IOSG Founding Partner: 2025 will be the "worst year" for the crypto market, but BTC may reach $120,000-$150,000 in the first half of 2026.

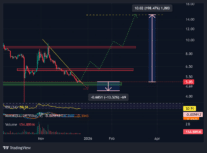

PANews reported on December 21st that Jocy, founding partner of IOSG, posted on the X platform that 2025 will be the "worst year" for the crypto market. OG investors will experience three waves of selling, from March 2024 to November 2025, with long-term holders (LTH) collectively selling approximately 1.4 million BTC (worth $121.17 billion): The first wave (late 2023 - early 2024): ETF approval, BTC price rose from $25,000 to $73,000; the second wave (late 2024): Trump's election, BTC surged towards $100,000; the third wave (2025): BTC will remain above $100,000 for an extended period. Unlike the single, explosive distributions of 2013, 2017, and 2021, this will be a multi-wave, sustained distribution. BTC has been consolidating at its high point for the past year, a situation never seen before, with 1.6 million BTC (approximately $140 billion) remaining unmoved for over two years decreasing since early 2024. But risk also presents opportunity, from an investment perspective:

Short term (3-6 months): Expected to fluctuate within the $87,000-$95,000 range, with institutions continuing to build positions;

Mid-term (first half of 2026): Driven by both policy and institutional factors, with a target of $120,000-$150,000;

Long term (second half of 2026): Increased volatility, depending on election results and policy continuity.

You May Also Like

Sandbrook Capital Announces Acquisition of United Utility Services from Bernhard Capital Partners

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council