Bitcoin Mining Profitability Crushed as Costs Explode

This article was first published by The Bit Journal.

Bitcoin miners are facing a cold and hard new reality as the cost to mine one BTC is surging higher with some public listed miners stating their total All-in cost is approximately $137,800, cash cost going for $74,600.

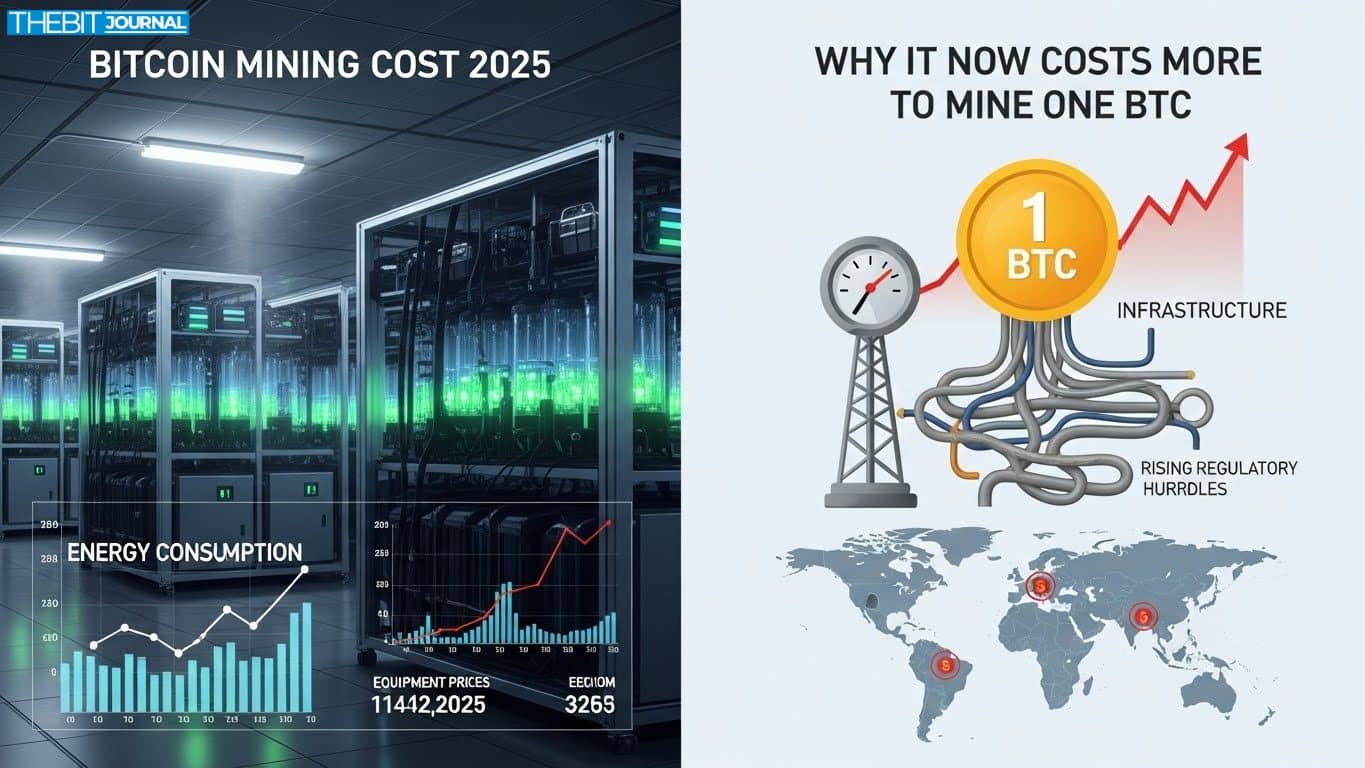

The high costs come from the 2024 Bitcoin halving, increasing energy prices and a rising network difficulty, squeezing miner profitability, particularly among smaller operators or those with inefficient rigs.

This cost pressure is now changing business models in mining, with large publicly listed miners adjusting their entire approach and some shunning pure BTC production altogether.

Expenditure For Mining Fees Q2 2025: The New Reality

Average cash cost to create one Bitcoin, published in Q4 of 2025 via CoinShares was $74,600 for Q2 2025 among listed miners. When non-cash expenses like depreciation and stock-based compensation are factored in, the overall cost per BTC skyrockets to roughly $137,800.

This rapid rise is a sharp increase compared to previous quarters. CoinShares noted the all-in per-BTC cost was approximately $137,018 in Q4 2024.

By mid-2025, that number had become more acute even as market conditions tightened and transaction fees dropped while energy costs increased.

Bitcoin Mining Cost 2025: Why It Now Costs $137,800 to Mine One BTC

Bitcoin Mining Cost 2025: Why It Now Costs $137,800 to Mine One BTC

According to the Q4-2025 report, transaction fees that were once relied on by miners as a topping of funds available from block rewards fell below 1% for May and June, reaching a record low.

This data shows a number of miners are already making Bitcoin at prices below the cost that it takes to provide them, with BTC production price or block reward falling against their profit, forcing margins and long-term prospects.

Drivers of the Surge

Energy is still the number one cost for miners. Utilizing the changes in electricity rates, rising demands on grids and competition for energy resources have led to values per hash increasing, especially to miners outside of low-cost energy zones.

The 2024 Bitcoin halving was a void in block rewards, but miners now must produce approximately double the amount of blocks for the same BTC output. With revenues per block falling, per-BTC costs soared, particularly among miners employing older or less efficient hardware.

2025 brought on a rapid rise of the global Bitcoin network hash rate, driving mining difficulty to record or near-record levels. As difficulty increases, so does the amount of power and computer work it takes to mine a BTC, which increases costs.

There’s been substantial spending for public miners on new hardware, datacenter expansion, cooling systems, and other types of infrastructure. Depreciation, maintenance, and non-cash compensation (stock-based) all shoot up the total per-BTC cost, combining to create a steep $137,800 all-in number.

While transaction fees at one point boosted miners’ revenue, mid-2025 saw fees as 1% or even below; they are no longer any type of hedge for miners.

Together, these forces have squeezed miner margins, particularly for less efficient operators or those with higher energy costs.

How Miners Are Responding

Many miners are reassessing their options in the face of shrinking profitability. CoinShares reported that a notable chunk of publicly listed miners are diversifying, moving infrastructure to support high-performance computing (HPC) or AI workloads instead of staying single-stranded in Bitcoin mining.

This trend can be seen through various industry movements such as companies expanding in AI datacenters or colocation deals, where rack space originally meant for mining now serves AI or HPC customers.

Bitcoin Mining Cost 2025: Why It Now Costs $137,800 to Mine One BTC

Bitcoin Mining Cost 2025: Why It Now Costs $137,800 to Mine One BTC

Others are searching for ways to cut energy costs, moving to areas that have cheaper electricity or switching to more efficient mining rigs. Yet smaller miners, or those using older equipment, come under greater pressure, with many going out of business, consolidating, and being bought by larger players.

Conclusion

As of Q2 2025, the marginal cost to produce one Bitcoin skyrocketed: cash cost at approximately $74,600 and all-in cost, which includes depreciation and other non-cash expenses, close to $137,800.

These increased costs include a number of factors: increasing energy prices, intensified hash rate competition, infrastructure amortization, post-halving economics as well as low transaction fee revenue.

The data indicates that miners are fleeing to AI/HPC workloads or to regions with cheaper electricity. For the wider Bitcoin economy, this could potentially lead to supply-side tightening, industry consolidation and a change in the face of those who mine BTC.

Glossary

Costs in Cash per BTC – Actual out-of-pocket costs to mine one Bitcoin; depends on location and the miner’s efficiency.

All-in cost (All-in sustaining cost) – All of the costs associated with creating one BTC, including cash costs and non-cash expenses (like depreciation, stock-based compensation and infrastructure amortization).

Hash rate – The combined computational power that is being utilized in the Bitcoin network to mine and secure blocks.

Network difficulty – A health check on how difficult it is to mine Bitcoin (a balance that’s periodically adjusted to keep block time constant), but the higher the difficulty, the more energy and cost per BTC.

Transaction fees – Money that users pay to include their transactions into a block; bonus income for miners, but varies depending on network activity.

Frequently Asked Questions About Bitcoin Mining Cost 2025

Is Bitcoin mining still profitable in 2025?

It depends. Successful miners find cheap electricity and efficient mining hardware, maintain a low breakeven price for their Bitcoin mining efforts, and operate in geographically advantageous locations to mine (like places with cool temperatures). But for a lot of public miners, large all-in costs which are now close to or above $137,800 per BTC, eat into profit margins, and especially so when the price of BTC and/or transaction fees slump.

What caused the costs of mining to spike so drastically?

Costs spiked because it costs more for electricity now than before, network difficulty and hash rate have increased so much that the machines do not generate the same rewards when working correctly (due to faster than expected), depreciation of hardware and data center infrastructure rose as transaction processing was further away from halving.

Are all miners affected equally?

No, miners that operate at scale with efficient hardware and access to cheap power have better chances. Smaller miners, or ones with older rigs or steep power contracts, are looking at much tighter margins, if not outright losses.

What if a lot of miners go offline?

The network hash rate would be lower so the mining difficulty will decrease gradually, making it profitable for miners who remain. But new BTC supply coming onto the market in the short-term might slow, affecting Bitcoin’s issuance dynamics.

Is Bitcoin mining dead?

Not necessarily. The industry is changing. A lot of miners are transitioning to AI/HPC jobs and energy-efficient workloads. Small miners might struggle, but big, well-capitalized operators may continue to survive.

References

CoinShares

Benzinga

Phemex

Coindesk

AInvest

Beincrypto

Read More: Bitcoin Mining Profitability Crushed as Costs Explode">Bitcoin Mining Profitability Crushed as Costs Explode

You May Also Like

Today’s Wordle #1630 Hints And Answer For Friday, December 5

The Economics of Self-Isolation: A Game-Theoretic Analysis of Contagion in a Free Economy