Kinetiq unveils tokenomics and airdrop of the new KNTQ governance token

Kinetiq has unveiled the KNTQ governance token as it moves to formalise governance for its liquid staking products and ecosystem. The launch details were published alongside the project’s tokenomics and an airdrop schedule. It marks a formal step toward codifying how stakeholders will influence protocol parameters going forward.

What are the details of the Kinetiq token airdrop and KNTQ token distribution?

The project announced a public distribution that includes a 25% airdrop; remaining allocation details were summarised by the team and are available in the original report. See the initial report by The Defiant for full charts. In this context, the public drop is positioned as the principal vehicle for broadening community ownership.

The token has a maximum supply of 1 billion and an airdrop eligibility deadline of Nov 21 20:00 UTC. The team published a high-level split; full percentages include 30% for protocol growth and rewards, 25% to the initial airdrop (including 1% for Hypurr holders and 24% for kPoints holders), 23.5% to core contributors, 10% to the Kinetiq Foundation, 7.5% to investors and 4% to liquidity.

Who is eligible and how will the distribution work?

Eligibility rules target active users of the Hyperliquid ecosystem and early stakeholders; the claim process and on‑chain criteria are detailed in the project brief.

How does kinetiq liquid staking relate to hyperliquid layer one and hyperevm liquid staking?

Kinetiq positions itself as a liquid staking provider within the broader Hyperliquid layer one stack and integrates with Hyperevm liquid staking rails. The launch highlights cross‑protocol utility for governance and protocol parameters. The Kinetiq Foundation described the launch as “a formal governance layer for stakeholders” in its announcement, emphasising on‑chain proposal mechanics and multisig safeguards.

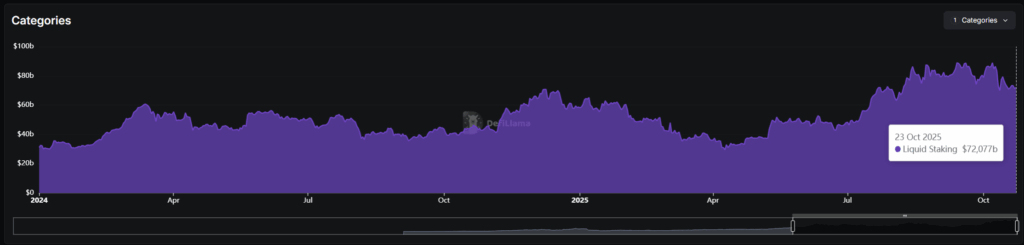

Liquid staking TVL remains a major context: the sector hit a record of $88B in September and sits at roughly ~$71B currently. Kinetiq reports TVL of > $1.6B across its pools.

Liquid staking TVL chart. Source: DefiLlama

Liquid staking TVL chart. Source: DefiLlama

Where does kHYPE and market liquidity fit?

The team pointed to related activity in the Hyperliquid ecosystem: kHYPE ranks 10th by TVL at $1.36B. Recent on‑chain flows showed $460M in 24h across 2,800 holders, averaging $164,280 per active holder; these figures were reported alongside the launch and illustrate the liquidity dynamics the governance rollout seeks to leverage.

What does the launch mean for holders and investors?

Founded in late 2024, Kinetiq raised $1.75M from investors active in the Hyperliquid ecosystem. The token governance model aims to give stakeholders voting rights and a role in protocol upgrades; in practice, governance tokens in liquid‑staking contexts can affect fee splits and reward routing, so clear vesting and timelocks are critical.

Note: this summary paraphrases the project’s release and The Defiant coverage; some allocation mechanics and claim steps should be reviewed in the primary announcement.

In brief: the KNTQ launch formalises governance for a liquid staking provider with >$1.6B TVL, a capped supply of 1 billion and a timed airdrop that closes on Nov 21 20:00 UTC. The move ties Kinetiq into the Hyperliquid layer one narrative and existing liquidity dynamics.

You May Also Like

SEC Approves Generic ETF Standards for Digital Assets Market

MemeCon 2025: A Gala Night for Web3 Culture & Creativity in Singapore