Best Crypto To Buy Now – Bitcoin Hyper Scales Bitcoin For The Next Cycle

The cryptocurrency market has always been shaped as much by narrative as by technology. From Bitcoin being framed as digital gold to Ethereum serving as the backbone of decentralized finance, symbolic labels often influence how investors interpret value.

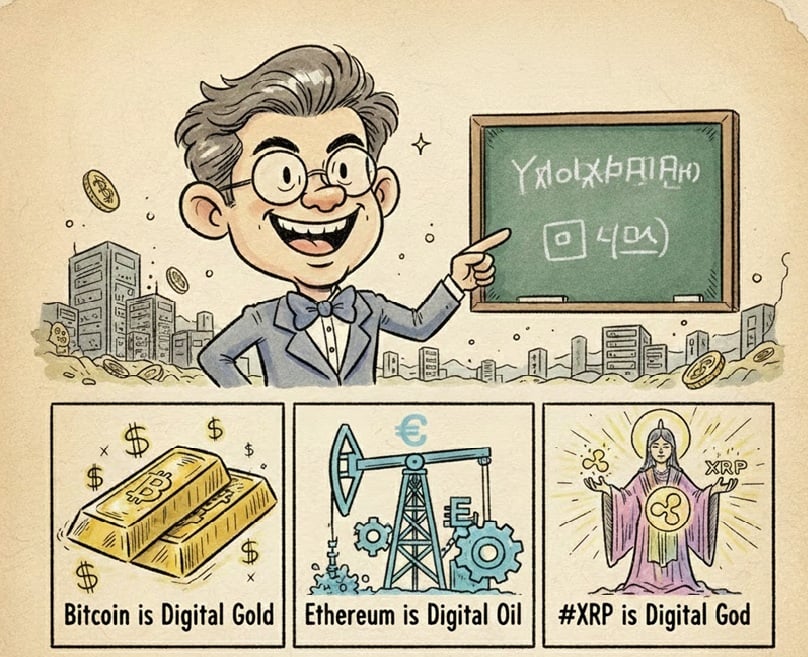

Recently, a new comparison sparked widespread discussion after World’s highest IQ holder YoungHoon Kim categorized major digital assets into a bold hierarchy, describing Bitcoin as digital gold, Ethereum as digital oil, and XRP as a digital god.

While the statement quickly went viral, its significance lies less in provocation and more in what it reveals about the current phase of the crypto market. Attention is increasingly shifting away from speculation and toward utility, infrastructure, and scalability.

Why Symbolic Labels Shape Crypto Perception

Labels such as digital gold or digital oil simplify complex technologies into narratives that are easy to understand and remember.

Bitcoin has long benefited from its association with scarcity and store-of-value properties, while Ethereum is often framed as essential infrastructure powering decentralized applications.

Referring to XRP as a digital god does not imply divinity in a literal sense. Instead, it reflects perceptions of dominance, liquidity, and relevance within cross-border payment discussions.

These narratives spread quickly because they offer clarity in a market that is otherwise highly technical and fragmented.

However, symbolic framing can also blur important distinctions, particularly between decentralized assets and the organizations associated with them.

Source – Cryptonews YouTube Channel

XRP, Decentralization, and Public Misunderstandings

One of the most persistent misconceptions surrounding XRP is the assumption that it functions as a corporate product.

Crypto commentator Mason Versluis, in a post on X, highlighted that XRP itself is a decentralized cryptocurrency, not a company. It does not have a marketing department, advertising budget, or paid promotional structure.

This distinction is critical. Ripple is a separate corporate entity that develops payment solutions, while XRP operates independently on a decentralized network. Viral content and social media amplification often lead to assumptions about paid endorsements, even when none exist.

The intensity of attention surrounding XRP illustrates how visibility alone can fuel speculation, regardless of intent. In many cases, the conversation becomes less about promotion and more about the sheer engagement that XRP-related topics generate online.

Expanding Bitcoin’s Potential With Smart Contract Functionality

As the market matures, investor focus is increasingly shifting toward infrastructure projects that address fundamental limitations. One area receiving growing attention is Bitcoin scalability, where Layer 2 solutions aim to improve speed and efficiency without compromising security.

Bitcoin Hyper represents this shift toward practical innovation. Designed as a Layer 2 network for Bitcoin, the project seeks to enable faster and cheaper transactions through bridge technology.

When users transfer Bitcoin to the network, they receive wrapped Bitcoin, allowing near-instant transactions at significantly lower cost.

Beyond payments, Bitcoin Hyper introduces smart contract functionality to the Bitcoin ecosystem through compatibility with the Solana virtual machine.

This design expands Bitcoin’s potential use cases, enabling decentralized finance applications while maintaining Bitcoin as the settlement layer. The native HYPER token supports gas fees and staking, positioning Bitcoin as a programmable asset rather than a static store of value.

The project has raised close to $30 million, a notable achievement given current market conditions and reduced risk appetite across the broader crypto market. This level of participation suggests sustained interest rather than short-term momentum.

As the market looks ahead to the next phase of the crypto cycle, infrastructure projects tied directly to Bitcoin may benefit from renewed institutional and retail interest.

Capital inflows historically tend to favor networks that offer clear utility and long-term relevance, particularly during early expansion phases. Bitcoin Hyper sits at this intersection, and the project’s focus on extending Bitcoin’s capabilities rather than replacing them aligns with broader market trends.

Long-Term Trends Shaping the Crypto Market

The broader takeaway from these developments is not the ranking of one asset above another, but the direction in which the market is moving. High-profile commentary continues to influence sentiment, yet long-term capital is increasingly gravitating toward projects that offer tangible utility.

Infrastructure, scalability, and self-custody are becoming central themes as the ecosystem prepares for its next growth phase. Secure, non-custodial tools such as Best Wallet play an important role in this environment, particularly for users participating in upcoming crypto presales and managing long-term holdings.

Whether XRP is viewed as a digital god or simply an efficient payment-focused asset, its ability to command attention remains undeniable.

At the same time, Layer 2 solutions such as Bitcoin Hyper highlight a broader transition toward functionality over hype. As the crypto market moves toward 2026, narratives may spark interest, but utility is increasingly determining where lasting value resides.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Coinbase Data Breach Fallout: Former Employee Arrest in India Over Customer Data Case Raises Bitcoin Security Concerns

Burmese war amputees get free 3D-printed prostheses, thanks to Thailand-based group