From former allies to tit-for-tat, data reveals the essence of the "civil war" between Pump.fun and Raydium

Author: Frank, PANews

In the Solana ecosystem, a "civil war" involving hundreds of millions of dollars in transaction volume is unfolding. Pump.fun and Raydium, two platforms that once depended on each other, are now in a competitive situation.

Through in-depth analysis of Raydium pool data, PANews found that Pump.fun's impact on Raydium may far exceed market expectations. In the past year, relying on the popularity of Pump.fun, Raydium can be said to have achieved a win without any effort. And Pump.fun's launch of its own decentralized exchange PumpSwap has undoubtedly cut off Raydium's biggest source of income.

In the context of the overall cooling of the MEME market, is this "civil war" just a meaningless internal consumption? PANews will reveal the nature of this fight through data analysis and explore its impact on the Solana ecosystem and the entire MEME market.

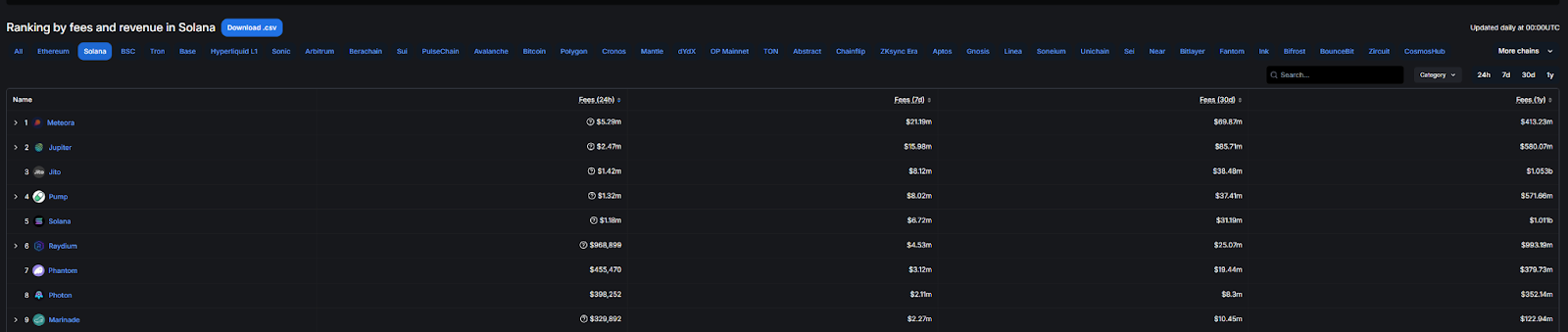

Data Perspective: Pump.fun Tokens Occupy Half of Raydium

When Pump.fun announced the launch of its own DEX, PumpSwap, in early March, the market generally believed that this would have a certain impact on Raydium, but few people realized the severity of this impact. PANews analyzed about 250,000 trading pairs in Raydium AMM and CLMM pools, perhaps to get a glimpse of the true relationship between Pump.fun and Raydium and their future possibilities.

In Raydium's AMM pools, the tokens generated by Pump.fun account for as much as 43.96%. Specifically, among the 216,000 AMM pools, 95,000 pools contain Pump.fun tokens. The total TVL of these Pump.fun token pools reached US$726 million, accounting for 50.79% of the total TVL of AMM. Even if the CLMM pool is included in the calculation, the overall share of Pump.fun tokens in all Raydium pools is still as high as 43.68%.

This means that Pump.fun contributes nearly half of Raydium's transaction volume and revenue. PANews estimates that Pump.fun brings Raydium an annual revenue of tens of millions of dollars. When Pump.fun announced the launch of PumpSwap, the price of RAY tokens plummeted by 15% within 24 hours. The market's reaction to the news confirmed the importance of Pump.fun to Raydium.

The launch of PumpSwap poses a direct threat to Raydium in three main aspects: first, the zero migration fee (compared to Raydium's 6 SOL) greatly reduces the cost of user migration; second, the instant migration function simplifies the process from token launch to trading; finally, the improved liquidity and creator revenue sharing model are more friendly to token creators. These advantages may cause a large number of users to migrate from Raydium to PumpSwap, further exacerbating Raydium's revenue loss.

Raydium’s Counterattack: Can LaunchLab Turn the Tide?

Raydium did not sit idly by in the face of the threat of PumpSwap. In mid-March, Raydium announced that it was developing a token launch platform called LaunchLab as a direct competition to Pump.fun. Interestingly, Raydium had actually been developing LaunchLab for several months, but had previously shelved the project, perhaps because it did not want the team to feel that Raydium was directly competing with Pump.fun. Obviously, the launch of PumpSwap broke this concern. On March 26, Raydium said it would officially launch LaunchLab within a week.

According to reports, LaunchLab plans to provide a number of innovative features, including linear, exponential, and logarithmic bonding curves to adjust token prices based on demand; allow third-party UIs to set their own fees; support multiple quote tokens in addition to SOL; and integrate with Raydium's liquidity provider locker. These features are designed to provide token creators with more flexibility and control to compete with Pump.fun.

However, it remains unknown whether LaunchLab can save the huge revenue loss faced by Raydium. First, Pump.fun has established a strong brand recognition and user base in the field of memecoin launches; second, PumpSwap's zero migration fee and instant migration function have provided users with significant cost and convenience advantages; finally, Raydium needs to complete the development and promotion of LaunchLab in a short period of time, which is a huge challenge in itself.

From a strategic perspective, Raydium emphasized that LaunchLab is not intended to replace Pump.fun, but to provide an alternative for teams that do not want to develop their own programs from scratch. This statement may be to avoid direct confrontation with Pump.fun, but in fact, the launch of LaunchLab is undoubtedly a strategic response to the threat of PumpSwap.

MEME market cools down: Is the civil war just a waste of time?

Behind the "civil war" between Pump.fun and Raydium, the bigger background is the cooling trend of the overall MEME market. At the beginning of 2025, the meme coin market showed a change from Solana's dominance to multi-chain competition, but the market heat has obviously declined.

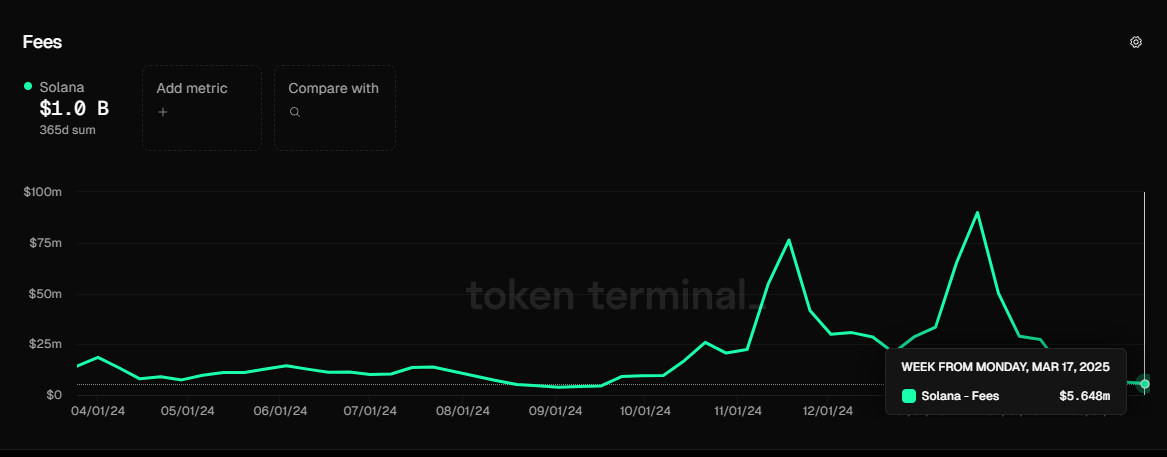

Solana’s on-chain fees dropped from a weekly peak of $89.91 million in January 2025 to $5.64 million on March 17, a drop of approximately 93.7%.

In addition, DEX trading volume has also experienced a cliff-like decline. On March 27, Solana's DEX trading volume was about 1.38 billion US dollars, which was only 3.8% of the high of 35.8 billion US dollars in January. From a macro-cyclical perspective, the current trading volume seems to have returned to the same period in 2024.

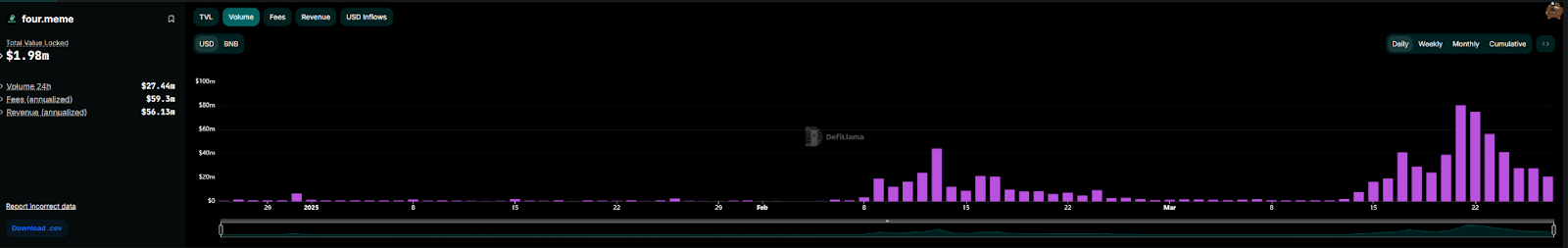

Several other competing public chains have also experienced a downturn. The daily transaction volume of the Base chain has now dropped to $369 million, down 86% from January. The BSC chain has created a short-term peak thanks to the orders of top Vs such as CZ. Although the current daily transaction volume remains above $1 billion, it is also much lower than the peak of 8.4 billion in January.

Four.meme, which is popular on the BSC chain, has also experienced a significant decline recently after a brief peak. On March 27, the transaction volume of Four.meme was only 20 million US dollars, a 75% decrease from the peak of 80 million US dollars on March 21.

According to PANews' observation, several professional Rug robots on Pump.fun have also been shut down recently. When the sickle is no longer profitable, the market seems to have really entered a cold winter period.

In this context, the "civil war" between Pump.fun and Raydium is likely to be just a meaningless internal consumption. The two sides are competing for a shrinking market, not a continuously growing blue ocean. Without real innovation and practical value, this competition may only accelerate the cooling of the market and the division of the Solana ecosystem.

The transformation of the relationship between Pump.fun and Raydium from cooperation to competition reveals the deep contradictions in the Solana ecosystem. Although data analysis shows that the launch of PumpSwap may cause Raydium to lose nearly half of the new token market in the future, it should be noted that data can only illustrate history, but cannot truly predict the future. As the market shrinks, Pump.fun may not have the ability to give Raydium a transfusion. The launch of PumpSwap is more like a helpless act of self-protection.

For investors, while paying attention to the competition between Pump.fun, Raydium or Four.meme, they should be more alert to the overall cooling trend of the MEME market to avoid becoming the "last leek" in this "civil war". The future market trend is still unclear, but patience is always the most core technology to cross the cycle.

You May Also Like

SEC Approves Generic ETF Standards for Digital Assets Market

MemeCon 2025: A Gala Night for Web3 Culture & Creativity in Singapore