XRP Price Prediction: Can Ripple Rally Past $2 Before the End of 2025?

The post XRP Price Prediction: Can Ripple Rally Past $2 Before the End of 2025? appeared first on Coinpedia Fintech News

The XRP price has come under enormous pressure after it experienced a huge sell-off throughout the weekend and closed on a bearish note. Bitcoin price slumped hard in the early trading hours, which dragged the entire market down, including XRP. The whale interest seems to have trembled a bit, which seems to have been absorbed by the bulls. With the technicals and the on-chain data hinting towards a ‘market reset,’ it would be interesting to watch whether the XRP price will reclaim $2 this year or not.

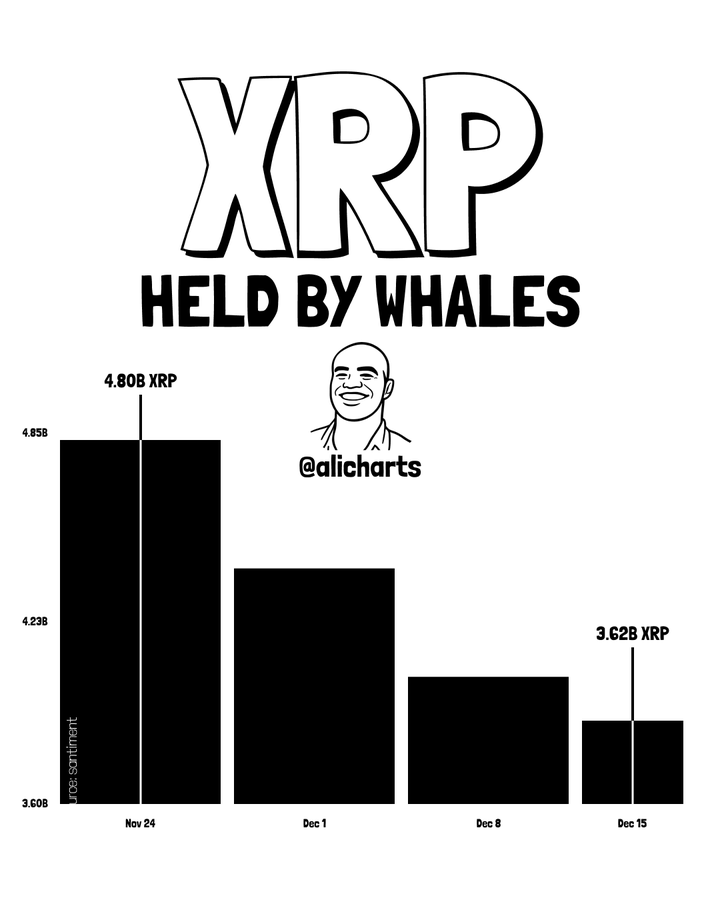

Whale Distribution Triggers Short-Term XRP Weakness

The clearest source of XRP’s current sell-side pressure comes from whales. Large-wallet holdings have fallen from roughly 4.8 billion XRP in late November to 3.6 billion XRP by December 15, according to Sentiment data presented by a popular analyst, Ali. This is a meaningful drop in deep-pocket supply and historically aligns with short-term tops or multi-week corrections.

Whales typically offload during high volatility or uncertainty, and their selling over the past three weeks has coincided with XRP breaking key support levels—including the crucial $0.60 zone—and sliding further in line with the broader market downturn. For now, the short-term trend remains bearish primarily because the largest holders are driving liquidity out of the market.

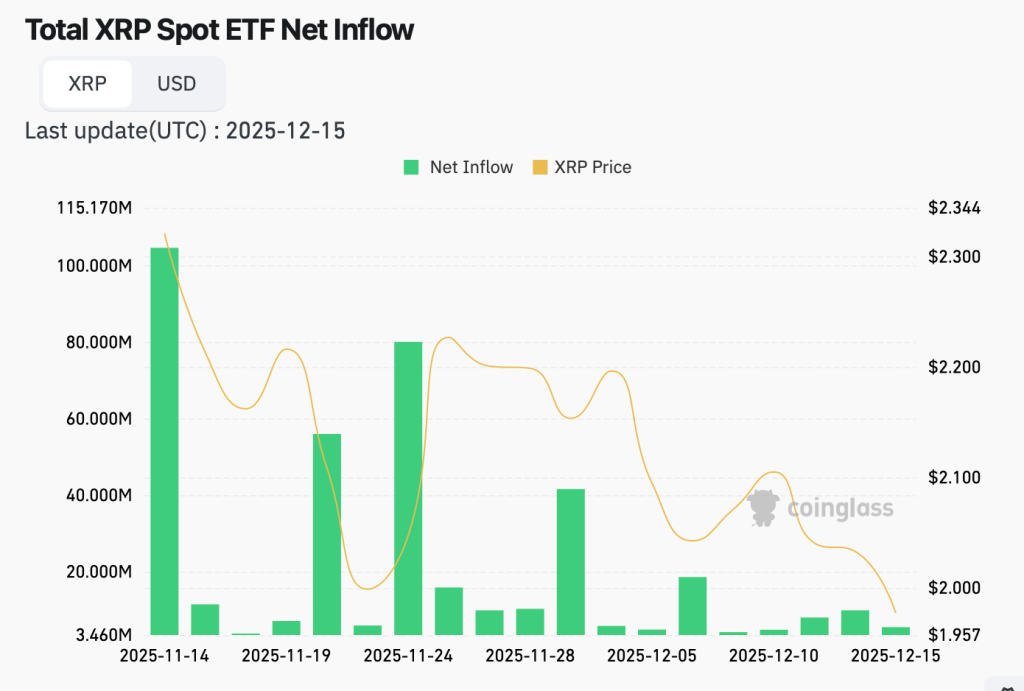

ETF Inflows Show Institutions Accumulating Into Weakness

But the second chart tells a very different story. While whales have been exiting, XRP-focused ETFs and ETPs have recorded consecutive net inflows, outperforming both Bitcoin and Ethereum products during the same period.

Bitwise, Franklin, and other issuers posted multi-million-dollar daily inflows, pushing cumulative net assets above $1.18 billion. Bitwise alone attracted nearly $3.9 million in new flows, while Franklin added more than $4.3 million, suggesting institutional allocators are quietly increasing exposure.

This divergence—whales selling, institutions buying—indicates that longer-term players view the current weakness as an opportunity rather than a trend reversal. ETF flows don’t typically chase short-term momentum; they reflect strategic positioning and confidence in future value.

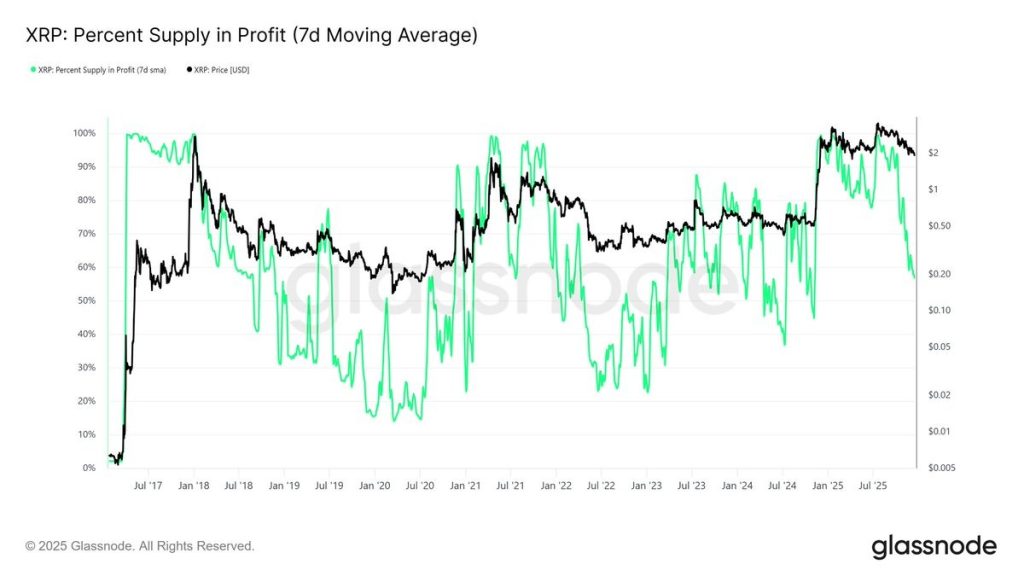

Percent Supply in Profit Confirms a Market Reset, Not a Breakdown

The final piece of the puzzle is XRP’s percent supply in profit, which has collapsed sharply during the recent decline. Historically, whenever the proportion of profitable supply falls this quickly, it signals one of two things: capitulation or the formation of an accumulation zone.

Current readings are now approaching levels seen during major resets in 2018, 2020, and 2022—each of which preceded substantial rebounds in the months that followed. This metric is crucial because it tells us that XRP’s corrective move is flushing out weak hands and resetting expectations, rather than ushering in a prolonged downtrend.

A Market That’s Weak Short-Term, But Strengthening Underneath

When all three signals are aligned, the conclusion becomes clearer: Whales are driving the immediate sell-off, and ETFs are absorbing a meaningful portion of that pressure, reflecting institutional conviction. Meanwhile, on-chain profitability metrics show XRP entering a historical reset zone.

Despite short-term weakness, XRP’s underlying market structure is quietly strengthening. Together, these trends suggest the current correction may be setting the stage for a broader recovery once selling pressure eases. If institutional demand holds and on-chain metrics continue to stabilize, XRP price could realistically work its way back toward the $2 level before the end of 2025.

You May Also Like

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?

Crypto Casino Luck.io Pays Influencers Up to $500K Monthly – But Why?