Ethereum Whale Accumulates 38,576 ETH Using Borrowed USDT

This article was first published on The Bit Journal.

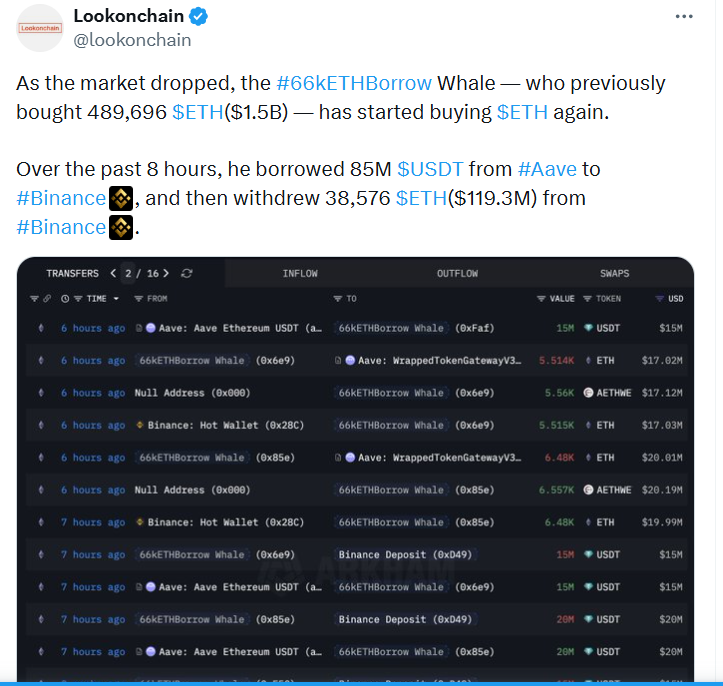

As ETH slid during a choppy session, a large whale executed a trade that left a clean trail on-chain: borrowed stablecoins, bought size, then withdrew the ETH off an exchange. The reported flow shows roughly $85,000,000 in USDT borrowed from Aave, routed to Binance, and followed by a withdrawal of 38,576 ETH, valued near $119,300,000 at the time it was flagged.

Leverage is the detail that sharpens the risk as borrowing stablecoins to buy ETH can boost returns if price rebounds, but it can also trigger liquidation if collateral values fall enough, because lending protocols close positions to protect lenders.

Ethereum Whale Transaction Table

| Time reference | Activity | Venue/protocol | Amount | Approx. USD value |

|---|---|---|---|---|

| Dec 15, 2025 | Borrowed stablecoins | Aave | 85,000,000 USDT | 85,000,000 |

| Dec 15, 2025 | Moved funds to exchange | Binance | 85,000,000 USDT | 85,000,000 |

| Dec 15, 2025 | Withdrew ETH after buying | Binance | 38,576 ETH | 119,300,000 |

| Nov 21, 2025 | Borrowed stablecoins | Aave | 25,000,000 USDT | 25,000,000 |

| Nov 21, 2025 | Withdrew ETH after buying | Binance | 13,154 ETH | 37,000,000 |

Why the Withdrawal Is the Signal

A buy can be loud, but a withdrawal often matters more for near-term liquidity. ETH held on an exchange is close to becoming sell pressure, while Ethereum moved off-exchange often shifts into custody, staking, or DeFi positions that rotate more slowly, even though a redeposit later is always possible.

Market data cited by Glassnode showed ETH on centralized exchanges falling to around 8.7% of total supply, the lowest level since Ethereum’s early years. With less inventory sitting in order books, price can react faster when demand returns, because there is simply less Ethereum readily available to sell into strength.

Fundamentals Add Context

Ethereum activated the Fusaka upgrade on Dec 3, 2025, and coverage highlighted efforts aimed at reducing node burdens and improving rollup settlement, with PeerDAS discussed as a scaling approach for data availability. These changes typically work as gradual tailwinds rather than instant catalysts.

Source: X

Source: X

What Traders Watch Next

As of Dec 16, 2025, Ethereum was around $2,934.30, after moving between $2,895.63 and $3,173.91 intraday, a range that shows how quickly sentiment can flip when liquidity is thin. Traders tend to watch whether fresh withdrawals continue, whether any of the withdrawn ETH returns to exchanges, and whether DeFi borrowing demand stays hot without triggering liquidation waves that turn leverage into sudden selling.

Conclusion

This 38,576 ETH withdrawal stands out because it lines up with a market that is already running lean on exchange-held Ethereum , while showing a willingness to take leveraged risk during uncertainty. That combination can support sharper moves when buyers step back in, but it also carries a clear downside path if leverage unwinds through liquidations, and readers should treat it as market context rather than a guarantee of direction.

Frequently Asked Questions

What is the key takeaway here?

A leveraged purchase followed by an off-exchange withdrawal, which often implies reduced near-term intent to sell.

Does low exchange supply guarantee a rally?

No, but it can amplify rallies because there is less supply ready to sell.

Why is borrowing USDT considered aggressive?

It increases exposure while adding liquidation risk if collateral drops.

Glossary of Key Terms

Whale: A large holder whose trades can affect liquidity and sentiment.

Exchange reserves: Supply held on centralized exchanges, often treated as readily sellable inventory.

Leverage: Borrowed exposure that magnifies gains and losses.

Liquidation: A forced close when collateral falls below required thresholds.

Stablecoin: A token designed to track a stable value, commonly used for DeFi borrowing.

References

TradingView

CoinDesk

Crypto News Flash

Read More: Ethereum Whale Accumulates 38,576 ETH Using Borrowed USDT">Ethereum Whale Accumulates 38,576 ETH Using Borrowed USDT

You May Also Like

Disney Pockets $2.2 Billion For Filming Outside America

MAXI DOGE Holders Diversify into $GGs for Fast-Growth 2025 Crypto Presale Opportunities