Trading time: ETH/BTC hits a nearly five-year low, Bitcoin may continue to dominate the market

1. Market observation

Keywords: FOMC, ETH, BTC

The ETH/BTC ratio has fallen to its lowest level since mid-2020, and economist and cryptocurrency trader Alex Kruger has made a trading suggestion: "If you still hold ETH, now may be a good time to switch to high-beta altcoins. Even if the market falls, the losses in both cases may be comparable, but if the market rises, there is hope for significant excess returns, which can then be exchanged back for BTC. However, market indicators show that we are still in the "Bitcoin season", and crypto trader Hansolar has clearly predicted that 2025 will be the "year-round Bitcoin season." CoinMarketCap's altcoin seasonality index is only 13/100, and Bitcoin's market dominance has risen to 62.15%, far higher than the 42% level when Ethereum hit an all-time high of $4,800 in November 2021.

Judging from the trading data, USDT wallet activity has increased significantly. Vincent Liu, chief investment officer of Kronos Research, believes that traders usually accumulate USDT during market declines to find buying opportunities. The current surge in USDT activity is a bullish signal, indicating that there is a lot of buying power in the off-market. With the inflation rate falling to 2.8% in February, lower than expected, this may reduce the pressure on cryptocurrency prices. Traders also need to pay attention to the upcoming FOMC meeting on March 18, which may point out a new trading direction for the market.

It is worth noting that Qiao Wang, founder of Alliance DAO, pointed out that Ethereum has reached an oversold level similar to the Terra crash in 2021, the deep bear market in 2018, and the DAO hack in 2016, and there may be trading opportunities at this price. In contrast, the game asset market has performed well. The return on investment of CS2 accessories has surpassed the S&P 500 index and major crypto assets, becoming one of the best performing trading varieties. The total value of in-game items has exceeded US$4.3 billion and maintained an upward momentum.

2. Key data (as of 13:00 HKT on March 13)

-

Bitcoin: $82,999.85 (-11.36% year-to-date), daily spot volume $37.583 billion

-

Ethereum: $1,861.07 (-44.18% year-to-date), with a daily spot volume of $22.944 billion

-

Fear index: 45 (fear)

-

Average GAS: BTC 2 sat/vB, ETH 0.60 Gwei

-

Market share: BTC 61.3%, ETH 8.5%

-

Upbit 24-hour trading volume ranking: XRP, BTC, ETH

-

24-hour BTC long-short ratio: 0.9242

-

Sector ups and downs: Meme sector rose 4%, Layer2 sector rose 3.7%

-

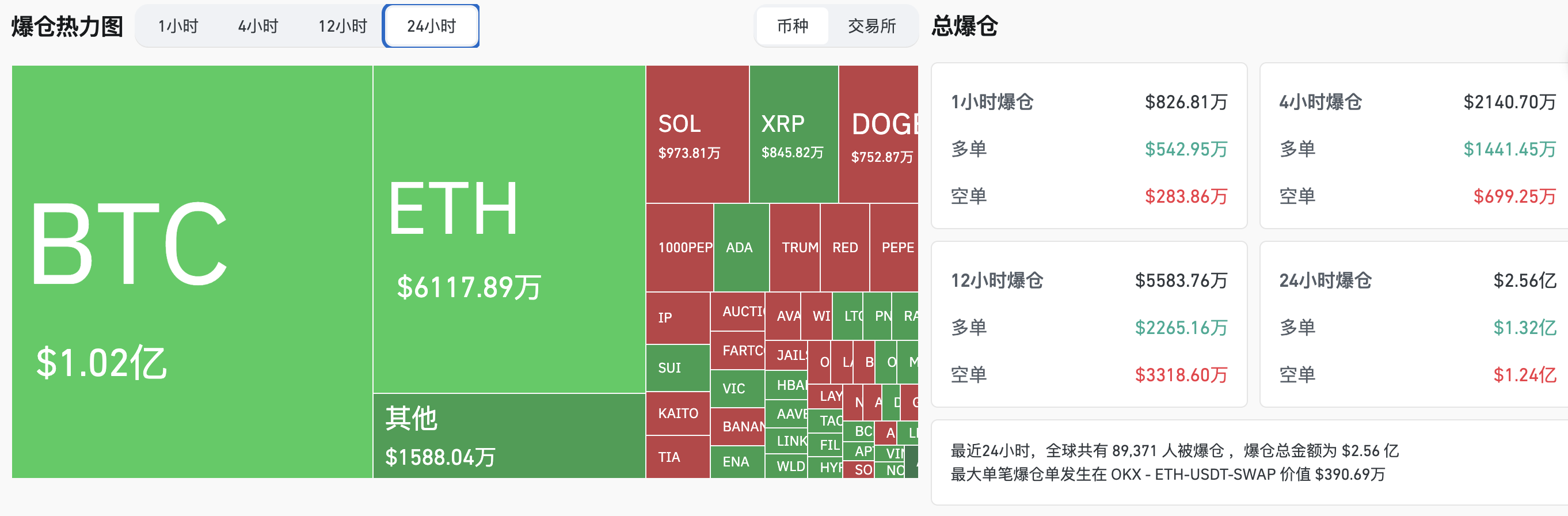

24-hour liquidation data: A total of 89,371 people were liquidated worldwide, with a total liquidation amount of US$256 million, including BTC liquidation of US$102 million and ETH liquidation of US$61.1789 million

3. ETF flows (as of March 12 EST)

-

Bitcoin ETF: $13.33 million

-

Ethereum ETF: -$10.3 million

4. Important Dates (Hong Kong Time)

US President Trump met with US technology leaders, including the CEOs of HP, Intel, IBM, and Qualcomm. (March 11, 2:00)

US President Trump signed an executive order. US February unadjusted CPI annual rate (March 12, 20:30)

-

Actual: 2.8% / Previous: 3% / Expected: 2.9%

U.S. February seasonally adjusted CPI monthly rate (March 12, 20:30)

-

Actual: 0.2% / Previous: 0.50% / Expected: 0.30%

Number of initial jobless claims in the United States for the week ending March 8 (10,000 people) (March 13, 20:30)

-

Actual: None / Previous: 22.1 / Expected: None

5. Hot News

Ripple receives Dubai license to provide crypto payment services in the UAE

China Banknote Printing and Minting Group: Never sold virtual currency through any channel

OKX will delist multiple spot trading pairs including XR, GOAL, KP3R, LBR, LAMB, BZZ, GPT, etc.

U.S. stocks closed: Nasdaq rose 1.2%, Tesla rose more than 7%

Coinbase to List Maple Finance (SYRUP) Trading

Coinbase will list Aethir (ATH) trading, and trading pairs will be available on March 14

Venice airdrop ends, $100 million of unclaimed VVV tokens destroyed

North Korean hacker group Lazarus embeds cryptocurrency-stealing malware in new batch of JavaScript packages

Bezos-backed banking startup Stark Bank SA targets Brazilian cryptocurrency business

Binance announces $2 billion investment from Abu Dhabi investment firm MGX

Bolivian State Energy Company YBFB to Pay for Energy Imports with Cryptocurrency

CBOE Submits 19b-4 Filing for Franklin Solana ETF

Video-sharing platform Rumble spends $17.1 million to buy 188 BT

The Russian Central Bank plans to establish a special experimental legal system for three years to allow a limited group of people to buy and sell cryptocurrencies

Traders still expect the Fed to resume rate cuts in June

U.S. CPI data for February fell short of expectations

Market News: Russian Central Bank allows investors to purchase cryptocurrencies on a limited basis

Binance Alpha launches new audit mechanism and removes multiple tokens that do not meet the standards

Analysis: Bitcoin forms bullish RSI divergence just ahead of US CPI release

South Korea plans to issue new guidelines in the third quarter to lift the ban on institutional cryptocurrency investments

Over 136.7 million USDT transferred from unknown wallet to Binance

You May Also Like

The Next “Big Story” in Crypto: Crypto Credit and Borrowing, Says Bitwise CEO

SEC New Standards to Simplify Crypto ETF Listings