Colossal $300 Trillion Paxos Minting Error Briefly Sends PYUSD Market Cap Past Global GDP

A blunder by stablecoin issuer Paxos briefly sent the market cap of PayPal USD (PYUSD) to $300 trillion, exceeding global GDP, before the tokens were burned minutes later.

Paxos said in a post on X that the 300 trillion PYUSD mint was caused by a technical error during an internal transfer and was reversed within 22 minutes. It confirmed there was no security breach and that customer funds remain safe.

The minting glitch temporarily disrupted DeFi markets, prompting lending platform Aave to suspend PYUSD transactions as a precaution. Although the issue was quickly resolved, it reignited concerns over the lack of safeguards to prevent stablecoins from issuing token amounts that exceed collateral

“While I appreciate the transparency and the incredibly fast response to burn the excess PYUSD, the initial minting error itself is definitely concerning, given the bedrock trust required for a dollar-backed stablecoin,” said Rui Diao on X.

On-chain data from Etherscan shows that the tokens were minted at 7:12 pm UTC.

“Paxos immediately identified the error and burned the excess PYUSD,” the stablecoin issuer said. On-chain data corroborates this, with the entire amount of the PYUSD being burned just 22 minutes after they were minted.

Following the minting error and subsequent burn, Paxos went on to mint 300 million PYUSD as part of its routine operations.

PYUSD’s Market Cap Exceeded Global GDP, US Debt

Given PYUSD’s 1:1 peg with the US dollar, the incident saw the token’s market cap briefly soar to $300 trillion. This is more than the record US national debt, which stands at more than $37 trillion. It is also more than global gross domestic product (GDP), estimated to be around $117 trillion.

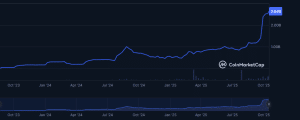

PYUSD market cap (Source: CoinMarketCap)

PYUSD’s market cap stands at around $2.64 billion as of 1:12 a.m. EST, making it the sixth-largest stablecoin. Tether’s USDT is ranked first with its capitalization of more than $181.42 billion, while USD is second with over $76 billion.

Ethena’s USDe token and Dai (DAI) are ranked third and fourth, respectively. Ranked one position above PYUSD is the Trump-linked World Liberty Financial USD (USD1) with its market cap of around $2.68 billion.

PYUSD Mint Raises Community Concerns Around Stablecoin Collateral

The stablecoin market has been gaining momentum since US President Donald Trump signed the GENIUS Act into law in July, providing regulatory clarity for stablecoin issuers.

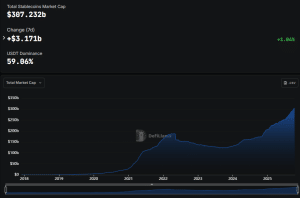

That sent the stablecoin market cap surging past $300 billion for the first time, data from DefiLlama shows.

Stablecoin market cap (Source: DefiLlama)

One of the key requirements for the GENIUS Act is that stablecoin issuers must maintain a 1:1 backing with its reserves. These reserves also need to consist of very liquid, low-risk assets.

Without safeguards that prevent stablecoin firms from issuing token amounts that exceed their collateral, crypto community members question how stablecoins differ from fiat currency, which a central bank can print as deemed necessary.

“It’s not the dollar amount you should be thinking about. It’s the fact that this is a collateralized asset that can be created without the collateral,” said a user on X.

Questions around reserves and liquidity have often been raised in the stablecoin space over the years. For example, Tether has been preparing for a third-party audit of its reserves for USDT for several months now, but no audit has taken place.

PYUSD has faced community scrutiny before, most notably after its market cap collapsed 40% about a year ago, raising fears of manipulation.

You May Also Like

Fed rate decision September 2025

Australia Cleas Path for Stablecoins: Here’s What It Means for Crypto Distribution