Crypto investors should learn from Xiaoqiang and find ways to survive

By BowTied Bull

Compiled by: Vernacular Blockchain

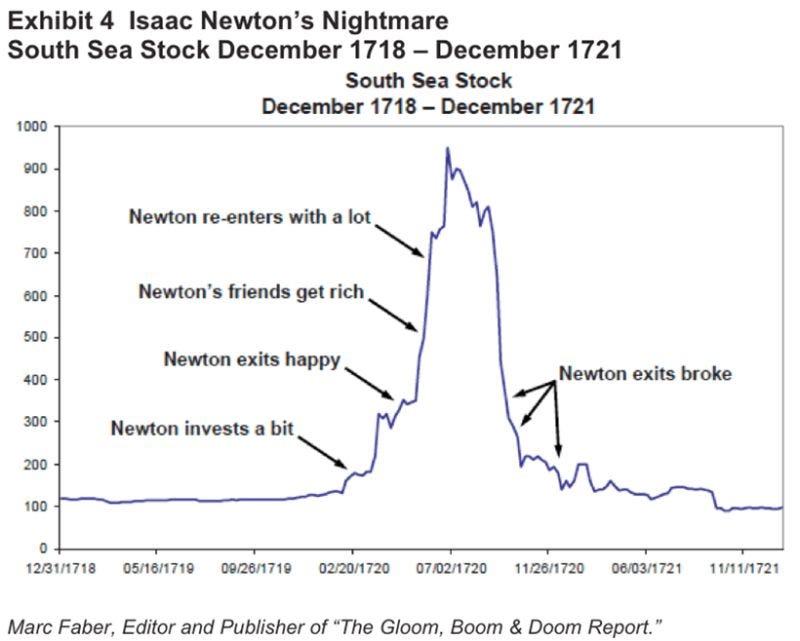

Throughout history, these dramatic booms and busts are nothing new. The only difference is that now, with the internet, these events are detected and amplified in seconds. Some people have assets exceeding $30 million and ended up with nothing. You know who else went bust? Isaac Newton—in the famous South Sea Bubble.

A Game of Attrition – Avoiding Zero

We can apply this to everything. People give up by the time they turn 25, indulging in cheap alcohol and shots from the bar. They work hard at their startup for three months at most before settling for annual salary increases that barely keep up with inflation. This even applies to dating. Most men either let things slide or refuse to venture abroad to find their ideal type (usually an attractive foreigner).

In short, life isn't a sprint. While you'll experience huge step-up leaps, the foundation is laid during those seemingly steady months or even years. It's a long, brutal race of attrition (think of those boring games on the TV show "Survivor" where the only thing you have to do is stand still on a pole). It's a test of who can stand firm while others burn out, quit, or self-destruct.

What's the difference between this game and those TV shows? You never have to go back to zero. You might have a bad year, month, or quarter. But that's okay. As long as you never go back to zero, there's no financial reset.

There's an unwritten rule in every game worth playing (business, investing, fitness, relationships, etc.): The winner isn't the fastest or strongest runner in a given year, but the one who survives a decade of ever-changing circumstances.

Recent crashes

There are so many stories like this. How many of you have forgotten the following: 1) Sam Bankman-Fried—a thirty-year-old billionaire who ran one of the most profitable trading platforms at the time. His greed led him to embezzle client funds, ultimately leading to bankruptcy and imprisonment. 2) Do Kwon—who once ridiculously declared, "Hold on, guys, we're putting in more money," but actually doubled down on his Ponzi scheme and ultimately went bankrupt. 3) Long-Term Capital Management—a fund literally founded by a Nobel Prize winner. An overly leveraged bet at the wrong time? Goodbye.

Even Isaac Newton lost his mind during the South Sea Bubble. After selling early for a profit, he reentered the market (at its peak) out of jealousy. He lamented, "I can calculate the motions of the heavenly bodies... but not the madness of human nature."

It's a lesson that's been repeated for centuries. The plot is the same, the technology changes, but the outcome is exactly the same: greed, leverage, and an inability to stay in the game.

The smartest people in the world have gotten so caught up in their own complex models that they forget that markets are driven by emotional humans, not numbers.

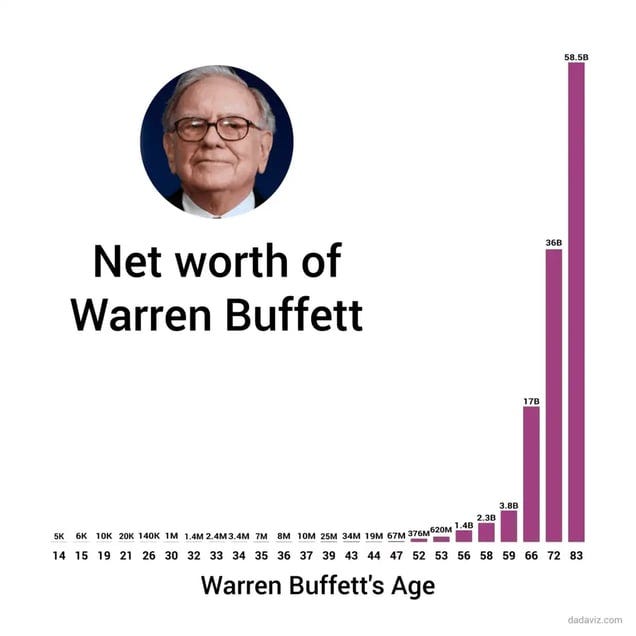

The core strategy is a war of attrition: a game that rewards those who can overcome their own psychological weaknesses. For decades, Buffett has been mocked as "boring." He underperforms during manias, consistently buying things no one wants. Yet, he remains viable. His empire compounds relentlessly because he has only one rule: don't lose money. While we'd never ask him for technical advice, his strategy is conceptually sound. All you have to do is stay in the game and refuse to sell at a loss (which requires thorough research, a "diamond hand" of determination, and zero leverage—the interest alone can cause you to lose money).

Jeff Bezos did the same thing. He raised $1 million by selling less than 20% of his company. He could have sold more, but he wanted to maintain control—stay in the game. It proved to be the smartest decision he ever made. Through the dot-com bust and years of heated board meetings, he remained firmly in control. By trading greed for endurance, he ultimately created an empire (Amazon) valued at over a trillion dollars.

Elon Musk has been through this, too. He's not the best example, as he could have gone bankrupt. However, he remains a prime example of survival. After PayPal, he invested nearly all his wealth in Tesla and SpaceX, at one point teetering on the brink of bankruptcy. He borrowed money from friends to pay rent, but never gave up. He fought to survive, not to appear successful.

Apple is another (surprising) example. In the 1990s, it faced bankruptcy. Most companies would have collapsed, but Apple didn't. They cut costs, rebuilt their business, and waited patiently. A few years later, the iPod came along, followed by the iPhone, and the compounding phase began. This is another trillion-dollar lesson in resilience.

In short, think carefully about all of these examples before you decide to use leverage. Could you survive a real recession? A -50% to -60% drop? Losing your job? Adding an emergency expense? It's much easier to model your predictions through rose-colored glasses.

Never make an investment you will regret

Any investment you've thoroughly researched and believe in should be held forever. For example, for 20-30 years. This doesn't mean you should hold all of it, but you should always keep a portion. If you bought Bitcoin at $100 and sold it all at $200, you'll never be able to live with yourself again. We know plenty of people who did that. Someone bought Ethereum at $80, sold it all at $200, and watched it rise to over $4,000, while their S&P 500 performance lagged by over 1,000% during that time.

In short, with any well-researched investment, you can sell some, but be sure to keep some in case you sell too soon.

There is no point in actively choosing to reset to zero

Most people aren't even defeated by leverage; they defeat themselves.

They sell after their stock or token has increased tenfold, proud of having "locked in profits." They sell their startup for a few million dollars for peace of mind, only to watch it later go public and be valued at millions or even billions (Victoria's Secret is a famous example). They abandon a career, relationship, or idea before the exponential curve bends upward. The inflection point is where all the gains are! (Reminder: progress is nonlinear, and this applies to stocks, tokens, and any small business).

To avoid this, you need to structure your life to absorb losses while retaining some high-risk positions that have already risen. Keep your overhead low and maintain enough liquidity to make large bets without feeling desperate. Protect your skills and equity. These two assets will continue to compound until the inflection point in the curve appears.

Be willing to endure the boredom that comes before a breakthrough, and be willing to look wrong for years. The people who succeed are not those who have the best strategy... they are those who stick with it long enough until it starts working.

Every major success story is a case study in pain tolerance and faith. Compound interest works only for the few who can stay solvent long enough to experience it. It's the ticket to the top 1%.

Most people can't stand being underestimated or having delayed gratification. They need approval and attention, so they cash in to feed their egos.

Their need for comfort leads them to forgo future possibilities. They mistake busyness for progress, and the approval of others for security. They voluntarily exit the game before it becomes advantageous for them. Ironically, their focus on survival and adaptability itself creates guaranteed success.

If you stay in the arena long enough, the odds will eventually tilt in your favor. The longer you can endure pain, boredom, and obscurity, the more exposure you have to favorable "tail events." Life can't stop someone who refuses to leave.

If you're in that "grinding" phase where you seem to be going nowhere, remember that it's all psychological. If you're making the right choices, momentum is quietly building. You shouldn't expect immediate rewards; you should focus on survival.

Every month you stay above the bankrupt, every year you hold your ground, your probability of a breakthrough increases. This is the mathematics of attrition.

People hate cockroaches, but they teach us a valuable lesson: Find ways to survive

The more you want results today, the less you'll get. That's how Lady Luck works. The skill you really want is persistence. Stay at the table long enough, and Lady Luck will eventually think, "Well, this guy really doesn't seem to care, so I'll give him the pot of gold."

Don't let yourself get crushed. Don't prematurely cash out of investments with the potential for asymmetric returns. Don't sell your future for comfort. Keep your expenses low, your ego smaller, and your runway longer. Because life doesn't reward the smartest player—it rewards the one who makes it to the final table.

Think of it like playing poker. Your goal is to make the final table, not to dominate the field on day one.

Live long enough and statistics will take care of the rest.

A final note on survival—even if you screw up

If you need some real-world examples of comebacks, here are a few names you’ll recognize today:

Disney: In 1923, after his Laugh-O-Gram Films went bankrupt due to unpaid distributors, he moved to Hollywood, created Mickey Mouse and Snow White, and built an empire.

Ford: He went bankrupt twice before founding Ford Motor Company. His first company, the Detroit Motor Company, collapsed due to overly expensive and inefficient products. He later created mass production and transformed manufacturing.

Jobs: Fired from Apple in 1985, he then devoted himself to NeXT and Pixar, nearly leading to financial ruin. Apple eventually acquired NeXT in 1997, allowing Jobs to return...with the iMac, iPod, and iPhone.

George Foreman: The famous boxer went bankrupt in the late 1970s but returned to the ring at age 38. Once he had earned enough money, he created the Foreman Grill, which earned him hundreds of millions of dollars.

Milton Hershey: He had two failed candy businesses before founding Hershey's Chocolate. Even the most well-known brands have founders who failed multiple times, but they just kept trying.

There are thousands of other stories we know about, and millions more we don't. The principle is the same: learn from others' mistakes. Don't go to zero, don't sell 100% of an investment you believe in, and don't use leverage.

In the rare case that you do screw up… well, others have come out of worse situations. It’s just that given the outsized returns expected from tech, cryptocurrencies, and niche internet businesses in 2025, there’s no point putting yourself in that situation.

However, this is just a cartoon character's point of view.

You May Also Like

Unleash Potential: Flare Network’s FXRP Revolutionizes DeFi Access for XRP

Fed Lowers Rates By 25bps: How Bitcoin And Crypto Prices Responded And What’s Next