Best Crypto to Buy Now That XRP Whales Are Loading Up

Takeaways:

- XRP whale wallets hit an all-time high of 317,500

- Best Wallet Token offers portfolio tools that whales actually use for tracking massive holdings

- PEPENODE and Bitcoin Hyper provide passive income strategies mirroring long-term holder mentality

The whales decided to stop pretending they weren’t interested in $XRP at $2.25.

According to fresh data from Santiment, the number of wallets holding at least 10K $XRP tokens just hit an all-time high of roughly 317,500. While retail was panic-selling into the void, the big boys were quietly backing up the truck.

Source: Santiment on X

Source: Santiment on X

Since $XRP broke above $1 back in November 2024, every single price correction has been met with renewed whale buying pressure. Add in Ripple’s rumored $1B Digital Asset Treasury and mounting speculation about an $XRP ETF approval, and you’ve got a recipe for serious upside potential.

When the big fish start feeding, it usually signals opportunity across the entire crypto food chain.

And right now, three presale projects are offering similar accumulation opportunities, minus the $2.38 entry price.

If you’re wondering where to deploy capital while $XRP whales are setting records, these three tokens are some of the best crypto to buy now.

1. Best Wallet Token ($BEST) – MetaMask Killer Targeting 40% Market Domination by 2026

MetaMask is the Internet Explorer of crypto wallets. It works, sure, but it’s clunky, outdated, and about as exciting as watching blockchain confirmations.

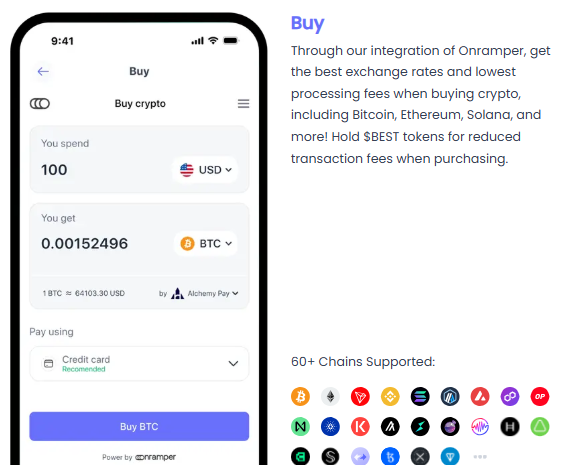

Best Wallet Token ($BEST) is the native utility token powering a next-generation wallet that’s on track to capture 40% of the crypto wallet market share by the end of 2026.

Those 317,500 wallets holding massive XRP positions need serious infrastructure, not Fisher-Price interfaces. Best Wallet is delivering exactly that with its revolutionary Upcoming Tokens feature, which has already raised over $2M for partnered presales in just six weeks.

This is direct presale access within the app, eliminating scam mirror sites and giving users legitimate early access to projects before they explode.

The presale metrics are absurd: $16.5M raised, first $100K stage sold out in 6 hours, and $162K captured in the first 24 hours of the exclusive in-app launch. The current token price sits at $0.025815 with 334.2M tokens staked.

$BEST holders get reduced transaction fees, early access to new projects, and exclusive iGaming partnership benefits, including free spins, lootbox access, and top-tier deposit bonuses.

With 70K social followers and 50% monthly user growth, Best Wallet is positioned to obliterate MetaMask.

When whales accumulate, they need infrastructure that doesn’t make them want to rage-quit. Best Wallet is building that infrastructure, powered by Fireblocks MPC-CMP security, and $BEST is your ticket to ride the wave before the 40% market share projection becomes reality.

Get Best Wallet Token ($BEST) now.

2. PEPENODE ($PEPENODE) – Mining Without the $10K Electric Bill or Melted GPU

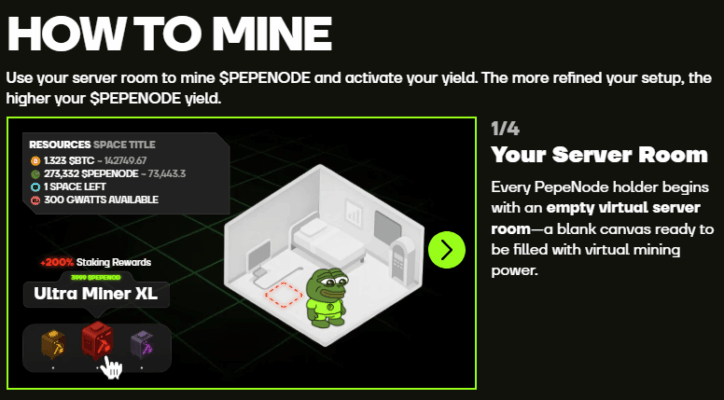

Remember when mining actually worked before you needed a second mortgage for ASICs and an industrial cooling system? PEPENODE ($PEPENODE) is bringing back that energy with virtual mining that doesn’t require you to explain weird noises to your landlord or negotiate electricity rates with your utility company.

PEPENODE introduces a virtual mining ecosystem where participants deploy and upgrade Miner Nodes to generate real token rewards without any hardware requirements. It’s mining reimagined for people who want the gains without turning their apartment into a sauna. The project has raised over 1.8M $USDT in presale, with tokens now at $0.0011094.

Here’s how to buy PepeNode in 5 easy steps.

PEPENODE gamifies the entire experience with customizable mining rigs, competitive leaderboards, and bonus rewards in trending meme coins like $PEPE for top performers. You’re actively competing, upgrading your setup, and earning while the system drives community engagement and volume.

PEPENODE delivers the same strategic depth at presale prices. Stake during presale to build your mining firepower, then deploy your custom rigs when virtual mining launches. It’s the first meme-coin-mining hybrid that actually delivers utility instead of just promising revolutionary technology in a poorly written whitepaper.

Get PepeNode ($PEPENODE) now.

3. Bitcoin Hyper ($HYPER) – Bitcoin’s First Real Layer 2 Running on Solana’s Engine

Bitcoin is impressive, sure, but what’s the point if you can’t actually do anything with it?

Bitcoin Hyper ($HYPER) is solving this with the first legitimate Bitcoin Layer 2, a full-blown execution layer built on Solana Virtual Machine (SVM). Bitcoin is getting Solana speed and sub-second transactions.

The presale has already raised over $24.1M, with tokens at $0.013135. And speaking of whales: buys of $325K and $274K suggest smart money is already positioning.

Presale buyers get priority access to airdrops, token launches, and governance rights.

Those $XRP whales are positioning for ecosystem expansion. Ripple’s $1B Digital Asset Treasury and RLUSD integration? That’s infrastructure.

Bitcoin Hyper is doing the same thing for $BTC, except it’s bringing the speed and capabilities Bitcoin never had. The project is audited and meme-ready for the culture.

When Bitcoin finally wakes up and realizes it needs an execution layer that doesn’t move like continental drift, $HYPER holders will already be in position.

Get Bitcoin Hyper ($HYPER) now.

The $XRP whale accumulation phase is a signal that smart money is positioning for the next leg up across crypto.

While retail scrambles to understand what just happened, whales are building positions, institutions are filing ETF applications, and projects like Best Wallet Token, PEPENODE, and Bitcoin Hyper are offering presale entry points that won’t last forever.

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Best Crypto to Buy Now That XRP Whales Are Loading Up appeared first on Coindoo.

You May Also Like

HitPaw API is Integrated by Comfy for Professional Image and Video Enhancement to Global Creators

Journalist gives brutal review of Melania movie: 'Not a single person in the theater'