NFT sales jump 10% to $136.5m, CryptoPunks shows 26% pop

The non-fungible token (NFT) market saw a 10.44% increase in sales volume to $136.5 million. This marks the second consecutive week of growth for the sector.

According to the latest data, the surge is occurring as the Bitcoin (BTC) price has risen to the $108,000 level. At the same time, Ethereum (ETH) has experienced a 3.6% surge in the last seven days. The global crypto market cap is now $3.33 trillion, up from last week’s $3.21 trillion.

According to data from CryptoSlam, market participation metrics remain stable, with NFT buyers unchanged at 1,061,348 (maintaining a 50.56% growth rate), and NFT sellers rising by 8.09% to 38,494. However, NFT transactions have declined by 19.72% to 1,357,295.

Polygon climbs to second place in sales

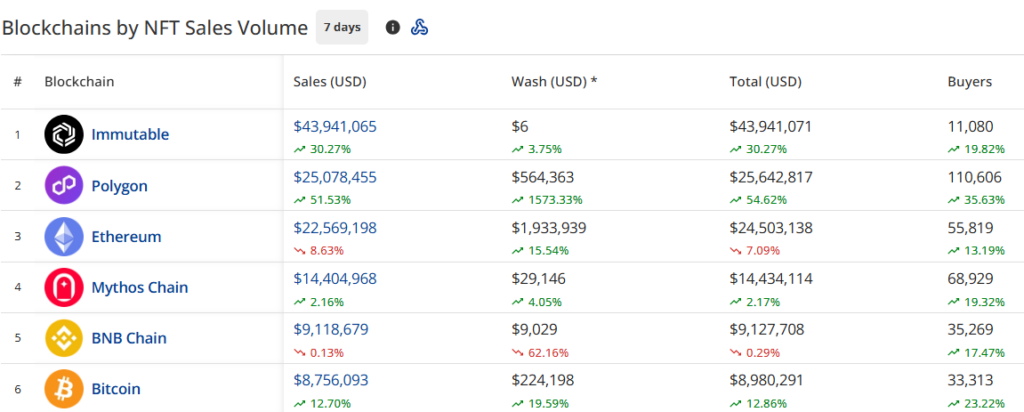

Immutable (IMX) has maintained its dominant position, with $43.9 million in sales, a 30.27% increase from the previous week. The blockchain’s wash trading remains negligible at just $6.

Polygon (POL) has climbed to second place, with $25 million in sales, a 51.53% increase. Polygon’s wash trading has exploded by 1,573.33% to $564,363.

Ethereum holds the third position with $22.5 million, declining 8.63%. Ethereum’s wash trading has increased by 15.54% to $1.9 million.

Mythos Chain maintains fourth place with $14.4 million, up 2.16%. BNB Chain (BNB) remains in fifth with $9.1 million, showing a minimal decline of 0.13%. Bitcoin sits in sixth with $8.7 million, growing 12.70%.

The buyer count has increased across most blockchains, with Polygon leading at a 35.63% growth rate, followed by Bitcoin at 23.22% and Mythos Chain at 19.32%.

Guild of Guardians Heroes has maintained the top spot in collection rankings, with $26.8 million in sales, representing a 37.72% increase. This gaming collection continues to benefit from Immutable’s strength.

The Courtyard on Polygon has climbed to second place with $18.9 million, a 22.53% increase. The collection has seen growth in buyers (16.22%) while sellers declined (6.65%).

The Guild of Guardians Avatars holds the third position with $9.7 million, representing a 24.19% increase. DMarket sits in fourth with $9.2 million, up 3.61%.

Gods Unchained Cards completes the top five with $7.2 million, growing 15.19%. This marks the third Immutable-based gaming collection in the top rankings.

CryptoPunks has climbed to ninth place with $2 million in sales, posting a 26.36% increase. The collection has seen growth across all metrics, including transactions (25%), buyers (12.50%), and sellers (14.29%).

Notable high-value sales from this week include:

- CryptoPunks #1831 sold for 150 ETH ($389,846)

- CryptoPunks #9778 sold for 150 ETH ($377,958)

- CryptoPunks #4868 sold for 76.5 ETH ($201,933)

- CryptoPunks #5586 sold for 70.07 ETH ($185,292)

- CryptoPunks #7516 sold for 60 ETH ($158,378)

You May Also Like

Michael Saylor’s Strategy follows Metaplanet, adding 6,269 BTC worth $729 million

Payward Revenue Hits $2.2 Billion as Kraken Exchange Reports Strong 2025 Growth