Data inflation? How can Polymarket be valued at tens of billions?

A recent research paper from Columbia University has embroiled the trending topic of "prediction markets" in controversy.

The authors analyzed two years of historical data from the blockchain platform Polymarket and found that approximately 25% of the trading volume may have been wash trading—that is, the same entity buying and selling between its own accounts to create false activity. During certain event weeks, such as the US presidential election or a major sporting event, this percentage could even surge to 60%.

Although the study has not undergone formal peer review, it is enough to pierce through a corner of the frenzy surrounding prediction markets. Because in the past six months, the popularity of this sector has been almost "visible to the naked eye": relaxed regulations, backing from giants, a surge in capital, and increased political support—prediction markets are becoming the most watched "new financial species" in 2025.

From "fringe gambling" to "new financial species"

The prediction market is not complicated to play: you can bet on events such as "whether Trump will win the election", "whether the Federal Reserve will cut interest rates", and "which country the next Nobel Prize winner will be from". The platform forms a "market probability" based on the prices of the two parties, which is regarded as a manifestation of "collective intelligence".

In 2025, this "voting with money" method ushered in a triple opportunity for explosive growth:

Deregulation

In May of this year, the U.S. Commodity Futures Trading Commission (CFTC) withdrew its lawsuit against Kalshi, formally acknowledging that forecasting contracts can be legally traded under certain frameworks.

In September, the CFTC issued a No-Action Letter to Polymarket, allowing it to reopen the U.S. market.

This means that the forecasting market is moving from a "gray area" to "regulatory visibility," clearing the biggest obstacle for capital intervention.

Capital + Political Bets

Immediately afterwards, funds poured in:

In August, Polymarket received investment from 1789 Capital, in which Donald Trump Jr., Trump's eldest son, holds a stake.

Then, following ICE, the parent company of the New York Stock Exchange, investing $2 billion in September to boost Polymarket's valuation to $8 billion, and rival Kalshi's valuation reaching $5 billion in October with a lead investment from a16z and Sequoia Capital, market enthusiasm continues to rise sharply.

According to the latest news from Bloomberg, Polymarket is seeking a new round of financing with a higher valuation of $12 billion to $15 billion, while Kalshi's valuation is believed to have exceeded $10 billion.

Behind this frenzy of capital investment, the deep involvement of political forces cannot be ignored.

The "market-friendly" regulatory environment fostered by the Trump administration paved the way for predicting a market boom. The CFTC's shift in attitude and ICE's massive investments were interpreted by the market as clear policy signals.

Even more noteworthy is the Trump family's direct involvement: Donald Trump Jr. not only invested in Polymarket through 1789 Capital, but also served as an advisor to Kalshi.

ICE CEO Jeff Sprecher—who is also the husband of former U.S. Small Business Administration Commissioner Kelly Loeffler—personally spearheaded the investment in Polymarket;

Meanwhile, Trump's social media platform Truth Social also announced the launch of its own encrypted prediction platform, "Truth Predict".

The combined forces of capital, policy, and family influence are propelling prediction markets from fringe experimentation to the mainstream financial stage.

Giants drive mainstream adoption

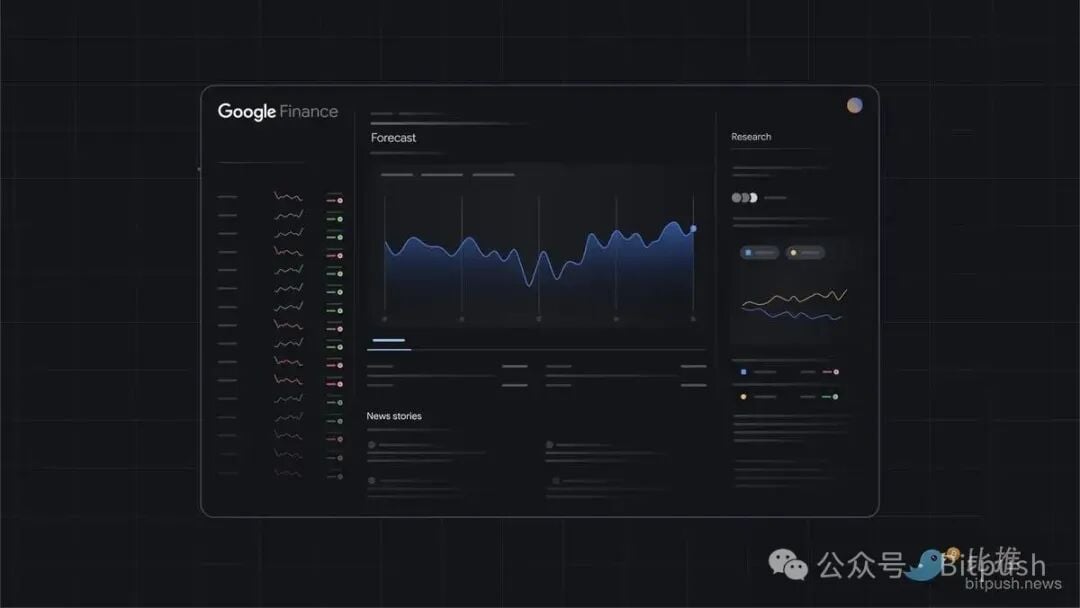

In October, Google announced that it would integrate real-time forecast data from Polymarket and Kalshi into Google Finance search results. For example, when users search for "who will be president in 2028" or "probability of a Fed rate cut", a real-time data chart of the forecast market will appear below the results.

This means that, for the first time, the prediction market has been "embedded" into the world's largest information portal, becoming part of the public information flow.

This means that, for the first time, the prediction market has been "embedded" into the world's largest information portal, becoming part of the public information flow.

Google did not disclose the specific cooperation model with the two companies, but for the market, this move can be regarded as a "mainstream milestone": the prediction market has changed from a "betting tool for cryptocurrency players" to a data product that is visible to ordinary users and can be cited by the media.

The results are clear: Polymarket's trading volume hit a record high in October, with monthly trading volume exceeding $3 billion, and the number of users increased by 93.7% compared to September.

How serious is the "fake transaction" that Columbia University is questioning?

Returning to the research data from the Columbia University paper: Approximately a quarter of Polymarket's transactions between 2024 and 2025 exhibited suspicious patterns: frequent wash trades between accounts, extremely short transaction intervals, and almost no holding settlements. These characteristics are remarkably similar to the "volume-boosting" practices prevalent in the past NFT market.

The report authors speculate that there are three main motivations for market-predicting wash trading:

① To compete for future token airdrops or incentive points;

② To generate market buzz and attract new users;

③ Some market makers stabilize the price range by creating "fake transactions".

In other words, some people might repeatedly place "fake orders" in the market to boost activity levels, accumulate points, and obtain future token rewards. This is not uncommon in the crypto space: from NFTs to DeFi, almost every round of innovation has been accompanied by "data manipulation," but even so, the "water" in prediction markets is not the highest in the industry. For comparison:

In the early days, unregulated Bitcoin exchanges had over 70% of their trading volume being fake (according to a 2019 report by Bitwise).

In the NFT market, during periods of market boom, the proportion of washing trading ranged from 20% to 50%.

In comparison, Polymarket's average of 25% is considered "moderately high." Furthermore, Kalshi has stronger compliance and stricter KYC procedures, making the overall "authenticity" of the industry far surpass that of the early days of the cryptocurrency market. Therefore, from an industry perspective, the "inflated" prediction market is not a catastrophic problem.

In addition, differing opinions have emerged within the industry regarding the conclusions of the Columbia University study.

Former AWS engineer yassinelanda.eth offered several rebuttals after reviewing the paper.

He argues that the study has methodological limitations—its conclusions are based on a single on-chain data model, while platforms like Polymarket actually possess more complex signaling systems to identify genuine users and distribute rewards fairly. Furthermore, the study's conclusions are highly sensitive to the parameters set during analysis, and the severity of the problems it reveals may not be consistent.

He further pointed out a key characteristic of prediction markets: in this field, valuable signals are far more important than raw trading volume. Simply engaging in a "left-hand to right-hand" volume-boosting cycle cannot generate genuine profit (PNL). Today, advanced on-chain monitoring and recommendation systems can effectively distinguish between informed, genuine trading flows and market noise from market makers, bots, and self-traded transactions, and reduce the weight of the latter in recommendations and rewards.

In his view, the core criterion for judging a prediction market should not be the easily manipulated surface data of "total trading volume," but rather:

Prediction accuracy: How accurate are the market results?

Calibration degree: Whether the predicted probability matches the actual frequency of occurrence.

Bid-ask spreads and market depth: How good is market liquidity and how high are transaction costs?

Slippage during news events: Whether prices react quickly and smoothly to new information, rather than fluctuating wildly.

These indicators of market quality and information efficiency are the true core of measuring the value of the forecasting market.

Gambling fever resurgence: When "betting" becomes the prevailing sentiment of the times

As observed by Lydia Grant, a sociologist at the University of Chicago, "Prediction markets, in a sense, perpetuate the American belief system—allowing people to gain a false sense of control through the act of 'betting' amidst great uncertainty."

This statement accurately captures the pulse of American society today. Faced with high inflation, political polarization, and class stratification, a "gambler's mentality" is quietly becoming a common outlet for emotions. From sports betting to cryptocurrencies, and now to prediction markets, more and more Americans are entrusting their fate to probability and releasing their anxieties through betting odds.

When Wall Street giants also get involved, this trend gains both capital and institutional validation. The massive investments by institutions like ICE indicate that the mainstream financial world is viewing prediction markets as the infrastructure for next-generation "event-driven" risk pricing, rather than just a peripheral gambling game.

As SynFutures CEO Rachel Lin points out, "The real value of the prediction market lies in its ability to quantify things that traditional finance cannot price, such as policy decisions, technological breakthroughs, and geopolitical risks."

Meanwhile, Polymarket's launch of the POLY token and other initiatives have injected new momentum into the ecosystem's development. Research firm Delphi Digital believes that future predictive "terminals" integrating multi-market data and AI analysis could very well usher in a new trading arena similar to the Meme coin craze.

Of course, challenges remain. U.S. regulators are still debating the definition of "derivatives" versus "gambling," and this lingering policy cloud remains the final hurdle in predicting the market's full mainstream adoption.

However, the convergence of capital, technology, and social sentiment is irreversible. People think they are predicting the future, but they don't realize that this nationwide gamble has become the most accurate reflection of our times.

You May Also Like

What Does Market Cap Really Mean in Crypto — and Why Australians Care

Fed forecasts only one rate cut in 2026, a more conservative outlook than expected