Solana Rises as the #1 Payments Network with 402x Growth

Solana Experiences Record-Breaking Week in x402 Payments

Solana has achieved its most significant weekly activity to date, with daily payment volumes soaring to approximately $380,000 on November 30. This milestone represents an impressive 750% increase compared to the previous week, underscoring the rapid adoption of the x402 protocol for machine-driven micropayments on the blockchain.

The surge in x402 usage positions Solana as the leading network by dollar volume for such transactions. This shift highlights how AI-powered payment systems are moving from experimental phases to real-world on-chain activity. The x402 protocol, built around the HTTP 402 “Payment Required” standard, enables APIs, applications, and AI agents to conduct gasless USDC transfers seamlessly, all under the hood of high-throughput, low-cost networks like Solana.

This week’s activity marks a pivotal moment, as stablecoin transactions via x402 are now flowing through facilitators at rates indicative of genuine service usage rather than speculative trading or artificial inflation. Unlike wash trading or airdrop farming, bot activity on Solana is increasingly focused on executing tangible services, making these transactions substantially harder to fake or manipulate.

Source: SolanaWhile the overall numbers remain modest compared to decentralized finance (DeFi) and trading volumes, the data signals a shift toward genuine on-chain usage, with real customers settling recurring payments through Solana. The protocol’s utility extends beyond speculative trading, as developers and service providers leverage x402 for backend operations, AI integrations, and API requests.

For example, Coinbase is exploring x402 for AI and API payments, enabling high-frequency, gasless USDC transfers. Such developments reinforce Solana’s position as a network optimized for micropayments, thanks to its high throughput and low fees. The growing ecosystem includes partnerships with entities like Kalshi, a prediction market platform, which aims to push more stablecoin and flow activity through the network.

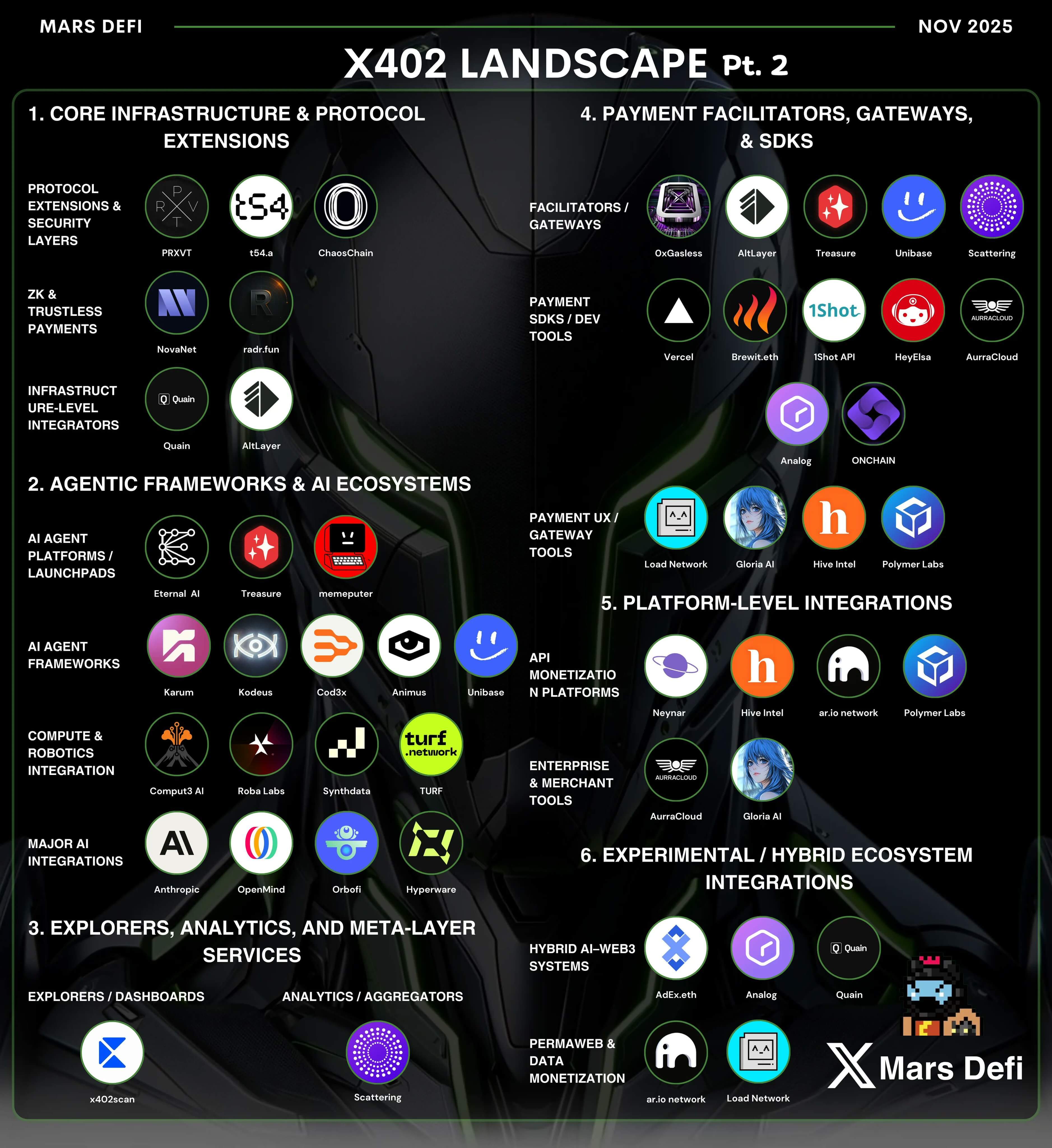

Source: Mars DeFi

Source: Mars DeFi

DeFi researcher Mars DeFi emphasizes that x402 is no longer a niche technology, but a burgeoning component of the broader Web3 infrastructure. Its adoption across various projects—from privacy enhancements to autonomous agent frameworks—illustrates its potential to unlock new revenue streams previously limited to subscription and credit-based models.

Should this trend continue, Solana’s proliferation of x402 traffic could evolve into a stable source of demand for blockspace and USDC liquidity. As layer 1 blockchains compete for a share of the emerging agent-economy, Solana’s recent activity suggests a fundamental shift toward real-world utility within the protocol’s ecosystem.

This article was originally published as Solana Rises as the #1 Payments Network with 402x Growth on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

What Does Market Cap Really Mean in Crypto — and Why Australians Care

Fed forecasts only one rate cut in 2026, a more conservative outlook than expected