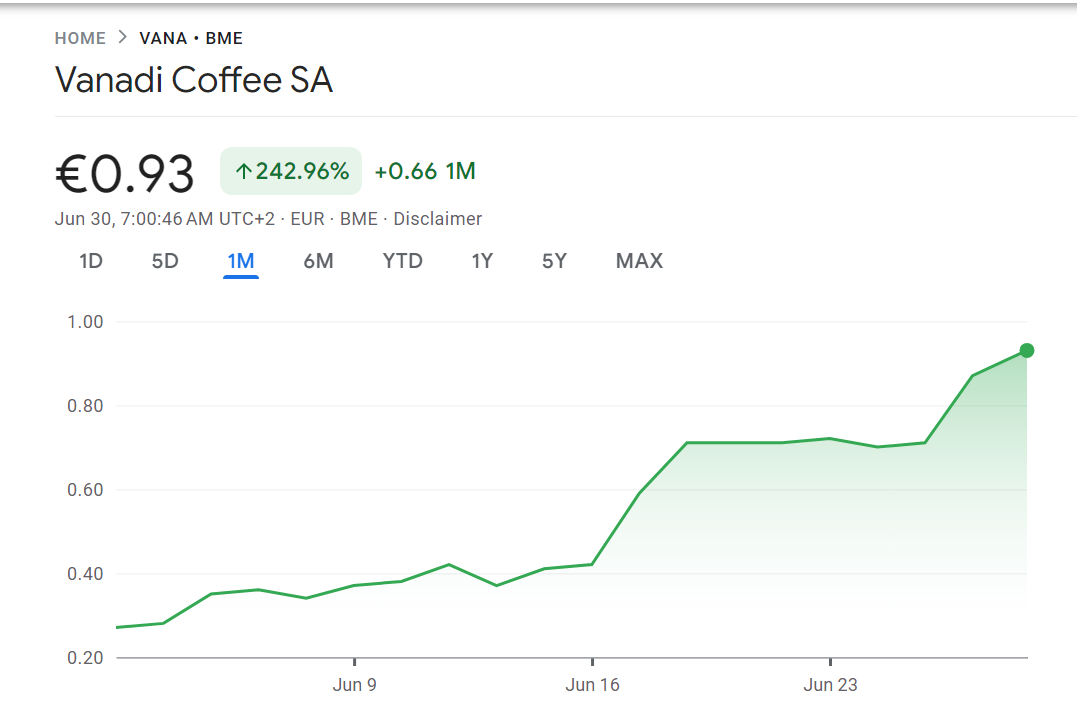

Vanadi Coffee stock surges 242% in a month, shareholders approve plan to establish $1.1b Bitcoin treasury

Struggling Spanish cafe Vanadi Coffee stock skyrocketed more than triple its initial value after shareholders of the firm approved a plan to invest up to 1 billion euros into its Bitcoin treasury.

According to a translated press release, on June 29, shareholders of Vanadi Coffee approved the company’s change in strategy to acquire more Bitcoin (BTC) on its balance sheet. The publicly-listed chain that currently operates six cafes based only in Alicante, now aims to become the largest Spanish company with a Bitcoin treasury.

At the time of writing, it currently holds the title of being Spain’s first publicly-listed Bitcoin treasury company. The company has reportedly been in a slump since 2024, when it revealed losses of 3.3 million euros, 15.8% more compared to its performance in 2023.

Soon after announcing its new BTC strategy, a recent notice indicated that the firm had recently added 20 BTC or equal to $2.16 million to its reserves. The firm’s latest purchase brought its total Bitcoin holdings to 54 BTC as of June 30. The amount is equal to more than $5.8 million.

News of the shareholder meeting’s pro-Bitcoin result boosted confidence in the Vanadi Coffee stock. In the past month, the Vanadi Coffee stock saw a meteoric rise of up to 242.96% following its mass acquisition of Bitcoin throughout the month of June. Shortly after the press release was published, the Vanadi Coffee stock saw another boost to its stock of 6.62%, rising from

Since April 2024, Vanadi Coffee has adopted several financial strategies to support its Bitcoin strategy, which involvws investing more of its corporate capital into BTC. Now, it plans to use Bitcoin as a strategic store of value in its new business model.

“Vanadi Coffee is redefining its business model by using Bitcoin as its primary reserve asset, and will accumulate significant amounts of Bitcoin as part of its treasury management,” wrote the company in its press release.

The company claimed that it was inspired by overseas companies like Strategy or Metaplanet, which have made major leaps in implementing a corporate Bitcoin treasury strategy. Many other companies have followed suit by making similar moves.

Previously, other European companies like Norway’s Green Minerals, the Smarter Web Company in the U.K., and The Blockchain Group have begun accelerating their efforts to raise large amounts of capital to buy more Bitcoin.

You May Also Like

Galaxy Digital’s 2025 Loss: SOL Bear Market

FCA, crackdown on crypto