The old tree blooms new flowers, Sonic ecosystem grows against the trend, a list of major native DeFi projects

Author: Castle Labs

Compiled by: Felix, PANews

The last two months have been one of the most challenging periods in the crypto space, with players exiting in droves and liquidity becoming the scarcest commodity in the space.

Likewise, individual ecosystems face growth challenges, but Sonic has been fighting through the bloodbath.

From Fantom to Sonic

From a technical perspective, the transition from Fantom to Sonic makes the chain one of the best performing EVM L1s with:

- 10,000 TPS

- Sub-second finality

- Solidity/Vyper support

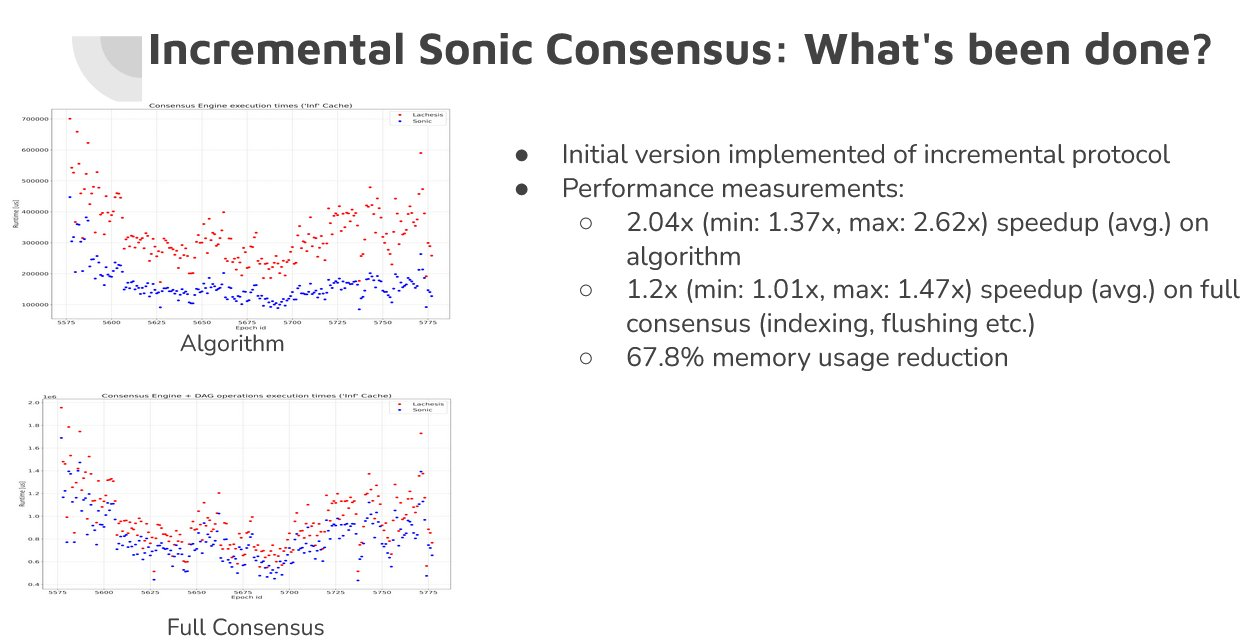

Thanks to incremental Sonic consensus, these features continue to improve rapidly: on average they are 2.04 times faster and use 67.8% less memory.

In addition, several incentive programs help to strengthen the community and attract new developers and users:

- FeeM (Fee Monetization): Apps can earn 90% of the fees they generate

- Innovators Fund: $200 million to support applications and drive new initiatives

- Airdrop: About $200 million to reward users

Ecosystem Updates

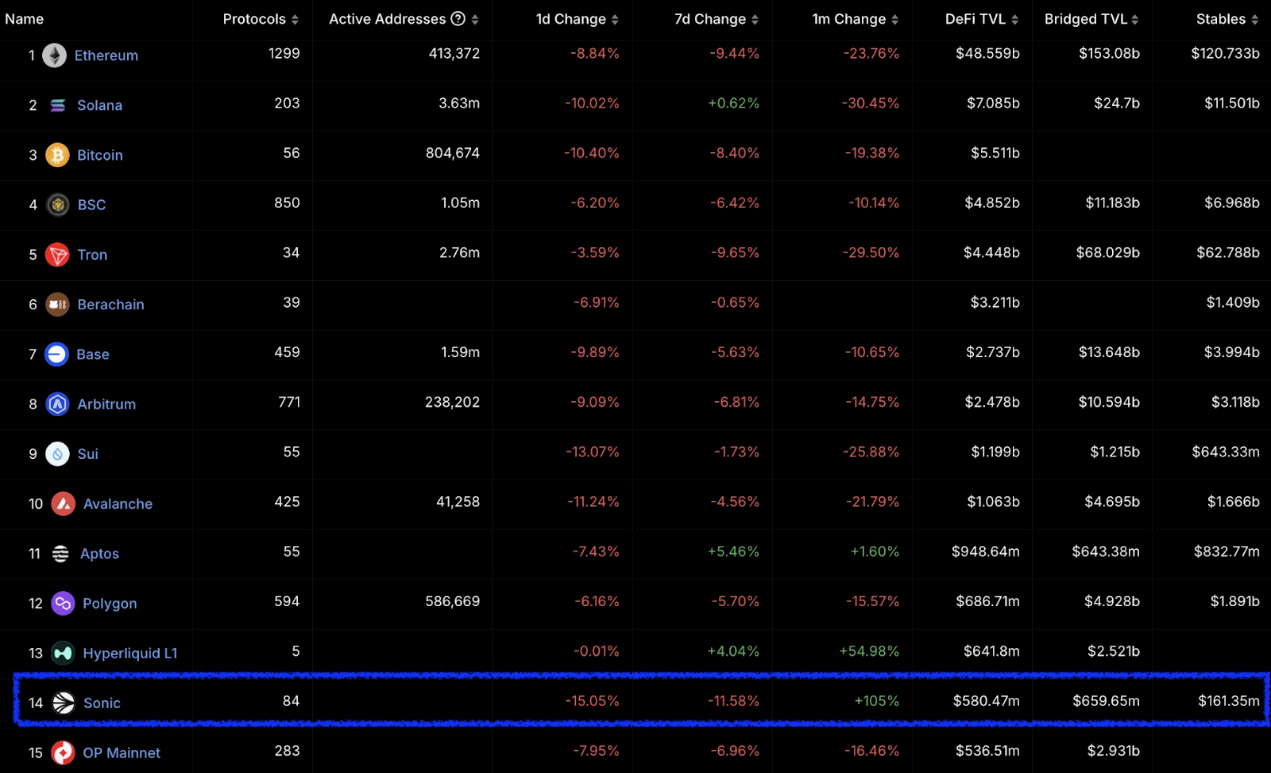

TVL growth: Among the top 25 chains by TVL, only three chains saw an increase last month, with Sonic seeing the largest increase.

Source: DeFiLlama

FeeM: Over 900,000 $S have been allocated to projects that generate fees on the network, with a value of over $500,000.

An evolving ecosystem

Aave deploys its lending market on the Sonic network. Users can borrow, supply, and earn incentives on Aave. Initial assets include $USDC, $WETH, and $wS. In addition, Sonic and Aave also provide incentives of $15 million and $800,000 respectively to attract users. The newly added market reached the supply cap on the first day.

Llamaswap: DefiLlama adds Sonic Labs to the list of supported chains. Users can use DefiLlama to exchange tokens more efficiently.

Trust Wallet also announced the integration of Sonic (S), allowing users to manage assets on the Sonic chain within the wallet, including sending, receiving and storing native S tokens and tokens issued based on Sonic.

In addition, Jumper is also launched on Sonic, and users can bridge tokens to Sonic through Jumper.

Native Project

Shadow Exchange : Shadow Exchange is a DEX platform that uses the (3,3) model that was popular in the last cycle and allows users to earn above-average APY returns on their pools. Shadow is also the 5th highest-grossing DEX in the past 7 days.

Related reading: 20 times in three weeks, will Shadow Exchange, which adopts the x(3,3) incentive model, become the Sonic DeFi engine?

Stream Finance : Stream Finance is a yield product that grew TVL from 0 to $25M in 10 days thanks to its vault, where users can choose USDC pools with up to 25% APY.

SwapX : SwapX is a DEX built on Algebra and is the first modular AMM with a V4 plugin. Key features include:

- Algebra Integral as the main engine

- Support modular upgrades to add new features without disrupting liquidity while retaining user self-custody rights.

- VE(3,3) Token Model

Hand of God : Hand of God is an AI-driven DeFi protocol inspired by the original Tomb Finance model that optimizes governance through real-time data analysis. The current TVL is approximately $19 million.

Eggs Finance : Eggs Finance is a DeFi protocol that allows users to mint $EGGS with $S, use $EGGS as collateral to borrow more $S, and maximize leverage strategies.

Related reading: What other wealth codes are worth paying attention to in the Sonic ecosystem?

Metropolis : Metropolis is a DLMM-powered DEX that combines AMM and order book capabilities to enable zero-slippage trading and high APY returns.

Related reading: After the gorgeous name change, this article will take you to understand the latest status of Sonic ecosystem

You May Also Like

The Next “Big Story” in Crypto: Crypto Credit and Borrowing, Says Bitwise CEO

SEC New Standards to Simplify Crypto ETF Listings