Hong Kong’s Spot ETF & RWA Growth Boost Confidence: Is SOL Price Ready For New ATH?

The post Hong Kong’s Spot ETF & RWA Growth Boost Confidence: Is SOL Price Ready For New ATH? appeared first on Coinpedia Fintech News

The SOL price is in focus due to multiple reasons, with the most notable being its price action. An expert this week displayed that SOL/USD has once again approached its most reliable five-year ascending trendline after several weeks of steady decline.

According to the analyst, this region aligns with a long-term uptrend that has consistently defined Solana crypto’s broader growth trajectory.

Historically, every major touch point of this support line has triggered strong rebounds lasting months, including during the 2022 bear market and the FTX collapse.

At the time of writing, the SOL price today hovered near $189, down around 5% in the past 24 hours with a market capitalization of roughly $103.3 billion.

The area between $164 to $176 continues to act as a critical support zone, combining both diagonal and horizontal demand levels from prior trading ranges.

That said, if the Solana price chart confirms a bounce from this region, it could mark the end of the recent correction phase and potentially set the stage for a fresh upward cycle.

Hong Kong Approves First Solana Spot ETF

Apart from price action, another major reason for solana remaining in focus is a major institutional milestone, as Hong Kong has officially approved the world’s first Solana spot ETF, set to debut on October 27 on the Hong Kong Stock Exchange.

This is Offered by ChinaAMC, the ETF provides exposure through HKD, USD, and RMB trading counters. This is broadening accessibility for both regional and international investors.

The product directly holds SOL, backed by the CME CF Solana-USD index, and charges a management fee of around 2%.

This approval positions Hong Kong well ahead of the United States in offering regulated access to Solana crypto exposure.

Also, the Projections suggest potential inflows of $1 to 1.5 billion into Hong Kong-based altcoin ETFs during the first year, a development that could gradually reshape demand dynamics for SOL crypto.

Tokenized Assets and Stablecoin Growth Strengthen Solana Network

Beyond market structure and ETF products, its adoption is rising which is boosting its fame. Recently, the Solana’s on-chain fundamentals data shows that they remain strong, despite price declines or macro concerns.

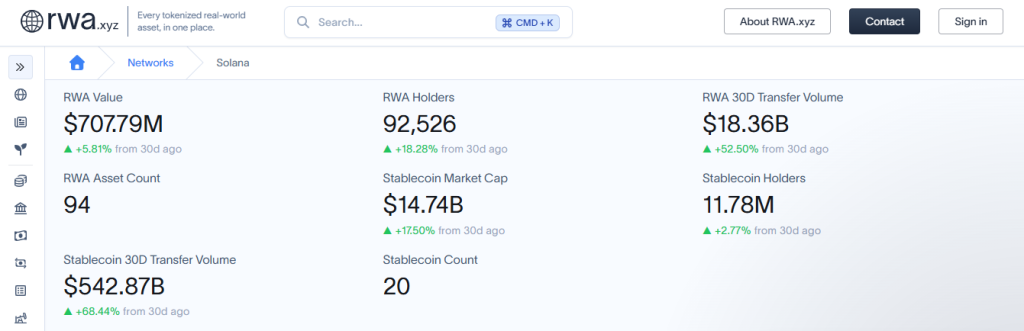

According to RWA.xyz, the total value of tokenized real-world assets (RWAs) on the Solana network climbed 5.81% over the past month to reach a record $707.79 million. It shows that Solana is acting as a hub for tokenization that’s effectively bridging traditional finance and blockchain ecosystems.

Moreover, the SOL price forecast 2025 here onwards gains incredible credibility from Solana’s unmatched throughput of 65,000 transactions per second.

More data highlights that RWA holders surged by 18.28% in the last 30 days, reaching 92,526, while the total number of tokenized projects now stands at 94, spanning real estate, treasury bills, and commodities.

Meanwhile, Solana’s stablecoin market cap rose 17.5% over the previous month to $14.74 billion, reflecting increased utility across trading, payments, and lending. Stablecoin transactions jumped 68.44% to $542.87 million.

These multiple factors increase hopes that the SOL price is set for a major rally this time, and accumulation builds near this historically reliable trendline; the SOL price USD could soon reflect renewed investor confidence.

You May Also Like

BFX Presale Raises $7.5M as Solana Holds $243 and Avalanche Eyes $1B Treasury — Best Cryptos to Buy in 2025

CME Group to Launch Solana and XRP Futures Options