Ripple’s RLUSD Goes Multichain, Here’s Why It Matters for XRP Holders

The post Ripple’s RLUSD Goes Multichain, Here’s Why It Matters for XRP Holders appeared first on Coinpedia Fintech News

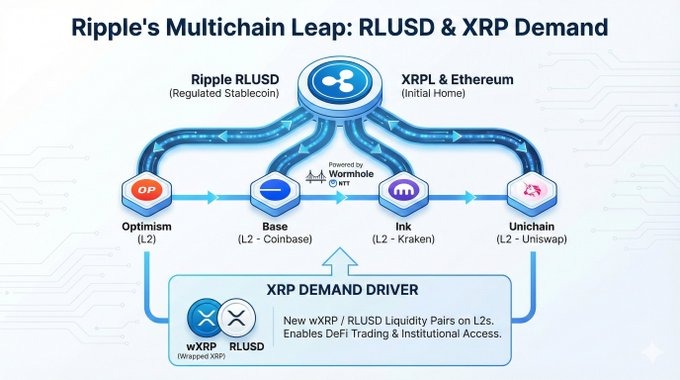

Ripple, a blockchain-based infrastructure for global payments, has taken a major step to expand the use of its US dollar-backed stablecoin, RLUSD. On December 15, the company confirmed it is testing RLUSD on several Ethereum layer-2 networks, including Optimism, Base, Ink, and Unichain.

This move builds on its earlier launch and aims to create a more connected system while increasing real-world use for XRP.

Ripple RLUSD Stablecoin Goes Multichain

According to recent updates shared by the Ripple community, Ripple’s RLUSD stablecoin, which already has a market value of about $1.3 billion, has adopted Wormhole’s NTT standard.

This upgrade allows RLUSD to move between blockchains as the original token, not as risky wrapped copies.

By using Wormhole’s Native Token Transfers system, RLUSD can shift smoothly across networks while staying secure and liquid. This setup also lets Ripple keep full control over how RLUSD operates on each supported blockchain.

How XRP Fits Into This Bigger Plan

While RLUSD acts as the “digital cash” in Ripple’s system, XRP plays the role of the liquidity engine. At the same time as RLUSD expands, partners like Hex Trust are rolling out wrapped XRP (wXRP).

This allows XRP to be used on networks like Solana and Ethereum, where it can serve as collateral, trading liquidity, or DeFi fuel.

Together, RLUSD handles stable payments, while XRP helps move value between blockchains. For XRP holders, this means XRP is no longer limited to one network and can now play a bigger role across the wider crypto ecosystem.

More Chains Planned in 2025

Ripple is currently testing RLUSD on major Ethereum layer-2 networks like Optimism, Base, Ink, and Unichain. A full launch is planned for next year, once regulators give approval.

Once live, RLUSD will work smoothly across different blockchains while staying fully regulated. With strong regulatory support and growing cross-chain use, Ripple is building RLUSD for the next stage of crypto adoption.

Institutional Adoption Strengthens Ripple Case

Ripple’s progress is backed by strong regulatory approvals in New York and growing use in tokenized funds. BlackRock’s BUIDL platform already uses Wormhole for cross-chain activity, showing rising trust from large institutions.

While prices may not rise quickly in the short term, Ripple’s multichain approach increases XRP’s real use. Over time, this wider use can support long-term value.

You May Also Like

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?

U.S. Banks Near Stablecoin Issuance Under FDIC Genius Act Plan