Lens Chain V3: A highly scalable SocialFi layer 2 network based on Avail DA

By Stacy Muur

Compiled by: Tim, PANews

When social applications on general blockchains reach a development bottleneck, it will build its own exclusive chain and migrate 125GB of social historical data.

This is exactly what Lens Chain is doing by launching a SocialFi L2.

This L2 is powered by Avail's DA (data availability) technology, which can be expanded to support billions of users at a low cost.

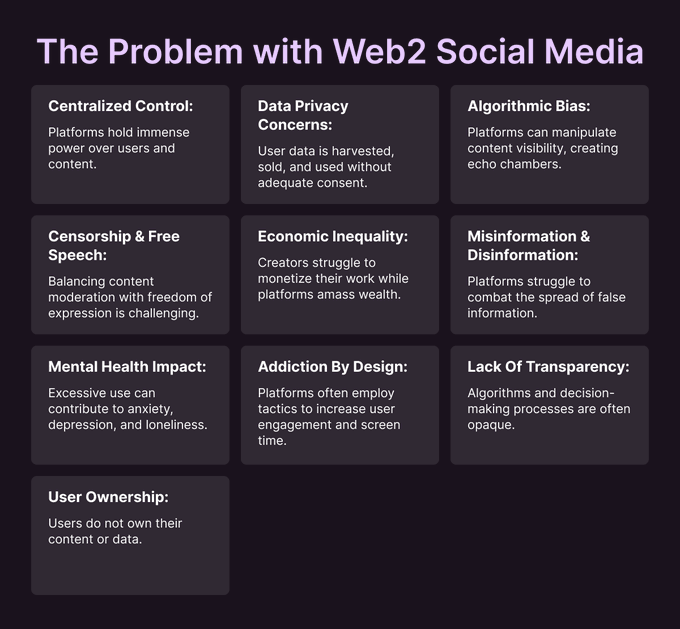

Social media is the most widely used consumer product on the Internet.

5.4 billion users use it for an average of 2.5 hours a day, but it is based on a closed and broken foundation: difficult-to-circumvent censorship mechanisms, personal data is restricted by the platform, accounts may be cancelled at any time, and so on.

Lens is a social protocol based on Avail with user ownership at its core.

What is Lens Chain?

Lens is laying the foundation for a decentralized, user-owned social network that is fully portable.

Open garden, free platform.

You completely own your social graph.

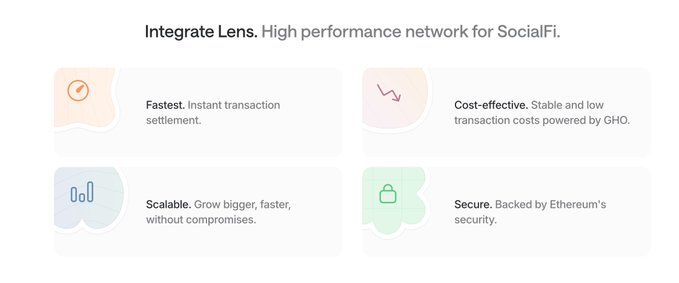

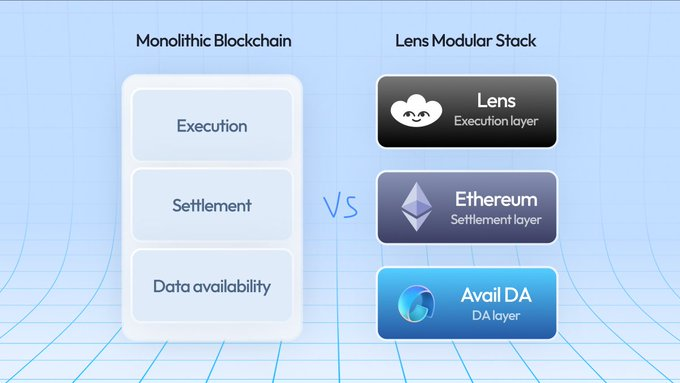

Core technology stack:

- High-speed transaction execution using ZKSync elastic chain

- Avail acts as a DA layer to ensure censorship-resistant data availability

- GHO as the native gas token

- Login without wallet through Family

This is a customized technology stack, and Avail is the core extension component.

Choosing Avail proved to be a wise decision, as the SocialFi application required a cost-effective large-scale data availability solution to reduce costs. The Ethereum blobspace solution cost 10 times more.

Why does SocialFi have such strict infrastructure requirements?

First, social networks generate massive amounts of data:

Profiles, Posts, Interactions, Following and Media.

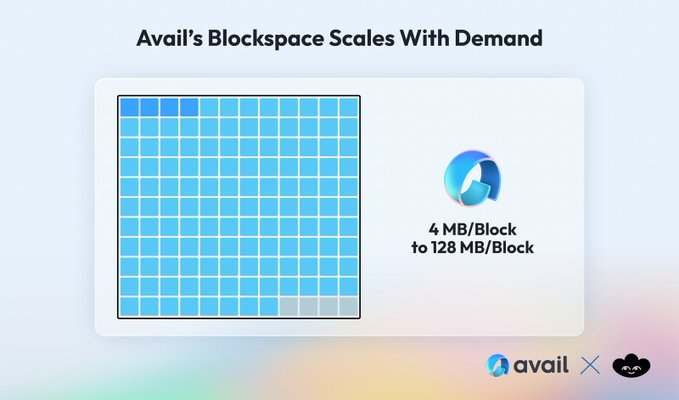

Therefore, Lens requires a horizontally scalable data availability layer that can accommodate the increase in block space corresponding to the explosive growth in demand without sacrificing security or decentralization.

The only eligible one is: Avail DA tier.

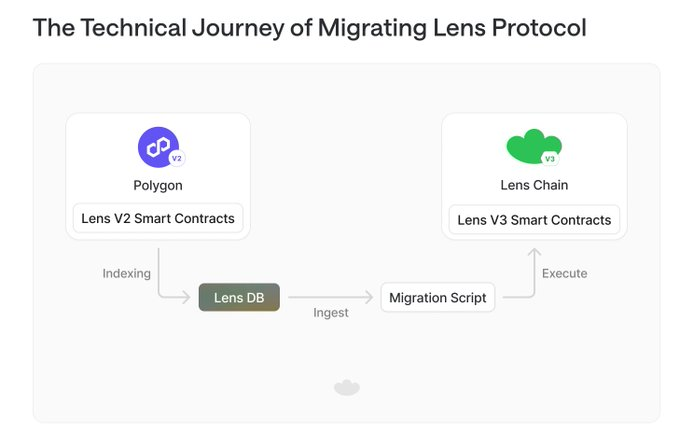

In order to launch Lens Chain V3, the team migrated 125GB of historical data (from Lens V2 on the Polygon chain), including: more than 660,000 user profiles, 28 million follow-up relationships, 16 million pieces of content (posts, comments, quotes), and 50 million interactions.

Lens V3: The evolution of SocialFi

- Programmable Smart Accounts (no longer supporting static NFTs)

- Global social graph: supports advanced attention functions and social relationship queries

- On-chain native features: token-gated content, paywalls, micropayments

- Seamless developer experience: Build social features faster than ever before

Lens chooses Avail over other options:

- Horizontal scalability: Block size from 4MB to 128MB → recently announced to achieve a leap from 1GB to 10GB

- Fast finality: Currently about 40 seconds, target is to reduce to about 250 milliseconds

- Peer-to-peer DAS technology: providing support for trustless light clients

- Cost advantage: Data availability cost is more than 90% lower than Ethereum

- Modular design: compatible with various expansion solutions such as ZKsync, Validiums, and Optimistic rollups

Avail's huge revenue opportunity

As Lens grows, every post, like, follow, and share will touch the Avail DA layer.

Other L2, Rollup expansion solutions and application chains are being followed up.

More incoming links → more data generated → more charges for Avail to capture.

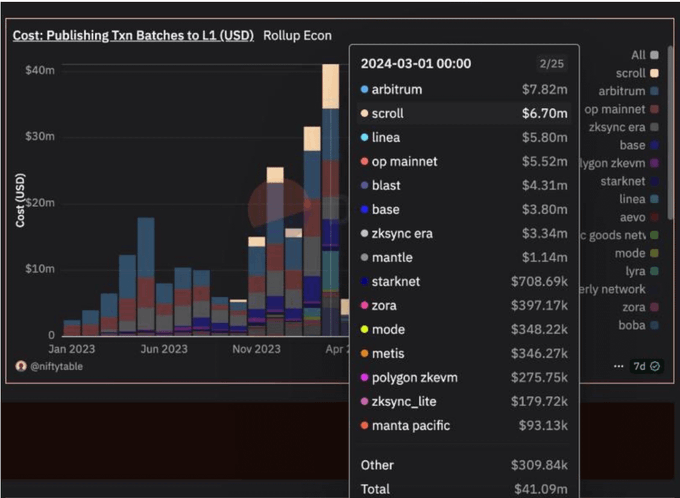

Avail’s processing cost is only one-tenth of Ethereum Blobspace.

In order to scale like traditional social platforms, SocialFi needs a low-cost data availability layer.

In March 2024, Arbitrum paid $7.82 million for Ethereum Blobspace.

If Avail's DA layer is used, this cost can be reduced by 90%.

This is exactly the marginal benefit that Avail achieves through scale.

Lens has raised over $46 million in funding and the project was created by Aave founder Stani.

No tokens have been issued yet, but it now has its own chain.

If you have used Lens ecosystem applications such as Orb, Tape, Hey, Soclly, etc. in the early stage, you are likely to get the opportunity to get the annual SocialFi airdrop.

Given the strategic partnership between Avail and Lens, you can consider staking $AVAIL tokens to increase the weight of your airdrop qualification.

Introduction to Lens Ecosystem Applications:

- Orb.club: Web3 social interaction platform

- Hey.xyz: Identity and social networking on the blockchain

- Tape.xyz: Innovative content creation and monetization methods

- Soclly: Web3 version of professional social platform

All are built on Avail's DA technology.

With the official launch of Lens Chain:

- Developers can get modular components to build social applications

- Users enjoy true content ownership + smart wallet

- Creators gain direct monetization channels (NFTs, tokens, subscriptions)

You May Also Like

SBI VC Trade Adds Litecoin to Japanese Lending Program

Work Dogs TGE Is Running — Is WD About to Drop in Q2 After March 30?