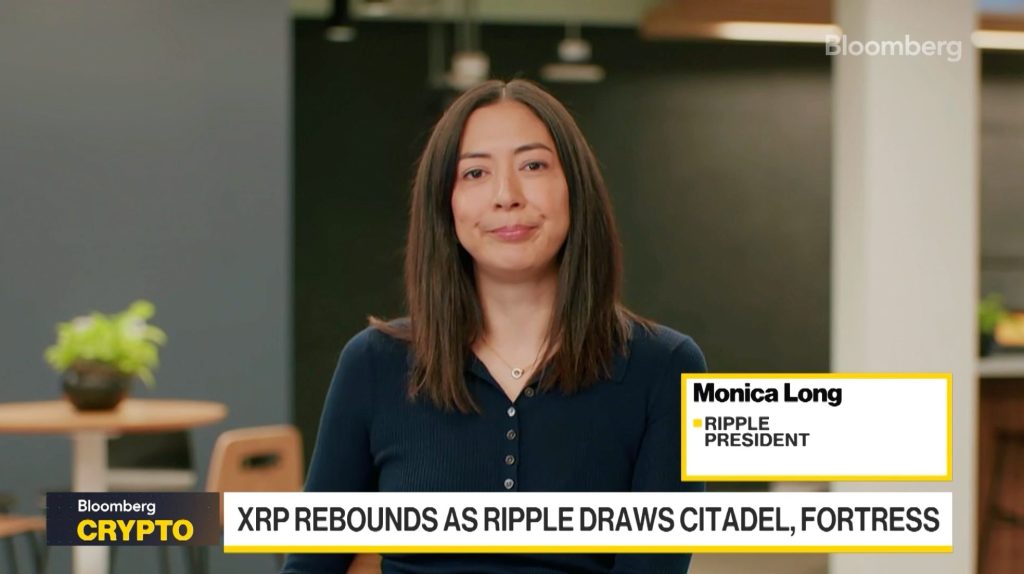

President Monica Long confirmed the decision in a Bloomberg interview, stating the company remains committed to staying private while leveraging strategic investor relationships and a strong balance sheet to fund continued expansion.

The $40 billion valuation round brought Fortress Investment Group and Citadel Securities onto Ripple’s cap table alongside crypto-native funds including Pantera Capital, Galaxy Digital, Brevan Howard, and Marshall Wace.

Long emphasized that investors “really saw was that our business is working” with Ripple’s strategy of “creating digital asset infrastructure for businesses and financial institutions alongside the inflection point that Stablecoin payments hit last year.“

Source: Bloomberg

Source: Bloomberg

Wall Street Backing Replaces Public Market Need

Long explained that traditional IPO drivers no longer apply to Ripple’s position.

“Currently we still plan to remain private,” she stated, noting that “between the strength of our balance sheet stand alone” and “interest from strategics like Citadel and Fortress,” the company is “in a really healthy position to continue to fund and invest in our company’s growth without going public.“

Ripple completed a $1 billion tender offer earlier in 2025 at the same $40 billion valuation, which shows sustained institutional demand for equity exposure.

The company has repurchased over 25% of its outstanding shares in recent years, providing liquidity to shareholders while strategically onboarding new partners.

During that time, CEO Brad Garlinghouse said, “This investment reflects both Ripple’s incredible momentum and further validation of the market opportunity we’re aggressively pursuing,” noting the expansion from the original 2012 payments focus into “custody, stablecoins, prime brokerage, and corporate treasury, leveraging digital assets like XRP.“

Over two years, Ripple executed six acquisitions, including two valued at over $1 billion each.

The company acquired Rail and integrated it into Ripple Payments, combining RLUSD and XRP. Ripple Payments volumes have surpassed $95 billion with 75 regulatory licenses globally.

Stablecoin Growth Drives Strategic Direction

Ripple’s RLUSD stablecoin surpassed $1 billion in market capitalization within seven months of launch, though it remains behind Circle’s $75.8 billion USDC and Tether’s $183.5 billion USDT.

The October acquisition of GTreasury extends treasury capabilities as institutions adopt stablecoins for payments and settlement following regulatory clarity from the GENIUS Act.

This came as Garlinghouse projects the stablecoin market could expand from $250 billion to $2 trillion as institutional adoption accelerates.

For Ripple, BNY Mellon serves as the RLUSD custodian and is pursuing a banking license and a Federal Reserve Master Account.

Back in November, Chief Legal Officer Stu Alderoty welcomed Governor Christopher Waller’s proposal for crypto firms to access “skinny” Fed accounts, stating, “I think it’s an attractive idea, and I think it should give traditional banks some comfort.“

Waller’s suggestion that stablecoin issuers could leverage central bank payment rails directly signals a shift in regulatory attitudes.

“I wanted to send a message that this is a new era for the Federal Reserve in payments, the DeFi industry is not viewed with suspicion or scorn,” Waller stated, adding his view for the Fed is to “embrace the disruption — don’t avoid it.”

While primarily theoretical, the proposal could materialize if Waller succeeds Jerome Powell as Fed chairman, with shortlist candidates demonstrating pro-crypto leanings.

Institutional Products Expand Beyond Payments

Ripple Prime has doubled client collateral since integration, while processing over 60 million daily transactions and tripling platform size. The prime brokerage offers collateralized XRP lending to institutions.

However, despite Ripple’s cross-vertical growth, XRP reached $3.65 in July 2025, but the token is currently trading over 30% below its January 2018 all-time high of $3.84.

Notably, Ripple contributed $50 million to the National Crypto Association for public education, as adoption data shows that 39% of crypto holders use digital assets to purchase goods and services.

While Ripple opts to stay private, the broader crypto industry embraces public markets. Circle’s June NYSE debut at $31 per share surged to $88 on opening day, now trading around $149 with a $34 billion market cap.

Kraken also raised $500 million at a $15 billion valuation ahead of its anticipated IPO, while Gemini raised $425 million on its September debut.

BitGo became the first dedicated crypto custodian pursuing a US exchange listing, and Figure Technology raised $787.5 million in its IPO at a $5.3 billion valuation.

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

U.S. Considers Bitcoin Reserve; Discusses Funding Options