- Grant Cardone’s poll shows 69% choosing Bitcoin over gold and silver combined.

- Peter Schiff’s rival poll also favors Bitcoin, but gold shows stronger long-term returns.

- Cardone says Bitcoin adds diversification, while rejecting gold and silver as redundant assets.

Real estate investor Grant Cardone reignited the Bitcoin vs gold debate after posting a poll on X. He asked users to imagine receiving $100,000 with one rule: the full amount must be invested in Bitcoin, gold, or silver and held until December 19, 2028.

The response was clear. 69% of voters chose Bitcoin, while gold received 17.7% and silver 13.3%. Reacting to the results, Cardone said retail investors prefer Bitcoin by nearly four times, raising questions about why gold and silver continue to outperform in the market.

However, one analyst responded and wrote, “Because X has a viewer base that is heavily bias towards crypto. Do the same survey outside of X and you’ll see that number very different.”

Peter Schiff Launches a Rival Poll

Soon after, Bitcoin critic and gold supporter Peter Schiff ran a similar poll, and once again, Bitcoin led the vote.

In Schiff’s poll, 60.6% selected Bitcoin, compared to 21.9% for gold and 17.5% for silver. Cardone responded by pointing out that even when gold and silver are combined, their total share remains below Bitcoin’s percentage.

Cardone Explains His Investment View

As the debate intensified, Cardone clarified that he is not a Bitcoin-only investor. He said he primarily focuses on real estate and manages $5.3 billion in assets.

According to Cardone, Bitcoin is added to his portfolio to create a new asset class and offer broader exposure. He stated that he would never include gold or silver, arguing that they behave like real estate but are far more abundant.

Schiff Questions Bitcoin’s Role

Schiff pushed back, saying investors can easily buy Bitcoin themselves without needing it bundled into investment products. He also claimed that Bitcoin has underperformed gold over the past four years and said Bitcoin’s strongest phase has already passed.

“I don’t see the value of including Bitcoin in your offerings when investors can easily buy Bitcoin on their own if they want to,” he wrote.

Performance Data Favors Gold

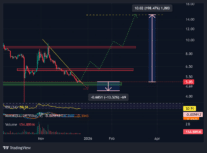

The discussion comes as gold reached a new all-time high of $4,383, while Bitcoin remains below $90,000 and continues to trade sideways.

The debate intensified after users asked AI tool Grok to check the data. Based on closing prices, Bitcoin rose about 83% between December 2021 and December 2025, while gold gained roughly 142% during the same period.

This supports Schiff’s claim that gold has delivered stronger returns recently, despite Bitcoin’s popularity.

Related: ‘Bitcoin Senator’ Cynthia Lummis Is Calling It Quits After One Term in the U.S. Senate

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/bitcoin-beats-gold-in-x-poll-as-cardone-schiff-clash-again/