When Bitcoin Crashed, Trump-Crypto Reddit Went Red Too | Research

Key Takeaways:

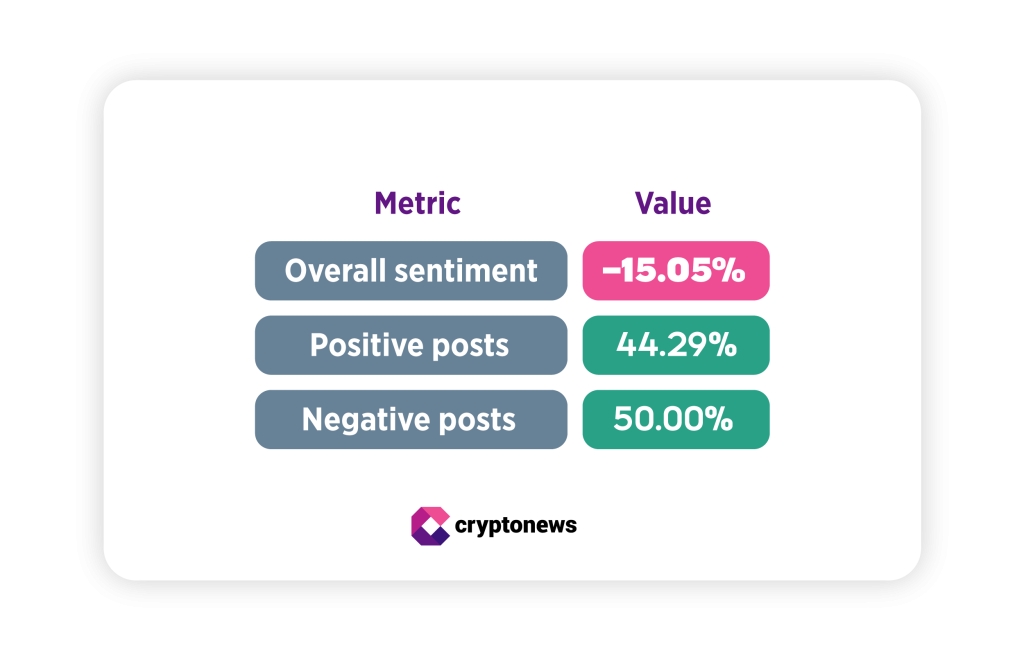

- Trump-related crypto sentiment on Reddit was mixed, but leaned negative overall.

- A single viral meltdown post during Bitcoin’s crash heavily shaped the entire month’s mood.

- Reddit sentiment around Trump and crypto closely mirrored Bitcoin market cap movements.

- When Trump was removed from the discussion, overall crypto sentiment turned positive.

As Bitcoin swung sharply in late 2025, crypto markets were not the only place where emotions ran high. Online discussions shifted just as fast. In particular, Reddit conversations linking crypto to Donald Trump showed sudden mood swings that closely tracked Bitcoin’s market — but with sharper reactions, louder panic, and more extreme language.

Trump remains one of the most polarizing figures tied to crypto narratives. His name often heightens emotions that already exist in the market. To better understand how politics and market stress interact, we analyzed more than 400 Reddit posts published between November 3 and December 2, 2025, focusing on discussions that mentioned both Trump and crypto.

The results suggest that when Bitcoin dropped, Trump-related crypto discussions didn’t just turn negative — they intensified.

A Community Split, but Slightly Pessimistic

Across the full dataset, Reddit sentiment toward Trump and crypto was not one-sided. About 50% of posts were negative, while roughly 44% were positive, with the rest neutral.

However, once engagement was factored in — meaning posts with more upvotes and comments carried more weight — the overall sentiment score dropped to –15%, indicating a mildly pessimistic tone. In other words, negative posts were fewer in number but louder and more influential. In particular, one extremely negative meltdown thread (originally shared on X) during the Bitcoin crash drew outsized engagement and pulled the overall score lower, even though nearly half of all posts were positive.

Sentiment Tracked Bitcoin’s Market Moves — Almost Perfectly

When sentiment is viewed on a week-by-week basis, changes in tone appear to broadly track market conditions over the period.

The timing suggests that shifts in Reddit sentiment around Trump and crypto may have followed Bitcoin’s market moves, with negativity peaking during the market sell-off and easing as prices stabilized. Put simply, when Bitcoin sold off, Trump-linked crypto discussions on Reddit appeared to turn sharply negative as well.

What Happens When Trump Is Removed from the Picture

To understand whether this negativity was about crypto itself or about Trump, we ran the same analysis on general crypto posts that did not mention Trump.

Without Trump, overall crypto sentiment turned positive, with an average score of +5.9%. Positive posts made up about 42%, while negative ones fell to 34%. The most viral post in this dataset was strongly bullish, not fearful.

That does not mean general crypto discussions ignored the crash. Sentiment still dropped during Week 3, falling from positive territory into the negative. But the decline was milder than in the Trump-related dataset.

How We Did the Research

We analyzed more than 400 Reddit posts published between November 3 and December 2, 2025. Each post was scored by a sentiment model on a scale from –1 (very negative) to +1 (very positive). Posts with more engagement — upvotes and comments — were weighted more heavily, since they shape what most users actually see.

Weekly and monthly sentiment scores were calculated by averaging these weighted results and rescaling them to a –100 to +100 range. We then compared Trump-related crypto discussions with general crypto posts to see how sentiment differed during the same market events.

You May Also Like

Thyroid Eye Disease (TED) Treatments Market Nears $4.3 Billion by 2032: Emerging Small Molecule Therapies Targeting Orbital Fibroblasts Drive Revenue Growth – ResearchAndMarkets.com

Virtus Equity & Convertible Income Fund Announces Special Year-End Distribution and Discloses Sources of Distribution – Section 19(a) Notice