Bitfinex Slashes Trading Fees to Zero in Bold Move Against DEX Competition

Bitfinex, a cryptocurrency exchange and sister company of Tether, has cut its maker and taker trading fees to zero in a long-term competitive strategy to grow its market share. Zero trading fees will apply to a diverse set of products and this change has no defined date to end.

According to a “Zero Fees Q&A” published by the company on Dec. 18, this new “default” for Bitfinex will apply to spot trading, margin trading, derivatives trading, securities trading on Bitfinex Securities, and OTC trading carried out through Bitfinex.

When questioned on how the company would profit without this revenue source, Bitfinex declared having multiple revenue streams other than maker and taker trading fees, including withdrawal fees and fees for specific capital markets activities.

Despite the explanations, comments below a reporting post by Colin Wu on X show skepticism on the model and mention potential hidden fees to compensate for this cut. The company however, has already addressed this concern, mentioning that there will be no hidden fees added to its products.

Crypto Exchange Competition Intensifies With DEXs

Competition around cryptocurrency exchanges has been intensifying lately with the rise of decentralized alternatives, dividing the industry into two categories: CEXs (centralized exchanges) and DEXs (decentralized exchanges).

Bitfinex is a centralized exchange owned by iFinex Inc., the same parent company who owns Tether, the leading stablecoin issuer and controller of USDT USDT $1.00 24h volatility: 0.0% Market cap: $186.25 B Vol. 24h: $84.61 B that dominates the ever-growing stablecoin market, as Coinspeaker reported earlier this week. The sister companies also share the same CEO, Paolo Ardoino.

Bitfinex faces competition in the CEX category from major players like Binance, Coinbase, Kraken, Upbit, OKX, Bybit, Bitget, Gate, Kucoin, MEXC, and many others.

On that note, the competition has intensified with the surge of solid decentralized alternatives like Uniswap, NEAR Intents, Raydium, PancakeSwap, Rhea Finance, Curve Finance, Aerodrome, and many others.

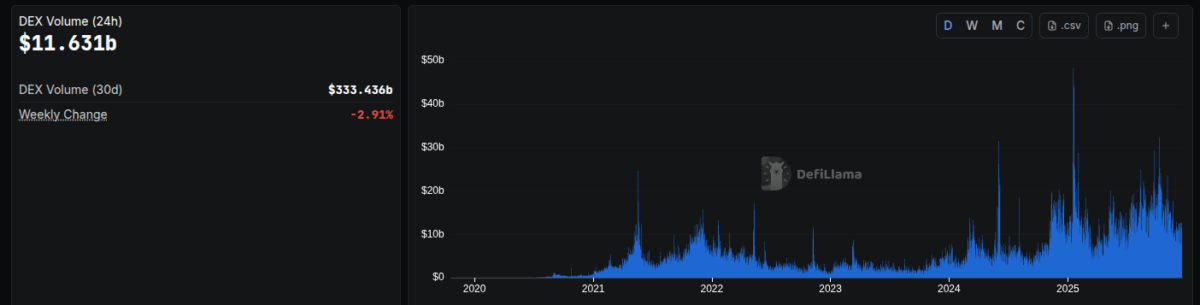

Data Coinspeaker retrieved from DefiLlama shows how the daily volume in these protocols have grown from nearly zero in 2020 up to a $50 billion peak in January 2025, now consolidating at $11.63 billion as market activity is more conservative during a bear market.

DEX volume (24 hours) as of Dec. 18, 2025 | Source: DefiLlama

Therefore, it is understandable that companies like Bitfinex now need to review their strategies and make bold moves to earn a significant share of this highly competitive market. Other centralized exchanges are also exploring new revenue streams, like Kraken launching xStocks on the TON blockchain.

nextThe post Bitfinex Slashes Trading Fees to Zero in Bold Move Against DEX Competition appeared first on Coinspeaker.

You May Also Like

‘Mysteriously disappeared’: DOJ Epstein prosecution memo vanishes after press inquiry

Mike Belshe: Stablecoins are a safer alternative to banks, BitGo’s operational controls are key for crypto market structure, and the future of finance is in asset tokenization