XRP and BNB Could Rally, Yet Ozak AI Forecast Suggests a Far Bigger Upside

The post XRP and BNB Could Rally, Yet Ozak AI Forecast Suggests a Far Bigger Upside appeared first on Coinpedia Fintech News

XRP and BNB are both flashing strong bullish setups as the broader crypto market regains momentum heading into 2025. XRP’s payments-focused ecosystem and BNB’s deep exchange-driven utility continue to anchor their positions among the most reliable large-cap assets. Both are showing signs of sustained growth as adoption expands and liquidity increases.

Yet even with these solid trajectories, analysts say Ozak AI could deliver a much larger upside, given its early-stage valuation, AI-native infrastructure, and rapidly accelerating presale momentum. While XRP and BNB may deliver steady, double-digit returns, Ozak AI’s structure suggests a potential 50x–100x move, making it one of the most explosive projects in the coming market cycle.

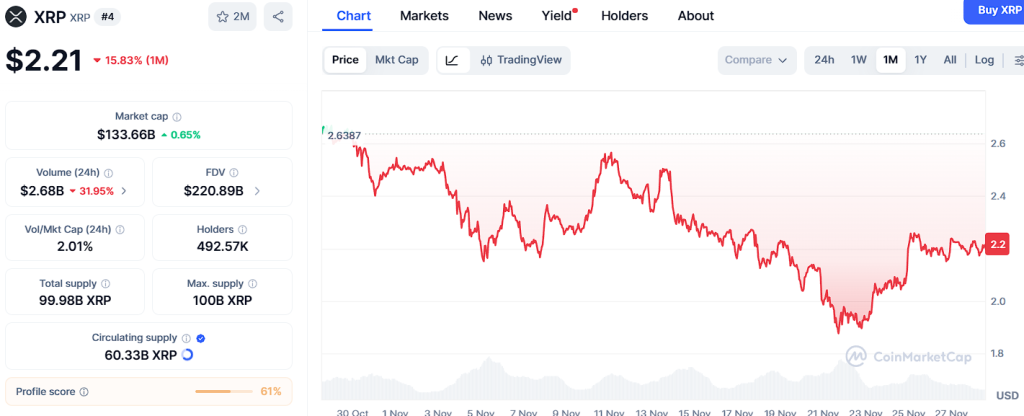

XRP Builds Toward Its Next Breakout Phase

XRP, trading around $2.21, remains one of the most solid large-cap performers, supported by way of robust institutional self-belief and developing cross-border fee adoption. XRP continues to find regular shopping for pastimes near the support at $2.12, $2.04, and $1.97, wherein long-term traders commonly acquire throughout consolidation phases. These zones beef up XRP’s bullish basis and mirror the underlying optimism for its use in financial settlements and banking infrastructure.

To cause its subsequent breakout, XRP has to clear resistance at $2.28, $2.36, and $2.47. These ranges have historically preceded strong rallies whenever XRP enters a high-liquidity section. With regulatory clarity improving and institutional partnerships expanding, analysts expect XRP to push better, doubtlessly concentrated on the lengthy-mentioned $5 mark. However, its mature valuation makes triple-digit multipliers fantastically not going, especially as compared to advanced-level projects like Ozak AI.

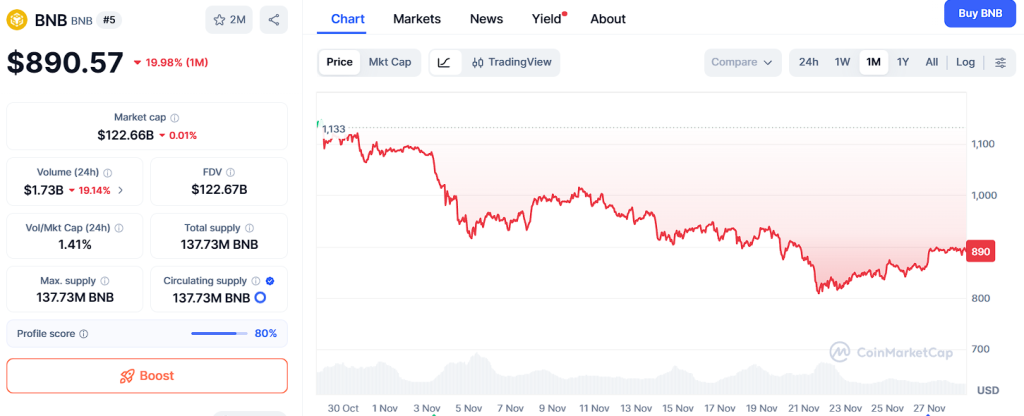

BNB Retains Strong Utility-Driven Growth Potential

BNB, trading near $887.61, continues to demonstrate strong technical resilience backed by its massive ecosystem utility within the Binance network. BNB remains supported at $867, $832, and $792, key levels that repeatedly attract accumulation during dips. These support zones create a strong technical floor for BNB’s ongoing uptrend.

For BNB to extend into a new rally, it must surpass resistance at $915, $958, and $1,003, levels that historically trigger multi-week expansions across the Binance Chain and DeFi activity. With Binance continuing to innovate in staking, launchpads, and cross-chain liquidity, BNB maintains a stable growth path. However, as one of the largest crypto assets, its ROI potential is more limited compared to smaller, early-stage projects.

Youtube embed:

How Much Will Ozak AI Grow By 2027? $OZ Overview

Ozak AI Emerges as the Top High-ROI Project

While XRP and BNB maintain steady bullish outlooks, Ozak AI (OZ) is emerging as the standout token capable of delivering exponential returns. Ozak AI merges AI and blockchain in a way that transforms how intelligence is applied across decentralized systems—offering real, scalable use cases that go beyond speculation.

Its advanced ecosystem features:

• Millisecond-speed AI prediction agents for real-time market analysis

• Cross-chain intelligence engines tracking multiple blockchains simultaneously

• Ultra-fast 30 ms market signals through a partnership with HIVE

• Distributed AI computation powered by Perceptron Network’s 700,000+ active nodes

• SINT-integrated autonomous AI agents that enable automated, voice-driven execution

These core features establish Ozak AI as a foundational intelligence layer for Web3, providing infrastructure for traders, bots, analytics systems, and AI-enhanced decentralized applications.

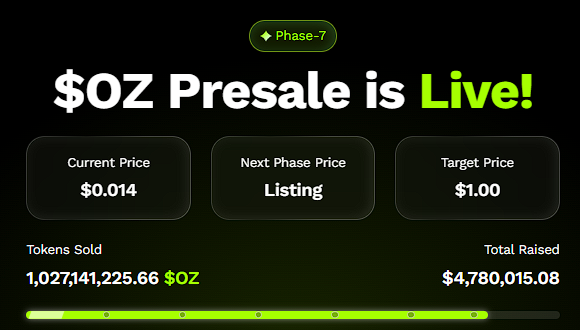

Massive Presale Momentum Signals Explosive Growth Ahead

The Ozak AI presale has already raised over $4.7 million and sold more than 1 million tokens, showing surging demand from early investors. Analysts note that this trajectory closely resembles the early stages of past cycle leaders that later achieved 50x–100x gains after listing. The combination of real utility, AI integration, and low initial valuation positions Ozak AI as one of the most promising early-stage projects in crypto today.

XRP and BNB remain two of the market’s strongest performers, supported by deep liquidity, institutional trust, and clear real-world utility. Both are likely to deliver steady, sustainable growth as the next bull cycle accelerates.

But Ozak AI’s forecast stands apart, driven by cutting-edge AI technology, low-cap entry, and massive early demand. With its utility expanding rapidly across Web3 intelligence systems, Ozak AI is increasingly viewed as the top high-ROI opportunity—offering a realistic path to 100x potential, far surpassing even the bullish projections for XRP and BNB.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse