BYDFI Exchange Review: Features, Fees, and Safety

The post BYDFI Exchange Review: Features, Fees, and Safety appeared first on Coinpedia Fintech News

Abstarct:

BYDFi has continued to expand as a global crypto trading platform since its launch in 2020, growing beyond basic spot trading into derivatives, copy trading, on-chain discovery tools, fiat on-ramps, and real-world payment solutions. The platform is positioned to support both new and experienced users by combining a simplified interface with deeper trading and monitoring tools, while maintaining transparency around fees and risk.

What Is BYDFi?

BYDFi is a global cryptocurrency trading platform that combines centralized exchange functionality with on-chain market visibility through its MoonX engine. Since its launch in 2020, the platform has focused on building a streamlined and accessible trading experience for users worldwide. Today, BYDFi serves more than one million users across 190+ countries and supports a wide range of trading and onboarding options, including spot markets, perpetual futures, copy trading, and fiat-based crypto purchases.

Guided by the vision “BUIDL Your Dream Finance,” BYDFi is designed to accommodate different levels of trading experience — from beginners entering the market through fiat purchases or spot trading to advanced users engaging with futures contracts and on-chain token discovery. In December 2023, Forbes recognized BYDFi as one of the Top 10 Global Crypto Exchanges, highlighting the platform’s growing global presence.

In 2025, BYDFi further increased its international visibility through a multi-year partnership with Newcastle United, becoming the Premier League club’s Official Crypto Exchange Partner.

For users exploring centralized and on-chain trading platforms, BYDFi: what you need to know offers a closer look at its features, fee structure, and trading tools.

Key Features of BYDFi

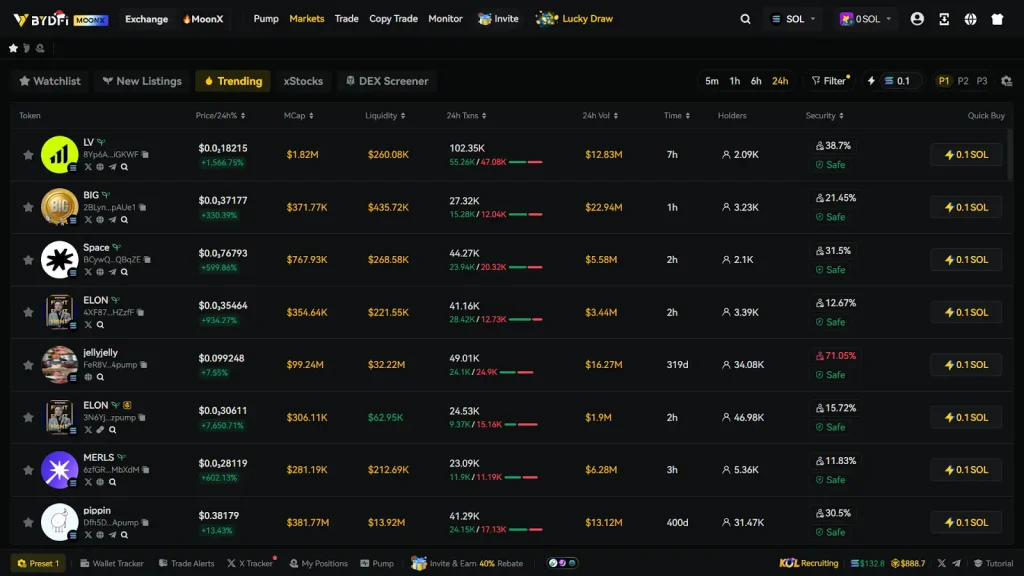

MoonX: On-Chain Market Engine

MoonX serves as BYDFi’s on-chain discovery and monitoring layer. It aggregates real-time data from active blockchain ecosystems and presents key metrics such as market capitalization, liquidity, holder counts, transaction activity, volume changes, and basic security indicators.

The interface includes sections for trending tokens, new listings, DEX-style screeners, and xStocks, allowing users to monitor fast-moving on-chain assets without relying on external analytics tools. Time-based filters and sorting options help users assess short-term activity alongside broader market trends.

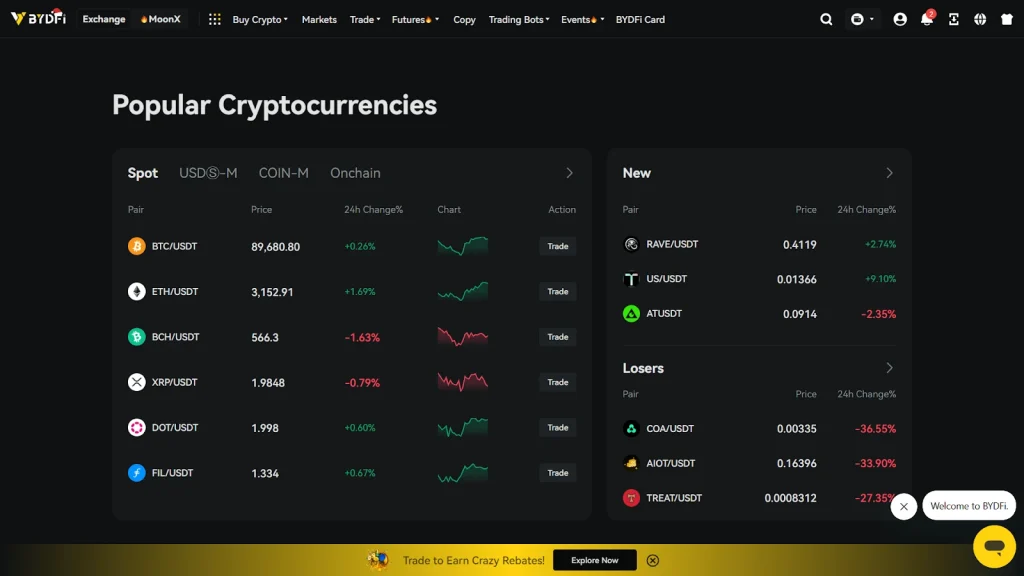

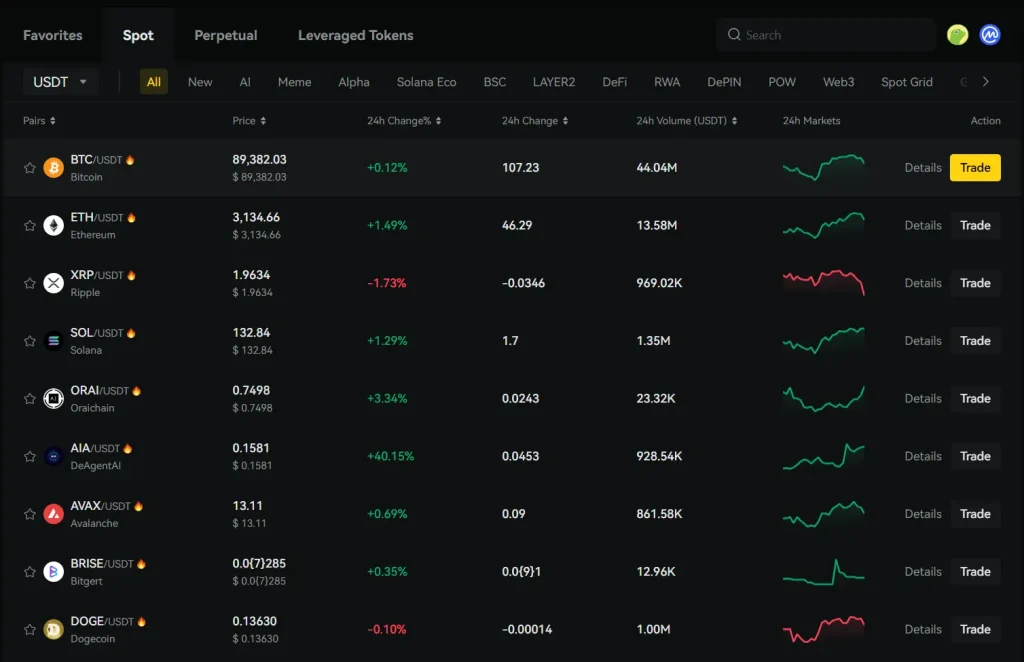

Spot Trading

BYDFi offers an extensive spot trading market across both USDT and USDC pairs. Based on current platform listings, there are nearly 1,000 USDT-based spot trading pairs available, with additional assets introduced on an ongoing basis. In addition, the platform supports 47 active USDC trading pairs, providing flexibility for users who prefer different stablecoin bases.

Spot markets include major cryptocurrencies, mid-cap assets, and newly listed tokens. The trading interface displays pricing, order depth, and 24-hour performance data clearly, while keeping order placement straightforward. This breadth of listings allows users to access a wide range of spot markets within a single platform.

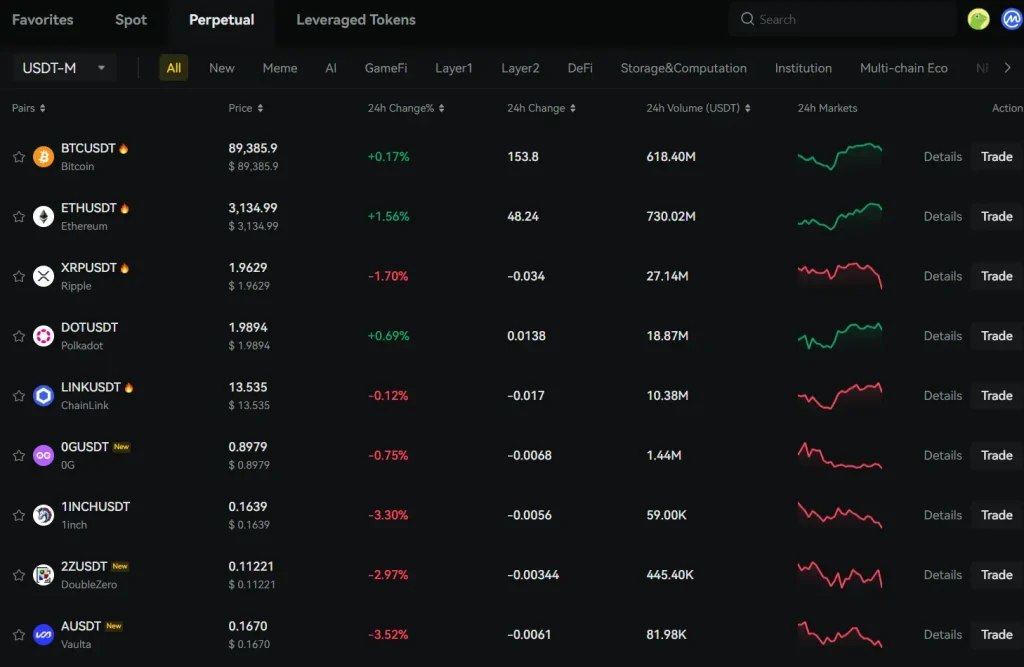

Perpetual Futures

Futures trading is available through USDⓢ-M and COIN-M perpetual contracts. Traders can adjust leverage, monitor their liquidation price, and view real-time profit or loss. The platform is transparent about risk, but users should remember that leverage increases volatility and the potential for rapid losses.

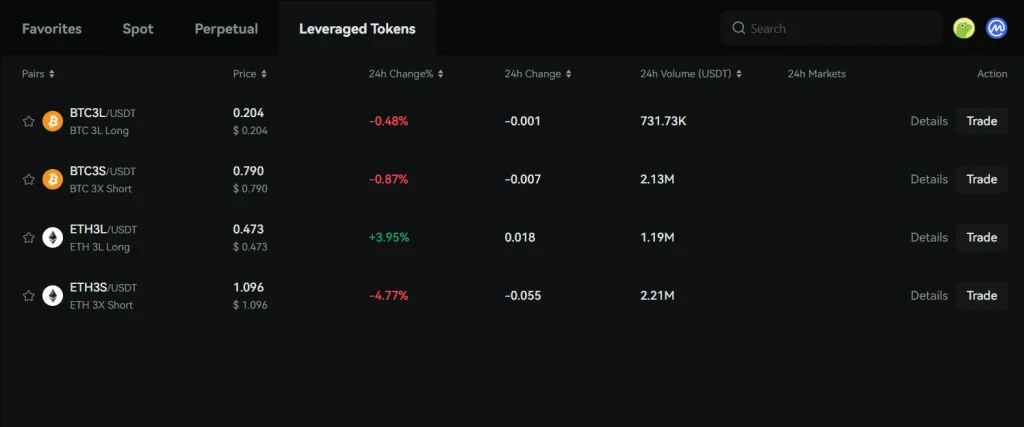

Leveraged Tokens (Leveraged Trading)

Alongside spot and futures, BYDFi also lists leveraged tokens such as BTC3L/USDT, BTC3S/USDT, ETH3L/USDT, and ETH3S/USDT. These products are designed to provide built-in leveraged exposure (typically 3× long or 3× short) without requiring users to manage margin, liquidation prices, or manual leverage settings the way they would in perpetual futures.

In the leveraged tokens market view, BYDFi displays key fields like price, 24-hour change, 24-hour volume, and market activity, with a direct “Trade” option beside each token. This makes leveraged tokens easier to access for users who want amplified directional exposure while keeping the trading workflow similar to spot — though it’s still higher-risk than spot because returns (and drawdowns) are magnified.

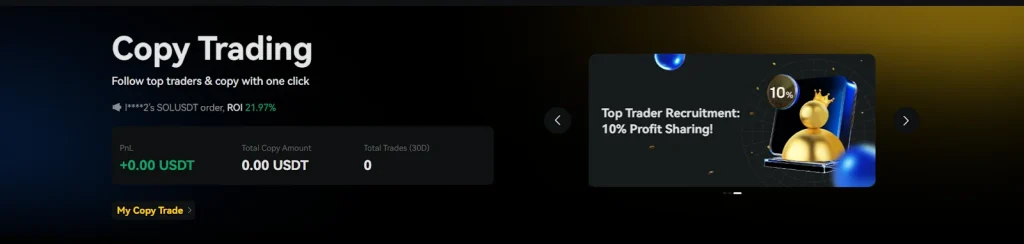

Copy Trading

BYDFi’s copy-trading feature displays verified trader profiles with statistics such as:

- Win rate

- 7-day performance

- Profit distribution

- Trading frequency

- Strategy type

Users can choose traders whose risk profile matches their own. While copy trading can simplify market participation, it carries inherent risk — especially when copied strategies rely on high leverage.

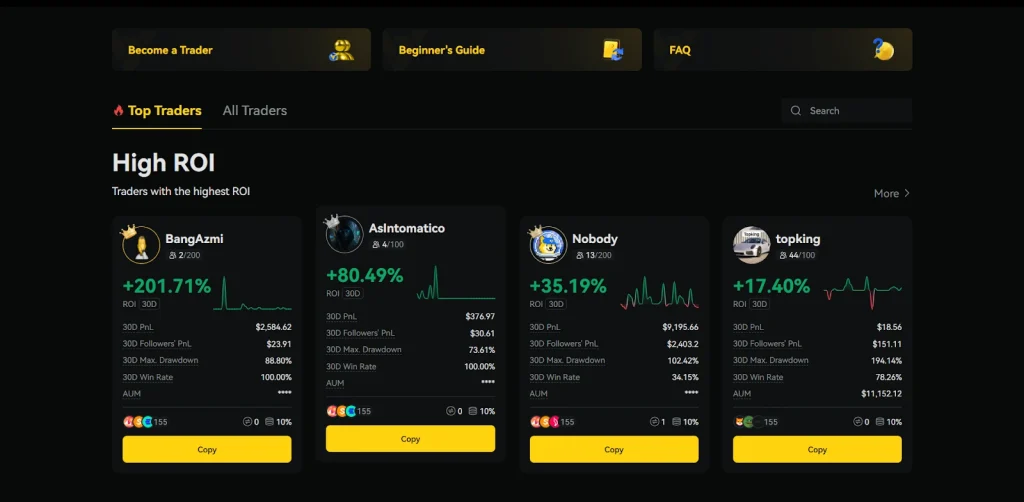

Automation Tools

The platform supports trading bots for grid strategies and automated recurring buys. These tools help traders maintain consistent strategies without constantly monitoring the market, especially during periods of volatility.

Monitoring & Analytical Tools

BYDFi consolidates several analytical features:

- Custom watchlists

- Wallet trackers

- Real-time alerts

- DEX-style token exploration

- Portfolio monitoring dashboards

These tools reduce reliance on external trackers and streamline multi-chain market analysis.

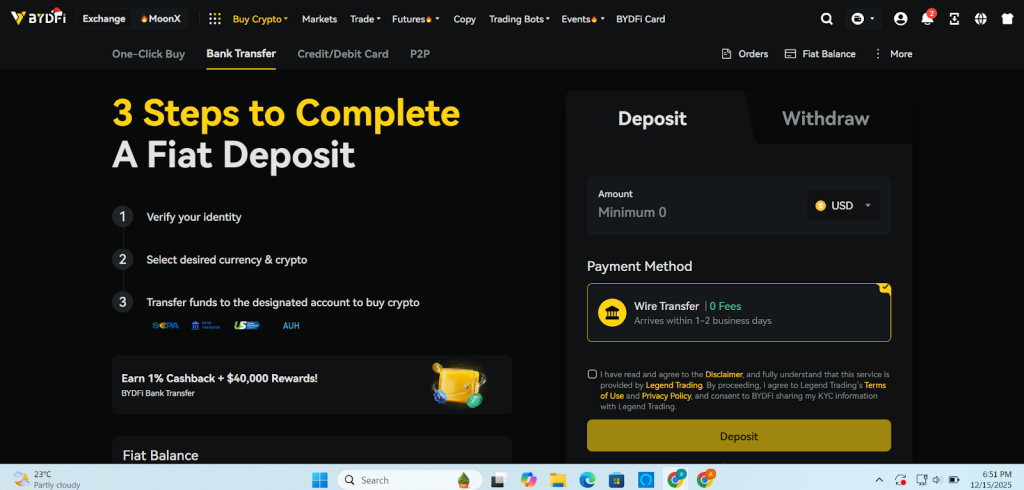

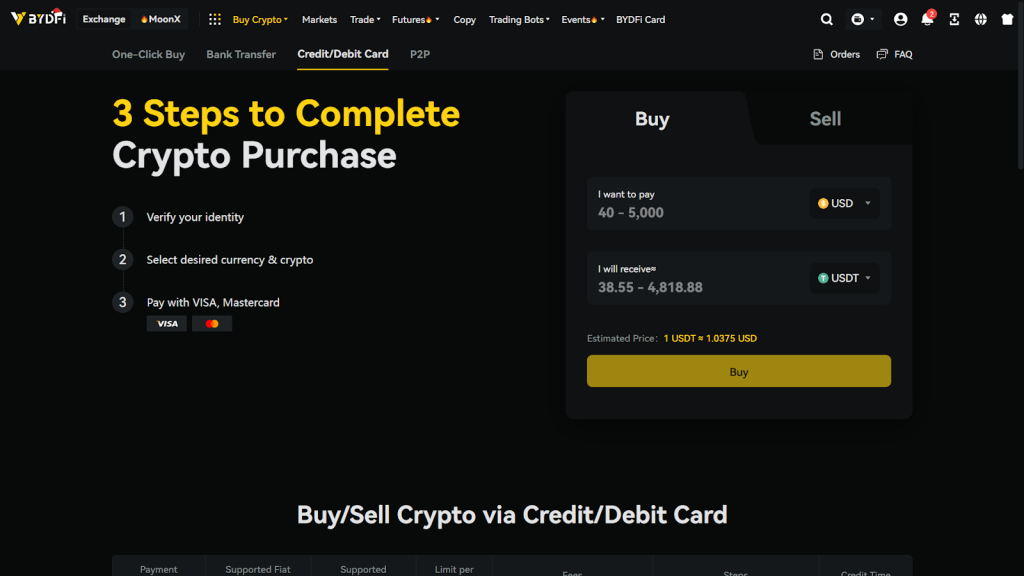

Zero-Fee & Supported Purchase Methods

BYDFi supports four primary ways to buy or onboard crypto, with zero-fee conditions applying to specific methods:

One-Click Buy – A simplified option for instant crypto purchases, with fees shown upfront.

Bank Transfer (0 Fee) – Fiat deposits via bank transfer are processed with zero platform fees.

Credit/Debit Card – Card-based purchases with transaction fees displayed before confirmation.

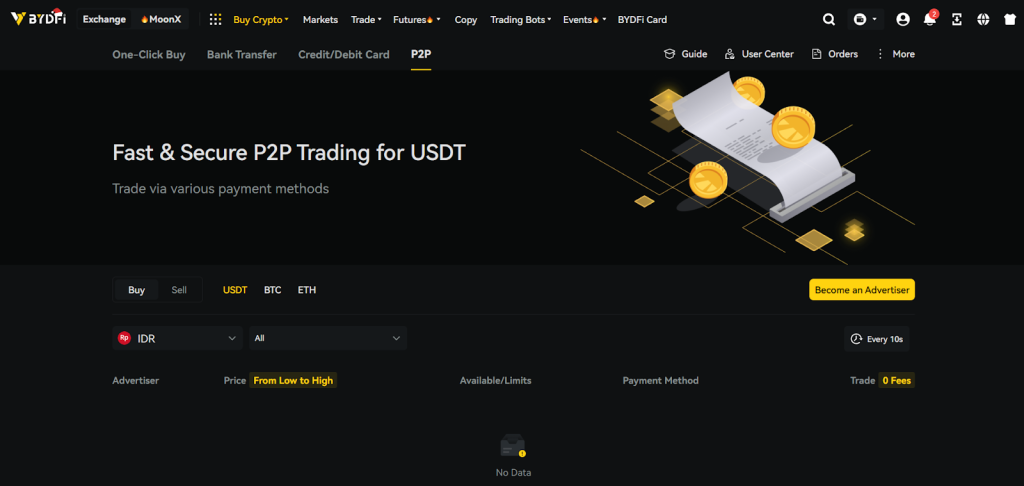

P2P Trading – A peer-to-peer marketplace operating with zero platform trading fees, where users trade directly with other users.

Fees Structure

BYDFi provides a transparent fee structure across trading and fiat on-ramp services, with costs displayed clearly before transaction confirmation.

Spot & Trading Fees

Spot trading follows a standard exchange fee model. Trading costs are shown directly within the order interface before execution, allowing users to review estimated fees in advance. No hidden charges are applied during spot trades.

Perpetual Futures Fees

For perpetual futures trading, fees are displayed in real time within the futures trading panel. Margin requirements, estimated fees, and position-related costs are visible before orders are placed, enabling informed risk management.

Fiat Purchase Fees (Buy Crypto)

- Credit/Debit Card Purchases

- Supported across 30+ fiat currencies

- Transaction limits typically range from $25 to $5,000

- Fees start from approximately 0.8%

- Crypto is credited instantly after confirmation

- Supported across 30+ fiat currencies

- Fiat Balance & Bank Transfer

- Fiat deposits via bank transfer are 0-fee

- Buying crypto with fiat balance follows a tiered fee structure, where larger transactions benefit from lower percentage fees

- Bank transfers typically settle within 1–2 business days

- Crypto purchases from fiat balance are credited instantly

- Fiat deposits via bank transfer are 0-fee

P2P Trading Fees

P2P trades for USDT, BTC, and ETH operate with zero platform trading fees, while pricing and limits are set by individual advertisers and displayed before confirmation.

Withdrawals

Withdrawal fees vary depending on the blockchain network and withdrawal method. All applicable fees and processing times are shown before confirmation.

How Does BYDFi Work?

BYDFi organizes its trading and tracking tools into a clean, modular interface. Users can move quickly between Spot, Futures, MoonX, Copy Trading, and the Card dashboard without facing the complexity present in many larger exchanges.

The experience is designed for simplicity:

- Spot traders access clear order tickets and market charts

- Futures traders get real-time margin, liquidation, and PnL data

- MoonX users explore trending tokens from Solana, BNB Chain, and other ecosystems

- Copy traders follow strategies from experienced traders with transparent statistics

- Cardholders convert crypto to real-world spending without leaving the platform

The absence of clutter gives BYDFi a smoother learning curve than many global exchanges.

The BYDFi Visa Card

A major extension of the ecosystem is the BYDFi Visa Card, which converts crypto holdings into spendable USD for real-world payments. It is available in both virtual and physical formats.

The card operates similarly to other well-known crypto cards — such as the Coinbase Card, Crypto.com Visa, and Binance Visa Card — but is integrated directly into BYDFi’s trading environment, allowing users to move from trading to spending without additional steps.

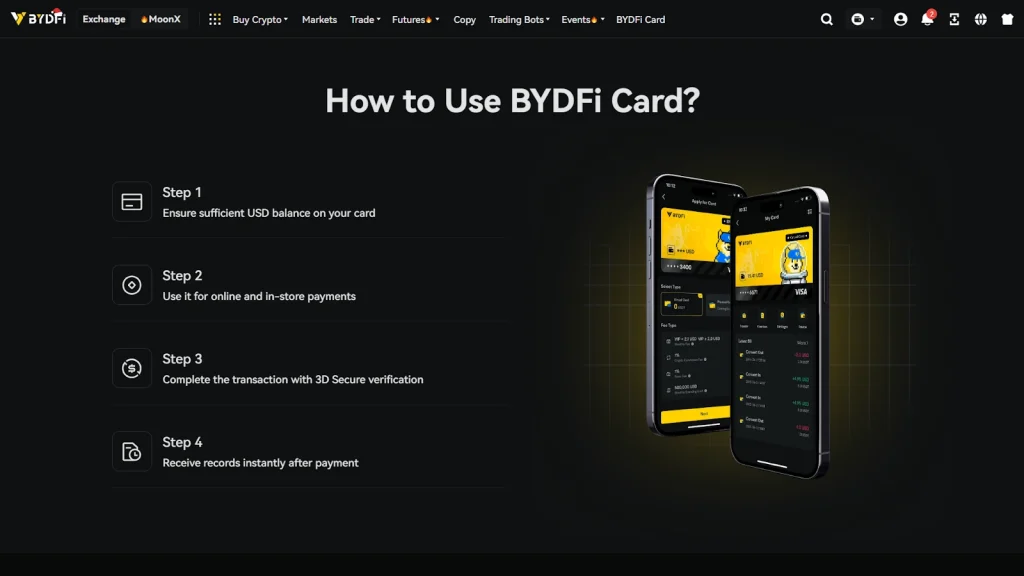

How the Card Works

- Load or maintain a USD balance

- Pay at Visa-supported merchants or online platforms

- Authenticate using 3D Secure

- View transaction history instantly in the app

Key Features

- Global Visa acceptance

- Google Pay and PayPal compatibility

- Low foreign exchange fees

- High spending limits

- Real-time transaction logs

- Seasonal cardholder promotions

The BYDFi Card provides practical utility for users who want crypto spending integrated into their trading platform.

Who Is BYDFi Best Suited For?

From beginners to advanced traders, BYDFi offers a structured environment that balances accessibility with depth.

It is designed for:

- Users who want simple spot trading

- Futures traders who need fast execution and clear risk data

- Traders exploring on-chain ecosystems

- Individuals who prefer automated strategies

- Users who want real-world crypto spending via a Visa card

- Traders who want charts, alerts, analytics, and wallets in one interface

The platform’s hybrid nature makes it suitable for users who move between CEX trading, on-chain trends, and practical payment solutions.

Limitations & Risks

- Liquidity is lower than major tier-1 exchanges

- High leverage increases volatility exposure

- On-chain tokens listed in MoonX can be highly unpredictable

- Withdrawal fees vary based on blockchain network load

- Regional restrictions affect card availability

- Copy-trading results can shift rapidly

These factors should be considered by any user evaluating the platform.

Pros & Cons

Pros

- Simple and clean interface

- Spot, futures, and on-chain trading in one platform

- MoonX provides structured on-chain visibility

- Transparent copy-trading metrics

- Visa card for global real-world spending

- Integrated monitoring tools

- Suitable for all experience levels

Cons

- Liquidity may lag behind larger exchanges

- Leverage introduces significant risk

- On-chain markets are volatile

- Withdrawal fees depend on the network

- Card accessibility varies by region

Final Verdict

BYDFi brings several components of the crypto ecosystem into one coherent platform. Its combination of centralized trading, on-chain analytics, automated tools, and a globally supported Visa card gives it broader utility than many mid-sized exchanges. The platform remains easy to navigate while offering enough depth for active traders.

MoonX and the BYDFi Card extend the exchange beyond simple buy-and-sell functionality, making it a practical choice for users who want market access and real-world spending from a single account.

While users should remain cautious with leverage and fast-moving on-chain tokens, BYDFi’s clear layout, transparency, and multi-feature design make it a compelling option for diverse trading needs.

You May Also Like

Shibarium May No Longer Turbocharge Shiba Inu Price Rally, Here’s Reason

Ripple CEO Quotes Buffett’s “Be Greedy When Others Fear” As XRP Wavers ⋆ ZyCrypto