Crypto Goes Mainstream in 2025 as Stablecoins and Institutions Lead Global Adoption: Report

The State of Crypto 2025 report shows crypto’s maturity as stablecoins, institutions, and blockchain infrastructure drive global adoption.

The year 2025 marks a defining moment for digital assets, as crypto moves from the fringes of finance into the global mainstream. According to the State of Crypto 2025 report by a16z, the total market capitalization has surpassed $4 trillion for the first time.

Major financial and technology firms now offer crypto services, expanding access to millions of users worldwide. Stablecoins have evolved into a key part of the on-chain economy, powering trillions in annual transactions.

Together, these trends confirm that the world has finally come on-chain.

Institutional Adoption Accelerates

Traditional finance’s embrace of crypto has reshaped the industry’s trajectory.

Major players such as BlackRock, Fidelity, Visa, and JPMorgan Chase have rolled out crypto products, allowing clients to trade or hold digital assets alongside traditional instruments.

Fintech giants like PayPal, Stripe, and Robinhood are also building blockchain-based payment systems to bring everyday transactions onchain.

Some of the largest financial institutions are embracing crypto, Source- a16z

Some of the largest financial institutions are embracing crypto, Source- a16z

The report notes that institutional participation has intensified through exchange-traded products (ETPs), which now hold over $175 billion in Bitcoin and Ethereum.

BlackRock’s iShares Bitcoin Trust became one of the most traded ETP launches in history, while Ethereum-based offerings have drawn steady inflows in recent months. These vehicles have unlocked new institutional capital that had remained sidelined due to regulatory uncertainty.

Legislative progress has also encouraged adoption.

The bipartisan GENIUS Act and the CLARITY Act have provided a clear framework for stablecoins and market structure, giving financial firms confidence to deepen their crypto involvement. This clarity has accelerated the creation of new crypto-linked financial services, from digital treasuries to blockchain-native funds.

Stablecoins Emerge as the Backbone of the Onchain Economy

Stablecoins have transitioned from niche trading tools to essential components of global finance. The State of Crypto 2025 report records $46 trillion in stablecoin transaction volume over the past year, rivaling established payment networks like Visa and ACH.

Adjusted figures, which filter out artificial activity, show $9 trillion in organic transactions, more than five times PayPal’s throughput.This growth highlights real-world adoption rather than speculation.

Monthly stablecoin volumes reached all-time highs in late 2025, with most activity occurring on Ethereum and Tron. Tether and USDC dominate the market, accounting for 87% of supply, yet new entrants and blockchains continue to gain traction.

Stablecoins now represent a macroeconomic force. Over 1% of all U.S. dollars exist as tokenized stablecoins, and issuers collectively hold more than $150 billion in U.S. Treasuries.

Analysts project the total market could expand tenfold to $3 trillion by 2030. Despite global shifts in reserve strategies, stablecoins are reinforcing U.S. dollar dominance across international markets.

The Onchain World Expands Beyond Finance

Beyond trading and payments, the on-chain economy has diversified into new sectors.

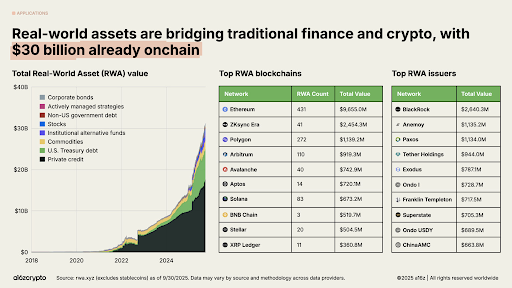

Real-world assets (RWAs) such as Treasuries, credit, and real estate are being tokenized, with a total market of about $30 billion, nearly quadruple that of two years ago. Decentralized infrastructure networks, or DePIN, are also gaining ground, powering telecommunications, energy, and transportation through blockchain coordination.

RWAs bridge traditional finance and crypto with $30B onchain, Source- a16z

RWAs bridge traditional finance and crypto with $30B onchain, Source- a16z

Decentralized exchanges now account for almost one-fifth of all spot trading, and perpetual futures platforms like Hyperliquid are processing trillions in annual trades. Meanwhile, prediction markets such as Polymarket and Kalshi have entered the mainstream, reflecting a broader shift toward decentralized finance tools.

These developments show crypto’s evolution from speculative markets to practical, high-utility ecosystems. They also reveal how blockchain applications are moving closer to everyday use cases, from commerce to governance.

AI, Infrastructure, and the Path Ahead

Rapid improvements in blockchain infrastructure have made this growth possible. Networks now process more than 3,400 transactions per second, a hundredfold increase from five years ago.

Solana has become a leading ecosystem, supporting DePIN projects and NFT platforms with $3 billion in annual revenue. Ethereum’s scaling via Layer 2 solutions has reduced transaction costs to fractions of a cent, expanding access for developers and users alike.

The convergence of crypto and AI is emerging as the next frontier. Decentralized identity systems are enabling “proof of human” verification, while crypto protocols power payment rails for autonomous AI agents.

With traditional computing becoming increasingly centralized, blockchains may serve as the balancing force, ensuring openness and transparency in the digital economy.

The State of Crypto 2025 report concludes that the industry has reached maturity. Institutional engagement, stablecoin adoption, and scalable blockchain infrastructure are transforming crypto into a foundational layer of global finance.

The post Crypto Goes Mainstream in 2025 as Stablecoins and Institutions Lead Global Adoption: Report appeared first on Live Bitcoin News.

You May Also Like

Tropical Storm Basyang expected to drench Caraga, Northern Mindanao

Hoskinson to Attend Senate Roundtable on Crypto Regulation