Norway Sees 30% Surge in Crypto Tax Reporting — $4B in Digital Assets Declared

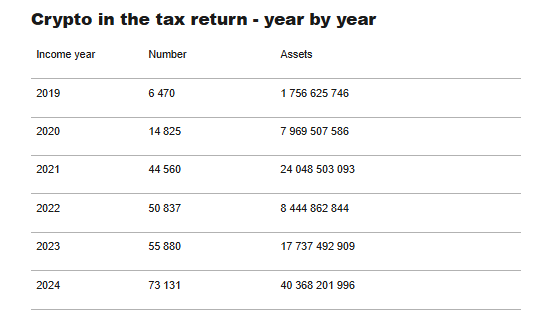

Norway has reported a sharp rise in cryptocurrency tax declarations, with more than 73,000 people disclosing digital asset holdings in their 2024 tax returns, a 30% increase from the previous year, according to new figures from the Norwegian Tax Administration (Skatteetaten).

The surge represents the largest year-on-year increase in crypto reporting since records began and signals growing transparency in the country’s digital asset market.

Source: Skatteetaten

Source: Skatteetaten

The total value of declared cryptocurrency holdings more than doubled to NOK 40.3 billion ($3.9 billion), the highest figure ever reported.

Sevenfold Growth in Crypto Declarations — What’s Behind Norway’s Tax Turnaround?

Tax Director Nina Schanke Funnemark said the increase reflects the success of recent measures aimed at encouraging voluntary compliance.

“It is gratifying that more people are reporting that they own cryptocurrency and in this way ensuring that the tax is correct,” she said. “We have taken several measures in recent years to increase this number, and we see that these measures are having an effect.”

In 2019, fewer than 10,000 Norwegians reported owning crypto assets. That number has now grown more than sevenfold.

The increase comes after the tax agency began sending out digital reminders, known as dults, to taxpayers who may own crypto or virtual assets but failed to declare them.

The latest data also reflects rising market prices throughout 2024, which significantly boosted the total declared value of digital holdings. Skatteetaten noted that crypto gains reached NOK 5.5 billion, while reported losses totaled NOK 2.9 billion for the same period.

Under Norwegian law, cryptocurrency is treated as a capital asset, not a currency, meaning that profits and losses from trading are subject to capital gains tax.

The current tax rate is a flat 22%, and the same rate applies to deductions for realized losses.

Gains are triggered when digital assets are sold, swapped, or used to pay for goods or services.

For example, if an investor sells 1 ETH that was purchased for 20,000 Norwegian kroner and sells it later for 50,000 kroner, the 30,000-kroner profit is taxed at 22%, resulting in a 6,600-kroner liability.

FIFO to Wealth Tax: How Norway Calculates and Enforces Crypto Obligations

The Norwegian system uses a First-In, First-Out (FIFO) method to calculate the cost basis of crypto sales, assuming the first coins bought are the first ones sold.

In addition to capital gains tax, crypto holders must declare their digital assets as part of their net wealth each year. Wealth above NOK 1.7 million is subject to Norway’s wealth tax, with rates that vary based on income and municipality.

Those earning from mining, staking, or airdrops must report such proceeds as regular income, which is taxed at a progressive rate depending on the taxpayer’s income level.

Norway’s crypto taxation system relies heavily on self-reporting, meaning individuals are responsible for disclosing their own crypto activity through Skatteetaten’s online portal.

Taxpayers must calculate their holdings, trades, and income in Norwegian kroner using the exchange rate on the transaction date. Failing to declare these assets can result in additional tax penalties or audits.

Funnemark said many first-time filers tend to report small sums, but authorities have also uncovered large undeclared amounts through audits.

Those who correct their declarations voluntarily can amend filings up to three years back to avoid penalties, provided the correction occurs before an official audit is initiated.

How Far Will Norway Go to Keep Crypto in Check?

The report added that from 2026, Norway’s oversight will expand further under new third-party reporting rules.

Exchanges and wallet providers operating in the country will be required to report user data directly to Skatteetaten, giving the tax authority more accurate insight into residents’ crypto activity.

“This is an important step towards more correct taxation of digital assets,” Tax Director Nina Schanke Funnemark said. “With this development, we will have a much better overview of who owns crypto assets, both in Norway and abroad.”

Taxes collected from cryptocurrency activity in Norway flow into the country’s general government revenue, helping to fund public infrastructure, education, healthcare, and social services.

Crypto-related tax income is treated no differently from that derived from stocks or other capital investments.

The latest rise in declarations coincides with a broader regulatory tightening in Norway’s digital asset sector.

In 2025, the government moved to align national law with the European Union’s Markets in Crypto-Assets (MiCA) regulation, introducing licensing requirements for crypto service providers and stronger consumer protection rules.

A temporary ban on new high-energy crypto mining projects was also announced in June, citing environmental concerns and energy conservation priorities.

Meanwhile, the government’s ethics watchdog, which oversees the $1.8 trillion Government Pension Fund Global, in 2024 said it was preparing to investigate crypto and gambling firms in its portfolio over money laundering risks.

The council’s findings could lead to divestment from some companies, reflecting Norway’s cautious but active approach to the crypto sector.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

XRP Price Targets $1.65 Next, But BTC Correction Could Push It Down First