Which Company Will Define The Next Decade of Technology?

Welcome back to 3 Tech Polls, HackerNoon's Weekly Newsletter that curates Results from our Poll of the Week, and 2 related polls around the web.

\ Thanks for voting and helping us shape these important conversations!

\ This week, we look into the future, and ask a real question - the biggest question halfway through the 2020s - Who’s shaping the future of tech? Is it the AI labs, the chip makers, the software providers, or the cloud giants? Or maybe someone we haven’t known yet?

\ We asked the HackerNoon community, and the results were surprisingly close 😬

\

This Week’s HackerNoon Poll Results

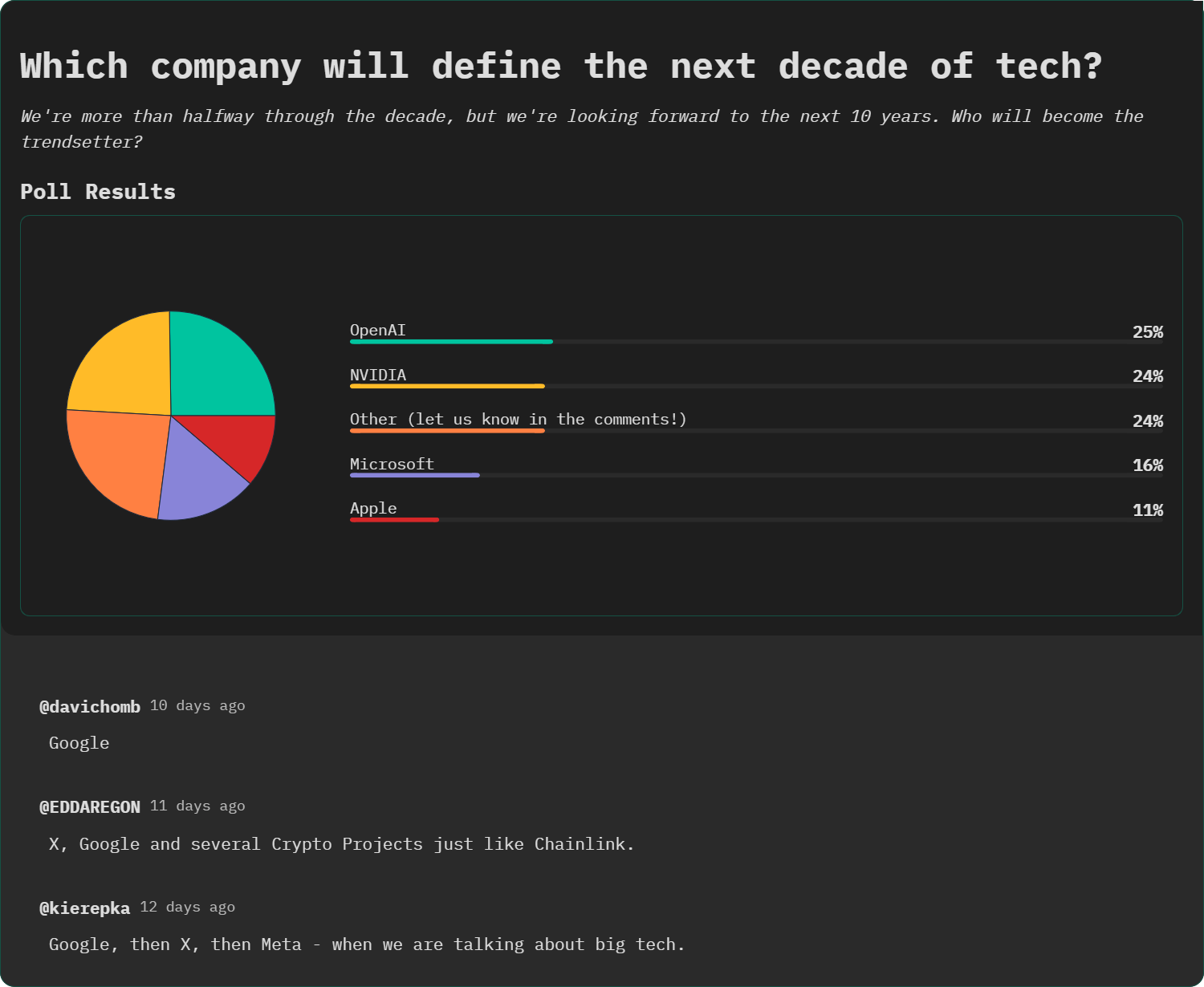

Which company will define the next decade of tech?

We're more than halfway through the decade, but we're looking forward to the next 10 years. Who will become the trendsetter?

\n

Heavily influenced by the AI boom and its rapid development over the past two years, it is clear from the results that we are experiencing a shift in perception around who holds real power in tech innovation moving forward. OpenAI took the lead by just a margin, signaling an affirmation of the belief in a future where the steering wheel will be held by companies that develop tools used by everyone around the globe. NVIDIA’s near equal share reinforces this statement - we are looking at a playing field where hardware and infrastructure manufacturers are no longer on the sidelines. The difference in votes between OpenAI and NVIDIA (25% vs 24%) also highlights a battle between product innovation and foundational tech.

\ On the other hand, Microsoft’s 16% suggests that despite the company’s influence on the tech industry in the past decade, it’s perceived less as a visionary driver in the coming years. Additionally, Apple, long a symbol of innovation, landed in the last place, with only 11% of votes - perhaps a reflection of the company’s current state, slower pace in AI, and less creativity in products.

\

"Other" Scores High - And the Comments Say a Lot

24% of voters chose “Other,” tying with OpenAI and NVIDIA. This has broken away from being a wildcard category, signaling mixed opinions, and a testament to how diverse and competitive the tech industry is in 2025 and going into 2026.

\ Comments also revealed diverse perspectives:

\

\

\

:::tip Weigh in on the poll results here.

:::

The Future is AI - What The Prediction Markets Have to Say

With every single company jumping on the development and integration of AI, it is clear that whoever gains the edge in the AI race will become the decision maker in the coming years. Let’s see how other markets predict!

\

Polymarket

Which company has the best AI model end of 2025?

\ Over on Polymarket, Google is the favorite to have the best AI model by the end of 2025, winning over an overwhleming 95% of market confidence. Trailing far behind are xAI (2.5%), Anthropic (1.4%), and OpenAI (1.3%). Despite OpenAI’s major role in the current AI boom, the public appears to be aligning more with Google’s infrastructure, distribution, and current development strategies for Gemini going forward.

\

Kalshi

Best AI at the end of 2025?

\ On Kalshi, the results are not much different, in which we witness again an overwhelming preference for Google’s Gemini to be the best AI by the end of 2025, standing at 93%. This is followed by Grok at 5% and ChatGPT at 3%.

\

Join the Conversation

:::tip Vote in this week’s poll: What Do You Think About Disney’s $1B Deal Letting OpenAI’s Sora Use Disney Characters For AI-Generated Video?

:::

\ We’ll be back next week with more data, more debates, and more donut charts!

You May Also Like

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse