Is XRP Price Setting Up for a Deeper Dip to $1 Before a Rebound in 2026?

The post Is XRP Price Setting Up for a Deeper Dip to $1 Before a Rebound in 2026? appeared first on Coinpedia Fintech News

The XRP price is presenting a rare series of events. On the one hand, institutional accumulation has remained uninterrupted for weeks, including XRP ETF net flows. But, on the flip side, the price action continues to bleed lower, testing investors’ and traders’ patience heavily. This growing divergence between fundamentals and market behavior is shaping one of the most complex XRP setups in recent years, that is keeping new investors at bay.

XRP Price Sees Unbroken Institutional Inflows

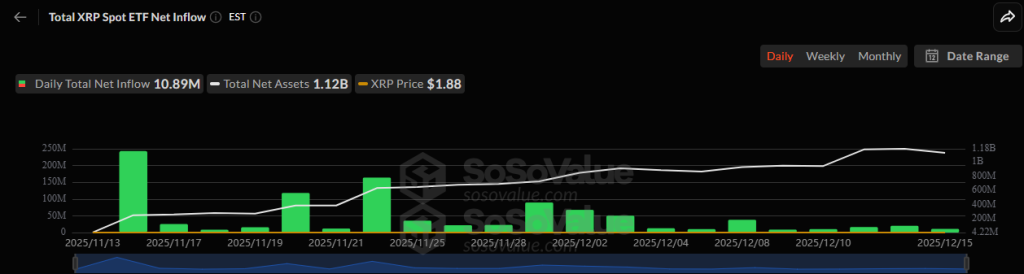

As evident on XRP ETF netflows, from November 14 to December 15, the XRP price chart recorded not a single day of ETF outflows. This clearly suggests that institutions are not only interested in XRP but are also steadily increasing their exposure, regardless of short-term volatility.

Institutional holdings have now reached approximately 0.98% of XRP crypto’s total market capitalization, translating to nearly $1.12 billion in net assets, per SOSOValue’s data. This level of confidence makes it hard to believe that the price would settle lower, given good fundamentals and a project with utility.

However, these positive net flows indicate a long-term role rather than short-term speculative positioning. The accumulation trend reinforces the idea that XRP’s fundamentals remain intact even as the price weakens, and it seems more likely that the market will show a big surprise soon or next year.

Why Strong Fundamentals Aren’t Lifting XRP Price

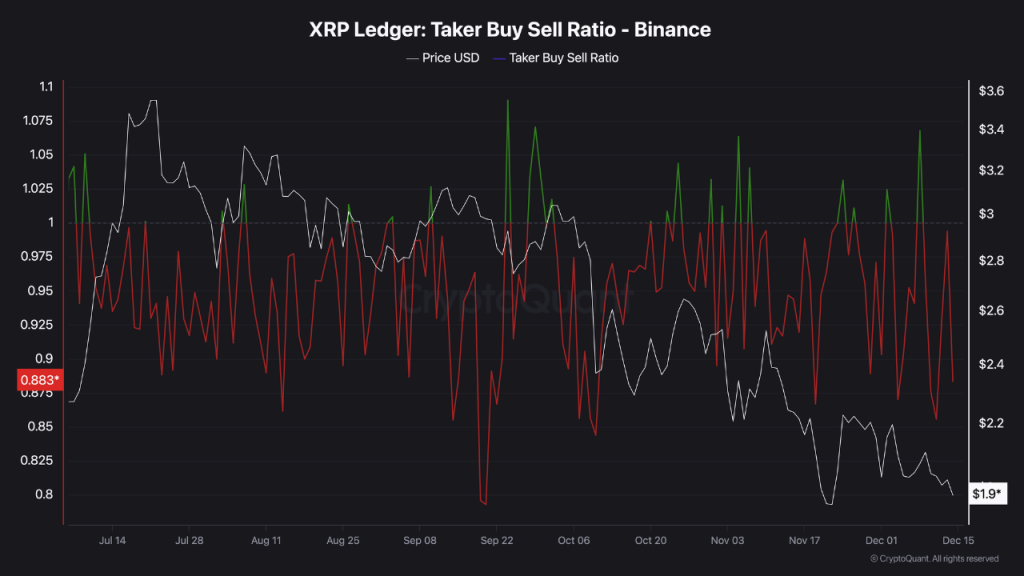

Now, many are intrigued as to why XRP ETF positive inflows aren’t supporting the price. Then, looking at the data, the picture becomes clearer, which underlines the real problem. The XRP price USD has failed to respond positively to ETF data, and the primary reason lies in insufficient buying power relative to broader selling pressure.

While XRP ETF inflows are constructive, they are not yet large enough to offset aggressive derivatives activity.

The Taker Buy Sell Ratio has stayed negative for most of this period, indicating that sell orders continue to dominate XRP’s futures market. This imbalance suggests that short-term traders remain positioned bearishly, limiting any sustained upside attempts.

Historically, such extended compression phases often end with sharp volatility expansions. However, current conditions show that bears momentum is still strong against bulls.

- Also Read :

- Solana’s Alternative PDP Aims for a 9,700% Crypto Rally for End of October, Analyst Says

- ,

Derivatives Market Keeps XRP Price Capped

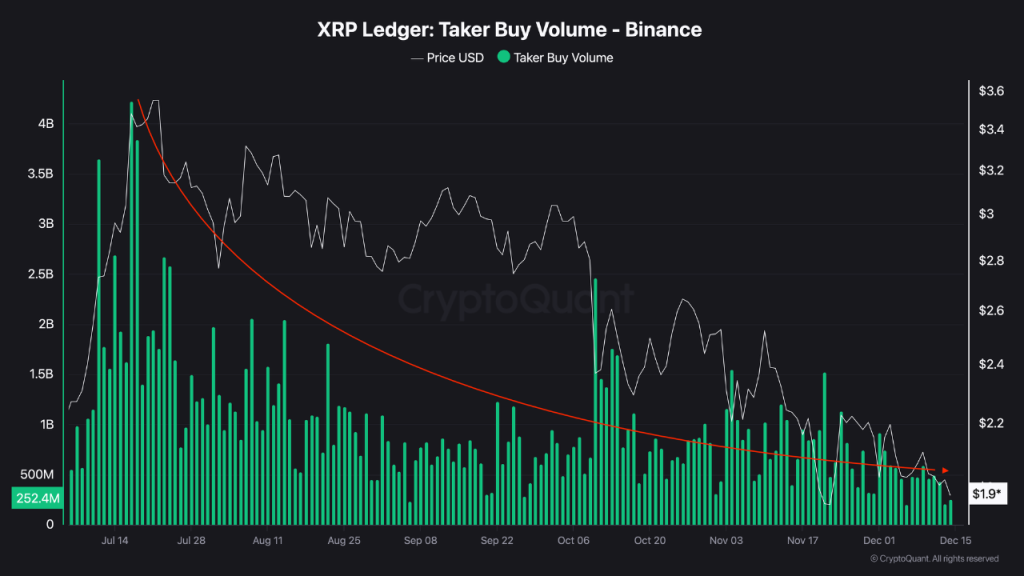

Another critical factor weighing on the XRP price forecast is the evaporation of buying pressure in derivatives markets. Insights from CryptoQuant suggest that the Buy-side futures volume has fallen to multi-month lows, signaling hesitation from leveraged traders.

Beyond XRP-specific metrics, the broader market context also remains unfavorable. Altcoins as a whole have experienced a significant dip over recent months. While Bitcoin continues to absorb the majority of available liquidity, holding onto its own support levels, it leaves limited room for recovery across alternative coins.

Additionally, at a time like this, new liquidity from new investors would have helped facilitate recovery; however, new investors are currently on the sidelines due to the tremendous liquidations across the altcoin sector in October, which have further eroded confidence. As risk appetite remains fragile, even fundamentally strong assets like XRP crypto struggle to attract aggressive bids.

Key Levels Define the XRP Price Outlook

From a technical perspective, $1.92 has emerged as a crucial turning point on the XRP price chart, at least in the short term. Now, a Failure to hold this zone could open the door to a deeper correction toward the $1.00 psychological level.

At the same time, prolonged weakness may continue to benefit institutional buyers. As weaker retail gets absorbed slowly, conditions could eventually shift toward a more durable accumulation base. In that context, many expect the XRP price to stabilize before any meaningful recovery phase potentially develops later.

FAQs

Analysts predict XRP could reach $5.05 by December 2025 if bullish momentum continues and key resistance levels are broken.

XRP price is influenced by ETF approvals, on-chain activity, investor sentiment, legal developments, and broader crypto market trends.

XRP shows bullish signs with strong on-chain activity and ETF interest, but investors should watch key support and resistance levels carefully.

You May Also Like

Solana Treasury Stocks: Why Are These Companies Buying Up SOL?

Unstoppable: Why No Public Company Can Ever Catch MicroStrategy’s Massive Bitcoin Holdings